Growing, Profitable Companies that No One Gives a Crap About 🧻

Rectifier (RFT.ASX), Vmoto (VMT.ASX), Vitura (VTI.ASX), Integrated Research (IRI.ASX)

I’d like to start by saying thank you to those that emailed me to share kudos for last week's article (link here). It was the best performing article to date in the short lifespan of my writings. On the back of this, I’ll therefore attempt to schedule a similar recurring monthly post where I offer a deeper lens on my investment evaluation strategy.

I ended last week’s article saying I would present the reverse view this week, now commenting on companies with a high multiple. The process of writing something worth reading is always a little longer than I expect. Hence, I’ll delay this post by another week as I do more research and spend more time creating fancy tables.

In the meantime, I thought I would entertain you with a spotlight on 4 companies that are profitable, growing, and trading at below market average PEs.

The goal being to answer the question: why does no one give a crap about them?

Growth and Profit ≠ Returns

There are 2 factors that are worth putting into the open upfront:

The current macro environment of rising interest rates, fear and doubt leads to investors seemingly only impressed with results that are strongly above expectations. Whilst these companies have recently reported good results in half year reporting, it appears none were surprisingly strong enough to get re-rated upwards. Studying history, this has often been a recurring trend in such environments.

These companies are on the smaller end of the market. As we all know, in the world of small and micro caps, it’s very common for a company to execute strongly for years before anything starts to change. In part, this has to do with institutional investors who have their hands tied to a number of rules that prevent them from touching these companies before certain milestones are hit.

