3 small caps I’ll be watching this reporting season 🔎

Just like you, one of my favourite seasons of the year is coming up soon

I love the reporting season. I’ll be monitoring the companies I own first, but also make a habit to monitor companies on my watchlist.

This reporting season will be especially important given all the dark sentiments out there that a recession may be impacting companies’ bottom line. Well, we’ll see.

The 3 companies below are not businesses I own in my portfolio. They are companies I’m watching closely. Each of them needs to prove themselves more before I will feel comfortable taking a position. I’ll share here what I like about them and what I would like to see happen.

Complii Fintech Solutions (ASX:CF1)

Complii Fintech is a software for Australian Financial Services (AFSL) companies. The software allows stockbrokers and financial advisers to complete their compliance requirements and raise capital. They’ve also added (by acquisition) a global trading platform which enables the trading of shares in unlisted companies and funds.

Complii caught my eye last year when they consistently posted some impressive revenue growth numbers.

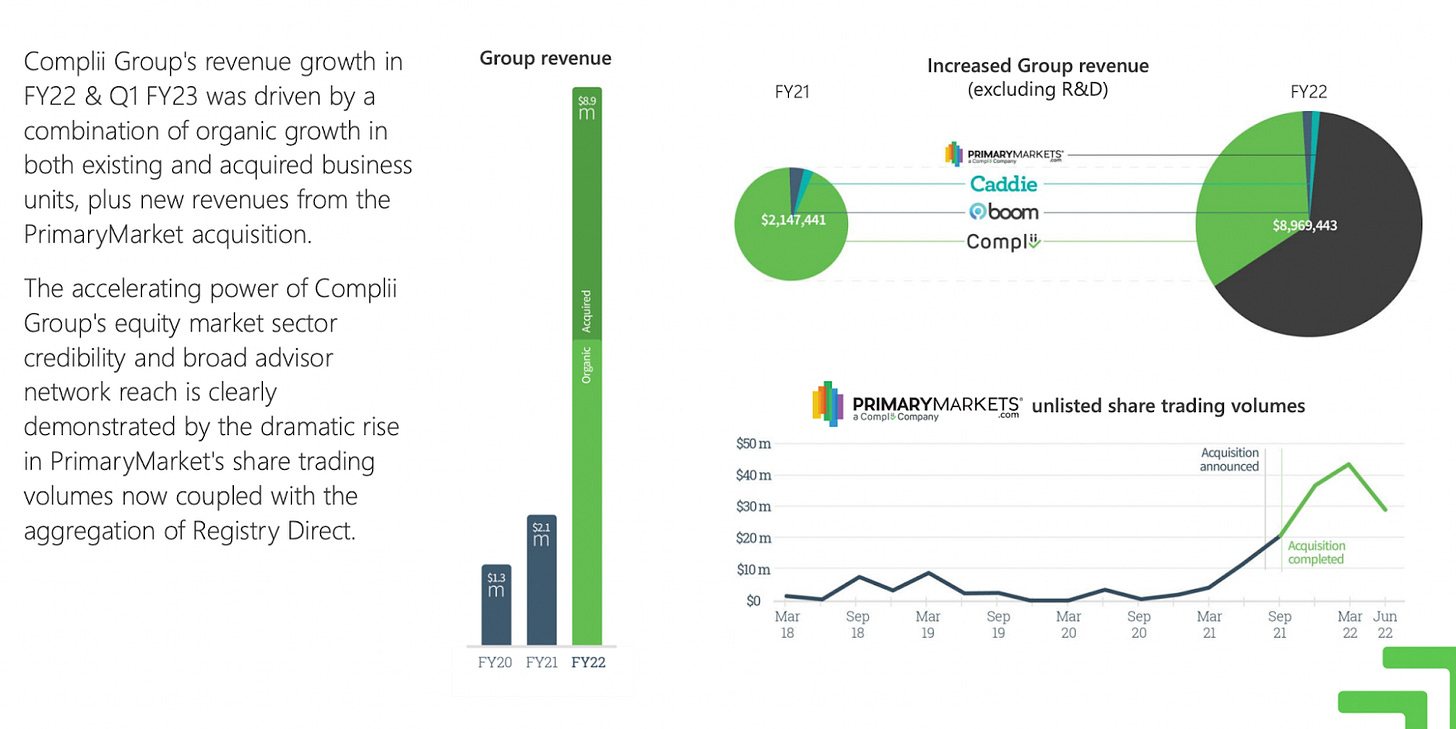

The downside of these pretty numbers is that they’ve been very acquisitive. In a fairly classic small cap fashion, they’ve not always been clear on how much of the growth came in organically, and how much has come from acquisitions. Recently this trend started to change as you can see below.

