Dropsuite, K2Fly and RMY Quarterly’s

Who's executing, and what are we looking for?

It’s always great to be right in the middle of the quarterly reporting season. I tend to pick up the reports of companies that come out at a good time, and save for later those I can dive into just yet. This week and last, here are 3 companies I spent time reading the reports of, and my comments on them. A reminder this is not financial advice, but my opinion only.

Dropsuite (ASX:DSE)

Dropsuite operates a platform that enables SMEs to backup their key business information, mostly email, and are quickly developing new backup products. They acquire new users entirely through their partner network, which they’ve grown to the point of becoming a strength to their business.

In their usual fashion, Dropsuite was out the gates early with their quarterly. In their usual fashion again, they executed strongly.

Top line results were:

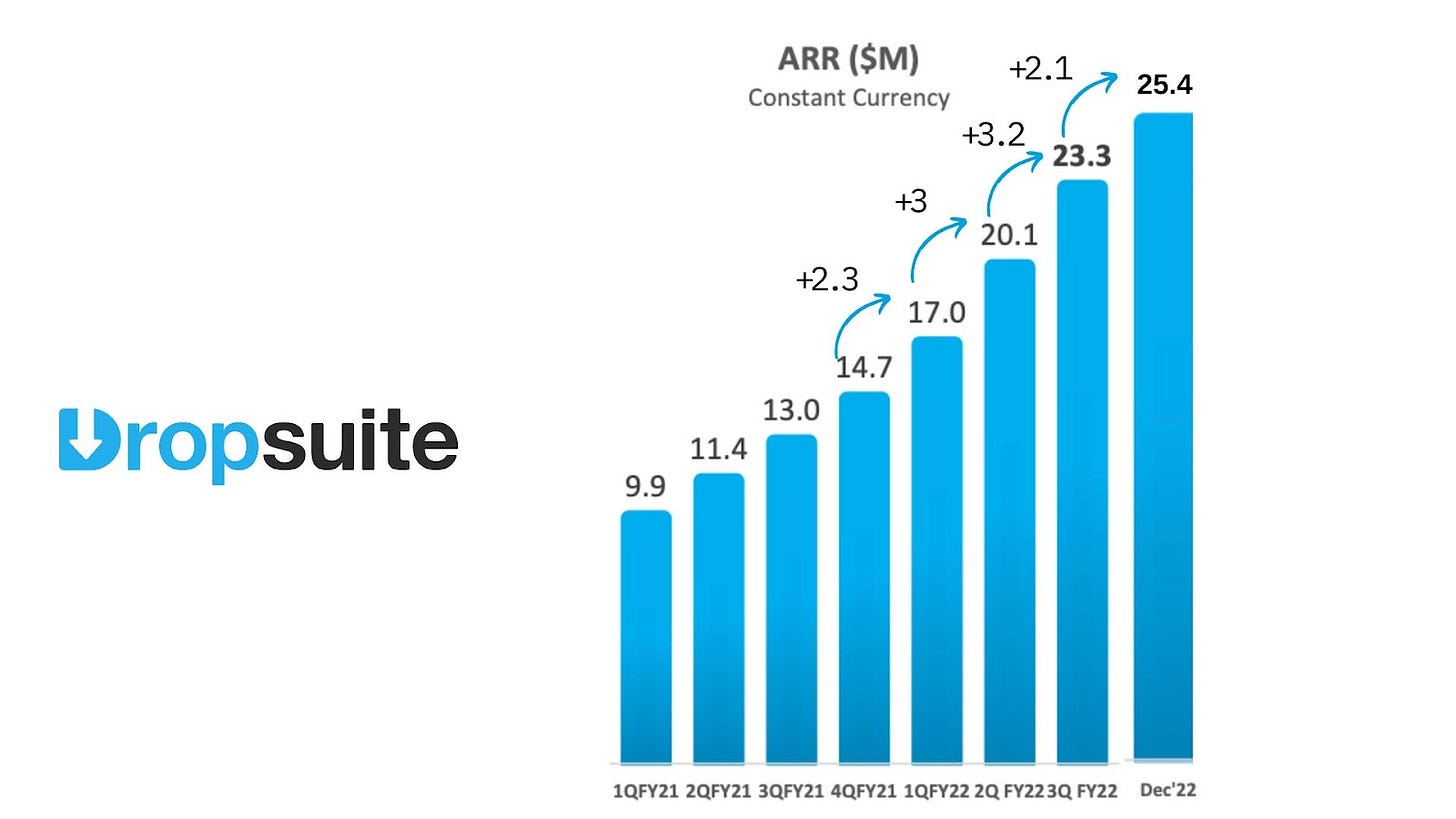

They added $2.1M in ARR. ARR now stands at $25.4M (up from $23.3M in previous quarter)

Maintaining strong revenue growth at 58%

3rd consecutive positive quarter of cashflow growth (cashflow of $0.45m)

ARPU & Margins up slightly

Cash continues to pile up: now have $22.3M in cash at bank

Very strong indeed. As always, nothing is ever perfect. Maintaining an objective lens, we can see growth slowed down a little. The 3 previous quarters prior to this one saw stronger growth. They mentioned the churn of a legacy customer but this was a small customer so didn’t affect the figures too much.