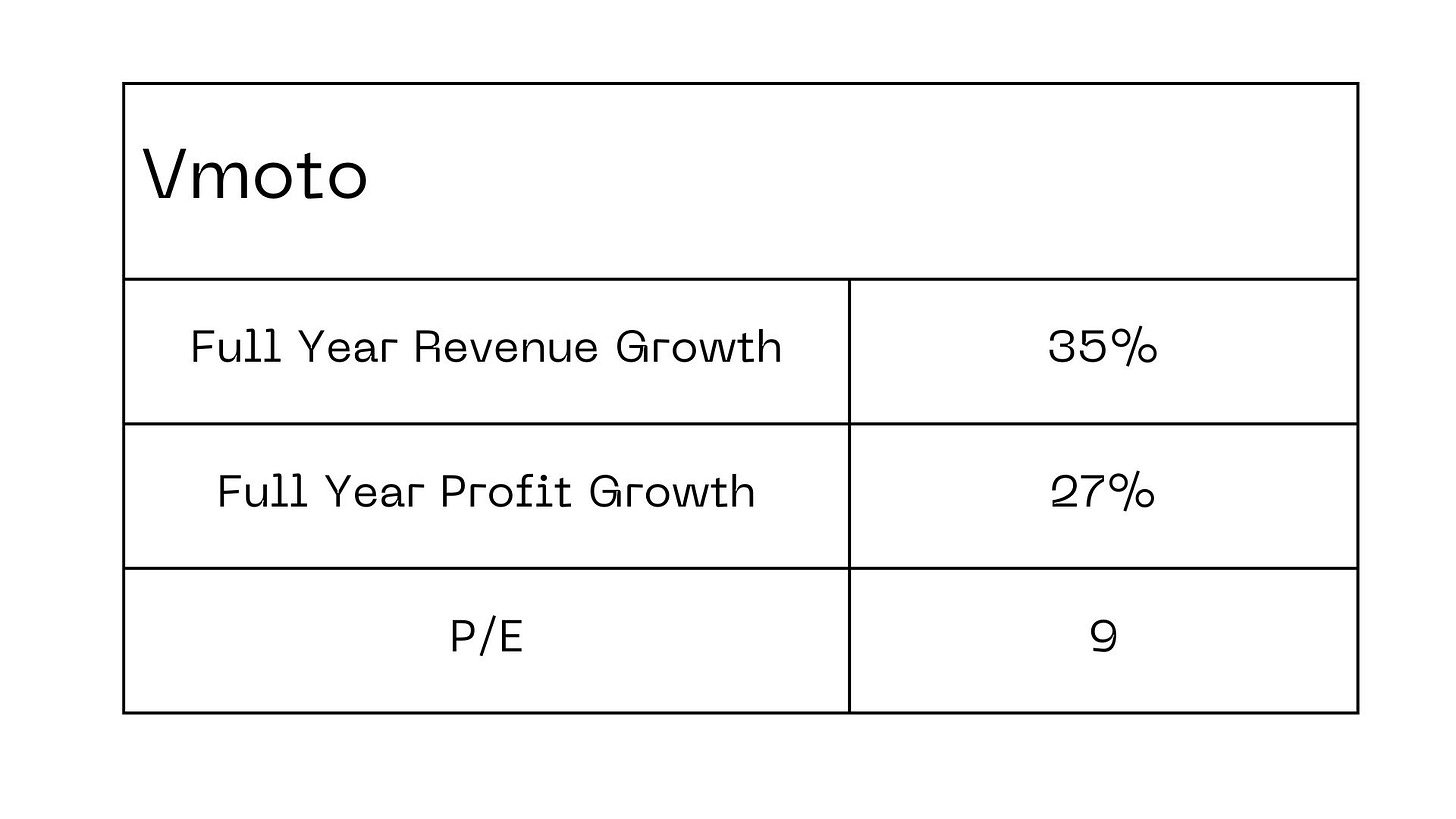

Vmoto (VMT.ASX)

I’ve previously commented on electric scooter and motorbike manufacturer Vmoto (here) saying I was anticipating what their full year results would be in the midst of recent turmoil.

As you can see on the table above, I think it’s fair to say they executed strongly. All important metrics moved 20% and above. Yet, on a 1 year basis, the stock is down 12%, and it’s down 30% on a 2 year basis.

Why?

Category worries: Investors have seen Vmoto’s listed peer Motorcycle Holdings’ (MTO.ASX) suffer decreasing profits, and they are worried Vmoto might face the same fate in the near future.

Future growth: Investors might not think the company will be able to replicate this growth in the future. This builds on the above point. Perhaps investors are worried that scooter’s are a non-essential purchase, and that the next year will see a decrease in the population’s appetite to keep buying these cool, electric two wheelers.

Management is not promotional: It’s rare that we hear from Vmoto’s leadership. The AFR had written an interesting piece on Vmoto 3 years ago (link here). But aside from this, it seems management is heads down in the factory and in customer’s offices delivering the goods.

The contrarian viewpoint

The contrarian viewpoint here would be to consider the fact that the CEO stated 3 years ago, in the AFR article, that he was running the company optimising for profit growth. If that’s true, then the (already cushy) bank balance will continue to pile up, and periods of potential slowdown won’t hurt the company too much as they may be able to act with boldness and buy others that don’t have such strong cash positions. Comparing Vmoto to Motorcycle holdings is also shortsighted; Vmoto manufactures their own bikes which are entirely electric, as opposed to reselling others products. The last few years have been a clear demonstration that the appetite for electric scooters is growing faster than traditional gas ones.

Let’s see what the future holds for these guys.