As a result of being so acquisitive, the shares outstanding have nearly doubled in the last 18 months. Pleasingly, revenue has increased more than 3x, but that’s from a low base, so I’m not sure I’m comfortable comparing increasing in share count vs. increase in revenue with Complii.

When companies are acquiring at this pace, I ask myself what it is they’re trying to accomplish, and find they typically fall within 2 ends of a spectrum:

Trying to hide/remediate a sub-par business model and looking for a way to still reach growth as a band-aid and potentially save the company.

Trying to build a better offering for their clients and deepen their moat in a way that would be too long if they built it internally. As a result, all initial stand-alone companies gain faster traction.

It’s never black and white. It typically falls somewhere in between. To date, it appears to me that Complii may be leaning closer to the second category, and certainly their narrative aligns with this. They are building this web that would allow brokers to do nearly everything on their platform:

The recent PrimaryMarkets acquisition is a good example of this. Here’s what they say in their announcement:

“The PrimaryMarkets trading and capital raising platform acquired in November 2021 gained a substantial boost from its entry into the Group, with the value of trades increasing by 521% year on year, increasing revenue from $1.35 million in FY21 (prior to acquisition), up to $6.13 million in FY22 (post acquisition) (Full year $7.57 million).”

Whilst they’ve declared a net profit, they’ve remained cash flow negative in the past few quarters, but still have about $5M in cash to run with. How they decide to run the business will be telling this year. If the growth trend continues, and they are diligent, we will see cashflow break in the positive direction this year, or next, depending on their growth plans. Importantly, I find myself a little more comfortable when the cash burn is reasonable (they’ve orientated in the -5% to -15% environment).

So for Complii, now that the Registry Direct acquisition is complete, and all the other ones too, I will be looking at them closely this year to monitor what growth can be achieved. I want to see the original business grow, not just PrimaryMarkets kick it out the park again.

I would certainly like them to be a little more clear in their reporting too, and perhaps we will see this in these upcoming half-yearlies.

Ep&T Global Ltd (ASX:EPX)

EP&T Global Limited (EPX) is a building energy management software. Buildings use they EDGE Platform to reduce energy and water wastage. The improved energy efficiency allows for big savings over time, and is also helping these properties be more eco-friendly.

As you can see in one of their case studies, the savings compound over time and can add-up to big numbers by building. This is great because it means EP&T can charge a good price for their software.

They’re a relatively recent float, having gone public in May 2021, so we don’t have tons of historical reporting to go with. I wrote about these guys on a forum 6 months ago. At the time, it was becoming clear that their current burn rate meant they would need to raise capital soon. I didn’t expect the CEO leaving, and this is normally a big red flag for me. We could see from afar however that difficult times were about to come. Are these structural, or temporary? I don’t know. Time will tell. The capital raise milestone was also reached and, unsurprisingly, the stock took a beating.

The capital raise was undertaken at an offer price of A$0.025 per new ordinary share to raise approximately A$5.0 million. Now, they will have to grow and show operating leverage, else this capital will last them less than 1 year at current burn rates.

There’s a number of interesting things about the business.

I already commented on their ability to bring in large deals. On the 30th of June 2021, they signed a 3-year contract with DWS Group’s real estate business. The annual contract value (ACV) was A$2.04m with total contract value (TCV) of A$6.12m.

Also, in a common Saas company fashion, they report on the deals they are closing, and will only classify them as ARR once implantation has begun (or is completed). Currently, this means they have nearly $3M in ARR that’s about to live soon. Whilst this is a dangerous thing to do for cash burners, after implementation, they would technically be on a valuation of 1X ARR. This seems a little too cheap in my opinion if growth is maintained, and cash management starts to look better.