What I’ll be watching for Dropsuite

How quickly new starters can ramp. They’ve announced they were expanding the team (“Continued investment in team expansion (Wages spend +15% QoQ, Marketing spend +80% QoQ), contributed to QoQ operating cashflow reduction.”) I’m pleased to see they are doing this, because they have the funds to fuel the growth, but also because they will need it to maintain this high growth rate. With their partner based go-to-market motion, I suspect it will take 2 quarters before we see results from this bigger team.

What they do with the pile of cash. Dropsuite have been open about proactively seeking acquisitions (“Advancing high conviction M&A opportunities which leverage existing internal growth and take advantage of strong market tailwinds around data protection..”). We’ve found expenses for due diligence in the previous quarter’s 4C. I’m curious to see if an acquisition does materialise., and what that would look like Personally, I’m a bigger fan of them re-investing in growth.

K2FLY (ASX:K2F)

K2Fly develops software for mining services to assess and manage corporate ESG risks, and improve their compliance to government regulations. This helps mine sites maintain their social license to operate whilst adhering to community standards.

I chose to include K2fly in this article because to the casual observer, the results might look rather average. If you focus on some points rather than others (Rio Tinto contract discontinuation!), you may even conclude results were negative.

I think differently here, and I’ll explain why.

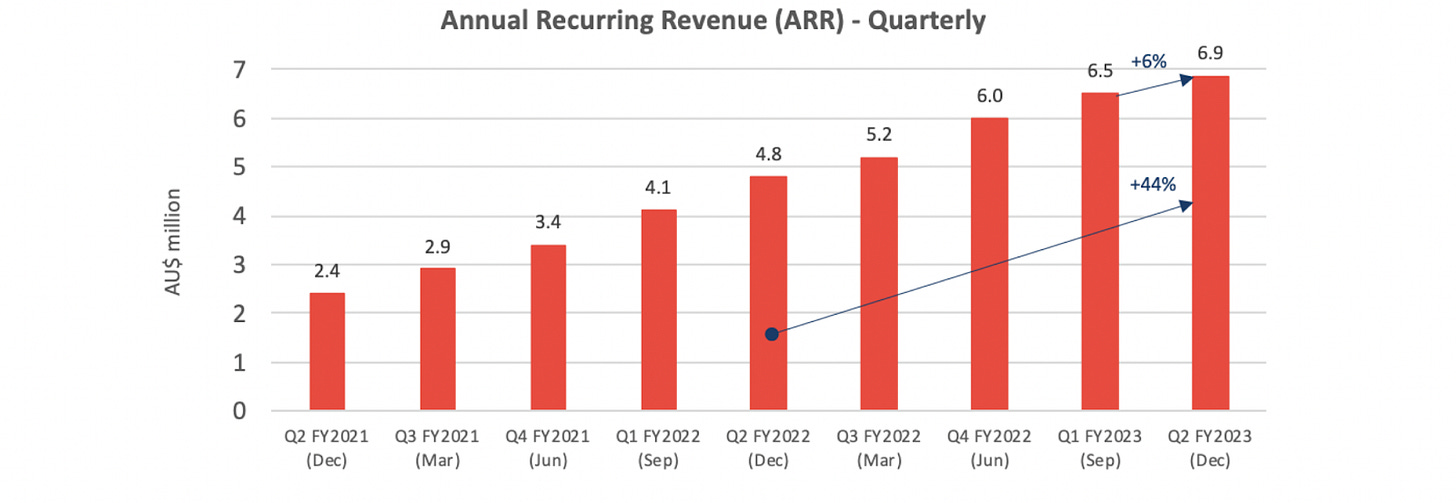

Whilst it’s not great to see the discontinuation of the ground disturbance licence with Rio Tinto (Contract TCV value of $2.6m and ARR of $620k), I remind myself that K2Fly is still in their early days as a company. Whilst they were founded in 2007, the software category they operate it is still considered quite nascent, and a company below $10M in ARR in my opinion is still pre Product-Market-Fit. Which to me means churn will happen as they improve the software and move closer in the direction of solving the bigger problems of their users.

The pleasing news we saw from them is that despite a large contract loss, they still managed to add an impressive series of new contracts, resulting in a net gain of $0.4M in ARR, which puts them on a 44% YoY growth rate. That’s good execution and tip my hat to Nick and the team.