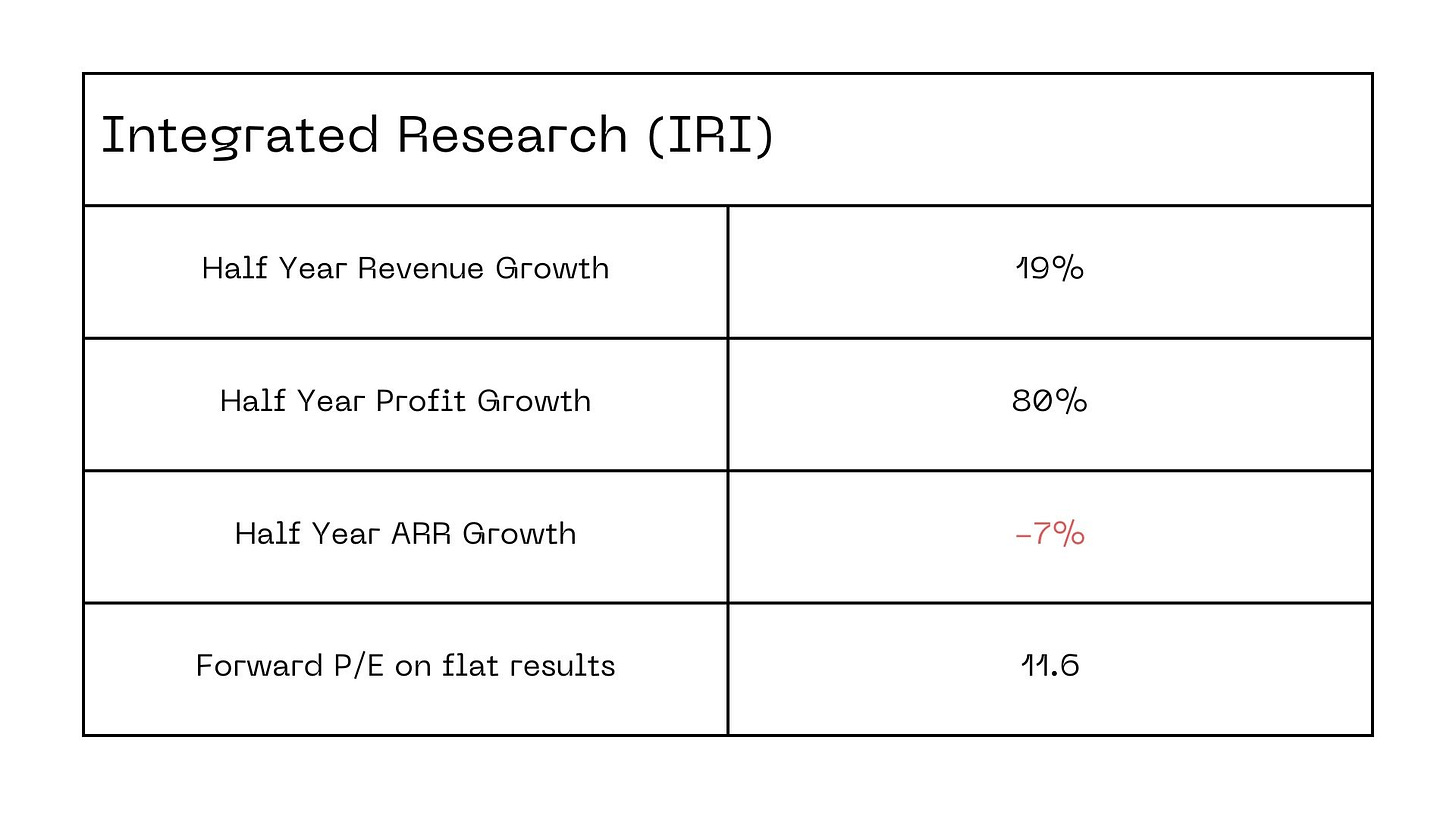

Integrated Research Ltd (IRI.ASX)

IRI provides a software platform that allows companies to monitor and troubleshoot their applications. This field was always important, and its importance has grown over the last few years with work environments becoming more dynamic (more working from home, and anywhere). Hence, the competitive landscape has also grown.

As we can see from the table, headline numbers are looking healthy, yet the stock is down 42% for the trailing 12 months, and down nearly 90% over the last 5 years.

Why?

ARR going in the wrong direction: Whilst it’s good that revenue grew, as I state often, with software companies it’s ARR we should care about.The CEO commented on the most recent results: “Subscription revenues for the period were $34.1 million, down 1% as a result of lower sales and lost clients from FY22. The lag impact of clients lost in H2, FY22 resulted in a 7% decline in ARR”. Before this company becomes interesting to me, ARR needs to grow, not just top line revenue.

Turnarounds rarely do turn: Dramas started in 2020 when IRI’s full year results were not as strong as expected. Since, downgrade after downgrade, the company’s been fighting a difficult battle in a difficult environment to change business models (upfront licensing to Saas) and regain investor’s confidence.

Software quality: The company is promoting a narrative of focused investment in R&D to continue to improve their product, and release new ones too. They were likely too slow to do in the first place. This would have been what eroded their growth. I think this is definitely the right decision to make, but improving software takes time.

Can they grow in USA and EU: Recent report mentions “Europe TCV +19% on pcp, Americas broadly flat on pcp, underwritten by strong renewals”. If the company is focused on growing both these regions, then investors will likely need to see growth in both of them.

The contrarian viewpoint

Whilst IRI will need time to win investor’s confidence back , they do have a few things going for themselves; primarily that even with recent difficulties, they still have a good base of steady clients. This will help them bring their new products to market faster. I also appreciate that they are quite transparent about what’s going well, and what isn’t going too well.

