7 Performers from Quarterly Reporting

My short comments on some interesting results

The end of January marks the end of quarterly reporting for companies that have not yet proven their ability to be cashflow positive over a full year period. Now that the 4Cs are done, I share my short comments on 10 companies that I feel had something strong about their results. Given these are small companies, rarely do they smash it out the park with strong results on all fronts. So I will caveat the use of the word “performer” in the title with the notion that I included many with results that may appear mixed, but there was something positive in there. I’ll share what I’m looking for in these companies moving forward.

1.MedAdvisor (ASX: MDR)

MedAdvisor impressed us all when they reported fantastic results.

Overall revenue was up 89.9% to $44.1 million and their US was up 97.7% to $39.4 million. This resulted in positive operating cashflow of $21M. It’s quite rare to see so much positive cashflow for companies still reporting on a 4C cycle.

As we can see, the vast majority (89%) of the revenue came from the US business. MedAdvisor acquired the Adheris LLC business from Syneos Health in 2020 for US$34.5 million. The intent of this move was to help the company become the leader of tailored opt-out, direct-to-patient medication adherence programs in the US as well as Australia.

Since then, the big revenue has come from marketing campaigns though. And the big boost here was from a Covid awareness program. This is clearly an incredible result and I tip my hat to the team, but doesn’t give us the same visibility of growth to come in the future as a pure Saas player would.

If you’d like to understand more about the business, Claude Walker wrote up a good piece on a Rich Life after the results. I will be looking at them a little more closely in the future to see what they can achieve.

2.Volpara Health Technologies (ASX:VHT)

Volpara are the producers of an AI-powered software for screening and early detection of breast cancer.

They listed in 2016 and have been burning cash since in an effort to move quickly and capture as much market share as possible. The reason why I would consider their report strong is because they finally showed us their ability to turn a corner, and reported their first positive net cash flow quarter on record.

When this happens, the share price tends to get re-rated slightly upwards, which has been the case for them, seeing a near 60% rise in just one month.

This is an important milestone that I’m glad to have seen them achieve. On the other hand, growth wasn’t fantastic in my opinion. They reported that Annual Recurring Revenue (ARR) is now at ~US$19.9M (~NZ$31.2M2), up from US$19.1M in the prior quarter (Q2FY23). This is roughly a 4% QoQ growth rate, which is slightly less than 20% YoY growth. Now, to have achieved this with reduced cost is great though, and it gets me more excited about the prospect of this business in the future.

In my humble opinion, at current valuations, I would need to see whether or not they can grow north of 20% in the future, and sustain that pace.

3. Mach7 Technologies (ASX: M7T)

Staying in the same vertical, Mach7 is a radiology imaging software provider, which I also think reported strongly this quarter.

The chart below gives us a glimpse of the lumpiness in the results of Mach7. The 4 quarters prior weren’t actually that great for the company. The chart within the chart, which I have magnified below, showcases in part why the growth was so fantastic this quarter.

The majority of software companies today will only allow customers to purchase on a subscription model, whereas Mach7 still offers clients ability to purchase outright. So 39% of their $22.4M, equating to a contract of $8.7M was purchased by a client as capital software. Whilst it’s fantastic for cash flow purposes to be able to bill the client upfront, this means the contract is not added to ARR.

We can also see from the cashflow statement that payment hasn’t been collected for the contract, which isn’t surprising. I suspect that the money will start trickling in over the next quarters, so this means we will likely see stronger cashflow statements from them in the near future.

In short, great results from Mach7, and for them I would like to see them cross into cashflow positivity and show us they can sustain the growth of the business that way.

4. DUG Technology Ltd (ASX:DUG)

The high-performance computing company DUG continued its 3-month long run of momentum when it released its quarterly.

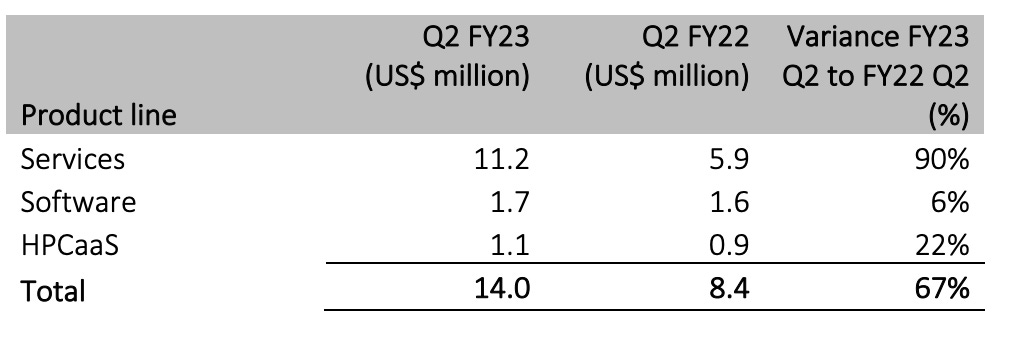

High level numbers looked really good with revenue in Q2 FY23 of US$14.0 million, an increase of 25% on Q1 FY23 and 67% on Q2 FY22.