Also, they announced a while ago they would management costs more closely with the aim to reach cashflow breakeven with their current funds. We’ve seen this in affect this quarter with expenses on staff down by roughly 30%. Costs were lower than the previous quarter, but the CEO did flag that this was also due to the timing of financial commitments, so they may rise slightly again in the future.

What I’ll be watching for K2Fly

ARR growth. Now they are quickly approaching the $10M ARR mark, I’d like to see them have more consistent strong quarters. I’d love to see them break the $1M/quarter mark. They would have to do this soon for me to be convinced they have strong product-market fit and can sustain high levels of growth moving forward. Note that without the contract churn, they would have achieved just that; a $1M/quarter. So I’m keen to see what lies ahead.

RMA Global (ASX:RMY)

As the name suggests, Rate My Agent is an app that provides data on residential property sale results for real estate agents. The app centralises all the reviews of agent performance from vendors and buyers. This data can be used by agents to build their profile to market themselves, or by vendors to compare agents and find an agent or agency to sell their property.

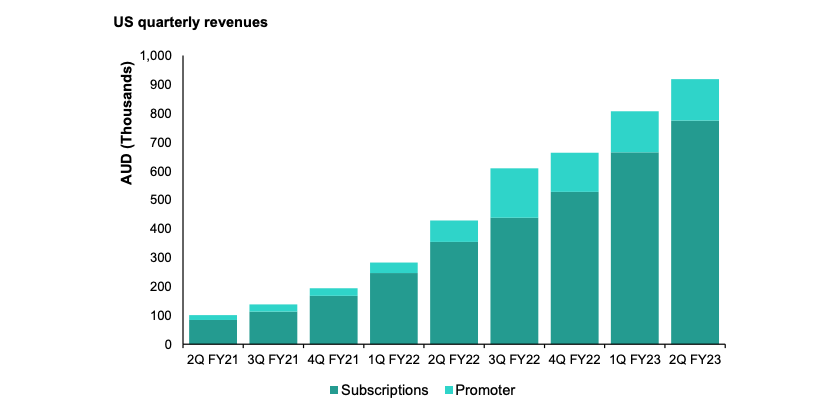

Rate My Agent interests me because the type of business model (a marketplace model) they operate can be lucrative if it’s well executed. They’re currently still in the phase of investment, mainly trying hard to replicate the success they’ve had in Australia in the US.

The began with a comment from the chairman on his confidence in the success the business might be able to achieve in the US.

Chairman David Williams went on the say, “If we superimpose our Australian experience, as it is today without any further growth, on the US market of approximately 865k active agents, then the US is a $360m revenue opportunity. I see no reason why we can’t replicate the Australian experience in the US. On the contrary, I can make a case that the business for the US can grow more quickly and be bigger than it is in Australia.

Whilst I appreciate the illustration, I don’t share the same levels of confidence as him. I was once in a leadership role at a company who tried to replicate the success of the APAC market into the US. It only took me a few weeks of speaking with prospects in the US to find that the market there was very different. Their problems were different to the problems of our clients in Australia, and it took much longer for us to break-in than we had initially thought.

The interesting thing however is that they are still growing agents on the platform in the US, and are doing so in a difficult environment for real-estate (“The real estate environment in the US declined further in this quarter, with total property sales in the market down c.35.4% YoY”). This means I feel they might prove me wrong, which would be great.

In Australia, the changing environment led to a decrease in users on their platform:

“Interest rate increases and inflation continue to impact the real estate industry, particularly in Australia where YoY housing sales volumes are down c.13% YoY2 . The number of active agents in the market has also decreased by c.2% since January 2022.”

What I’ll be looking for:

Growth in subscribers in the US. The chairman has been buying on market a lot. He’s clearly very confident in the company. I might become so if they continue to show execution. Over time, US revenue should eclipse AU revenue, and the US growth should almost essentially become the growth rate of the business. I’d like to see a number of quarters of this happening.

Cash Management. They’ve improved their cash management from last year, and currently have about 5 quarters of cast left at current burn rate. They would need to achieve a milestone for me to get interested. Let’s see how far they can go with the money.

Disclaimer

The content and data on this website is for information purposes only, and should not be read as investment advice, or advice on tax or legal matters. The companies and strategies discussed are on the site for entertainment only, we may or may not at any time be invested in the companies, and may be referencing companies simply as examples, ideas or for discussion.

By viewing the contents of this article, you agree:

(1) you have read and understood the warning and disclaimer above;

(2) not to make any decision based on the contents of the article;

(3) not to place any reliance on the contents of the article; and

(4) that the author is not responsible or liable, directly or indirectly, in any way for any loss or damage of any kind incurred as a result of, or in connection with, your use of, or reliance on, any of the contents of these articles.