Hence, for me, EP&T Global is about three common, and simple things:

Can they sustain good growth?

Can we send them move towards cash flow breakeven?

Will the new leadership team drive the company in the right direction?

Time will tell. I will continue to offer updates of them over time. Stay tuned.

Orcoda Ltd (ASX:ODA)

I’ll be upfront and say that Orcoda is much less interesting to me than the 2 above companies. They are a long-shot to me that do something cheeky in how they promote their business, which I’ll explain below.

Orcoda Limited label themselves as “Operational Efficiencies Specialist”. This means nothing to me unfortunately. Call me slow. Looking at their website, I conclude that they play in services & software primarily for the transport & logistics industry.

The use of good buzzwords remains present in their announcement presentations:

Our proprietary cloud-based, open ended, end-to-end software technology platforms have true optimisation capabilities, enabling clients to generate real time, fast, accurate and reliable information to make data-led decisions for the movement of people, parcels and goods, the assets they travel in and the infrastructure they travel on.

They went public through a backdoor listing and are a company with a very mixed bag history. Look at that 20 year chart. If you invested $1 in this company nearly 20 years ago you would have lost 94 cents.

Therefore, I would classify them in the category of potential turnarounds. Businesses in that category always need to offer more proof for me to be interested.

The cheeky thing they do is to fall in the category of businesses that like to promote the more attractive side of the business over the others. Looking at their financial statement gives us a clear picture that software isn’t the main part of their business. How in hell would they have so much vehicle expense if they’re coding quality software?

I gather from this that through Betta Group (one of their businesses), Orcoda is primarily a contractor.

A recent contract announcement speaks more to their contracting business:

Rockhampton has signed a $2.2 million Major Works Subcontract with Laing O Rourke to deliver mechanical services within a Major Contract being delivered by Laing O Rourke for a Department of Defence project at Shoalwater Bay. The $2.2 million in revenue is expected to be earned over approximately 18 months.

Despite this, they did start to tickle me a little with their annual results. With only a small part of the business being software, they’ve nonetheless delivered profit margins of 5% last year which isn’t all too bad.

The results from the previous quarter could indicate another potential good year for growth. They reported $6.7M in cash receipts in Q1, and if we annualise this, then we land at $26M. Annualising one quarter for a business with such a model isn’t a good idea at all, because they are likely to receive large lump-sum payments with the contracts they close. That would be a strong bull case, which would be significant growth (~52%) on the $17M in cash receipts they reported last year. A more realistic scenario is perhaps $20-22M, which would be 17% to 30%.

It seems some investors have picked up on this. When I last commented on this company 6 months ago, the stock price was at 6 cents and now, it’s run all the way up to 14 cents.

At a current market cap of ~$22M, if good execution continues, and the current recent trend to growth gets maintained, they might continue to be revalued upwards by the market, and some good upside may remain.

So whilst there’s been some positive signs recently, for me to be more interested, they would have to be consistently profitable, increase their margins slightly, keep growing, and be honest about what % of revenue comes from software.

A big ask, I know. It’s OK to be demanding as an investor.

Conclusion

So in closing, I’m hoping you share the excitement as me for reporting season. As always, there will be surprises both to the upside, and the downside. In the next few articles, I’ll comment on some of the good performers, and some of the laggards.

As always, thank you for reading. If you want to keep hearing about small companies that are hoping to solve big problems and could make for interesting potential investments in the future, I encourage you to subscribe. You will receive an email when an article comes out. I will remind you too that nothing you read here is financial advice. As of this writing, I do not own any of the 3 companies I wrote about.

Disclaimer

The content and data on this website is for information purposes only, and should not be read as investment advice, or advice on tax or legal matters. The companies and strategies discussed are on the site are for entertainment, we may or may not at any time be invested in the companies, and may be referencing companies simply as examples, ideas or for discussion.

By viewing the contents of this article, you agree: (1) you have read and understood the warning and disclaimer above; (2) not to make any decision based on the contents of the article; (3) not to place any reliance on the contents of the article; and (4) that the author is not responsible or liable, directly or indirectly, in any way for any loss or damage of any kind incurred as a result of, or in connection with, your use of, or reliance on, any of the contents of these articles.