This is a super strong set of results, so hats off to the team there who are executing strongly.

What we have to be mindful of however, is that the vast majority of the growth is coming from services, as the chart below shows. Services typically don’t scale like software of their HPCaas segment, and don’t offer the same margins. We must bear this in mind before extrapolating to far into the future.

Now, call me simple, but the reason I’ve never been too excited about them is because I find it hard to understand what they actually do.

I can understand they build data centers, and can understand the basics of high-performance computing (crunching incredible amounts of data to analyse at scale which requires insanely powerful computers), but the use cases are where it gets messy for me. I’ve never had to perform any “Full Waveform Inversions”, or do any “Depth and Least-Squares Imaging”. Perhaps they are outside of my circle of competence, or perhaps I will research more in depth the future of these use cases.

5.Mad Paws Holdings Ltd (ASX:MPA)

In a very different field, a business I can understand is pet services company Mad Paws. They showed nice signs of continued progress with many of the key metrics going in the right direction in their most recent quarterly.

Operating Revenues increased to $6.6m for the quarter. This growth results of this is 75% on a pro-forma basis, which is very strong. With the business having been held-back by Covid, it’s been great to see them kick goals this year and continue in the right direction.

For them, I will be looking more closely to see how they continue to grow in the next few quarters, as they start to reach post-covid comparisons. They’ve benefited greatly from their acquisition of the Pet Chemist business, which skews the growth in a favourable position, and adds to the complexity of having genuine growth rates . Monitoring them for longer will offer a more accurate view of what future growth can look like as they mature.

I will also be interested to see how EBITDA margins continue to move over the coming quarters; whilst their marketplace segment is looking better, the e-commerce business isn’t moving at the same pace, and is still in the red.

6. Camplify Holdings Ltd (ASX:CHL)

Operating with a similar marketplace model, Camplify's results looked very healthy when they were released.

Camplify is a peer-to-peer marketplace platform connecting recreational vehicle (RV) Owners to Hirers.

Similar to other marketplace providers, they lead their announcements with their GTV growth (109.87%), but I think that metric is too messy and I much prefer their revenue growth which came in at 63.8% versus Q2 FY22.

Their results are taking into account 1 month of contribution from Paul Camper, so I could do some back of the napkin map to pull out the organic growth, but I reckon the growth of their Australian business serves as a good proxy for that. And the growth there was 52.3% (pcp Q2 FY22). So we can see from this that the growth slowed down a little from the previous quarter (77%). Still, that level of growth is quite an achievement.

The next quarter will be a full contribution quarter from Paul Camper, which will hurt their take-rate, but improve revenue.

I’m interested to see what comes of that, and also very keen to see the full story when they report on the half-yearly in a few weeks.

7. Siteminder Ltd (ASX:SDR)

Moving away from small caps, the hotel services and commerce software provider Siteminder showed continued growth consistency, with organic growth coming in at 28% and leading to Annualised recurring revenue (ARR) of $143.5m.

Digging deeper, we can see that the majority of the boost came from transactions ARR. Subscription ARR increased 17.3% and Transaction ARR increased 77.2% y/y. This is coming from their compares which were largely hit by Covid, and their recent push for these transactions revenues, which is going well.

With their cash balance and the recent term deposit, the market wasn’t too worried with their continued cash burn, as they have more than 2 years of runway at this pace.

We can see from the cashflow that they are rebuilding sales and marketing, adding spend to fuel the growth. Sankar Narayan, CEO & Managing Director, said this will likely ease and that they are now reaching a comfortable operating size team.

It’s great to see a company of this size accelerating its growth, and I will continue to monitor them to see if we start to see signs of operational leverage in the next few quarters.

Which other companies did you find were strong performers?

Disclaimer

The content and data on this website is for information purposes only, and should not be read as investment advice, or advice on tax or legal matters. The companies and strategies discussed are on the site for entertainment only, we may or may not at any time be invested in the companies, and may be referencing companies simply as examples, ideas or for discussion.

By viewing the contents of this article, you agree:

(1) you have read and understood the warning and disclaimer above;

(2) not to make any decision based on the contents of the article;

(3) not to place any reliance on the contents of the article; and

(4) that the author is not responsible or liable, directly or indirectly, in any way for any loss or damage of any kind incurred as a result of, or in connection with, your use of, or reliance on, any of the contents of these articles.