Whilst I remain skeptical at this point, I’ll keep tabs on the company at reporting seasons to see if they can deliver on their plan.

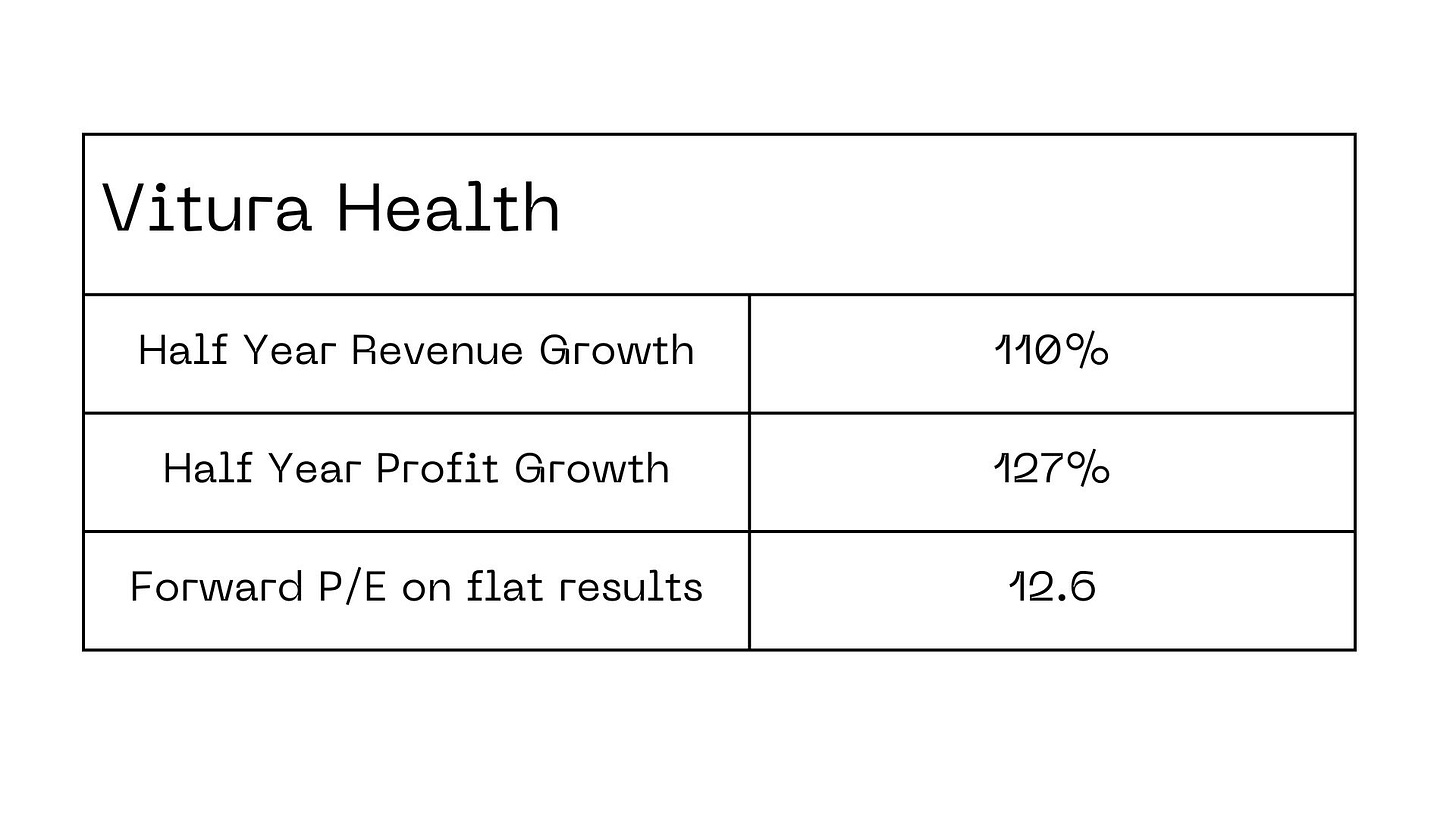

Vitura Health (VTI.ASX)

Another one I’ve also previously commented on is Vitura (here).

Headlines numbers are blurry because of the merger, so certainly no one expects growth to continue to look this good in the future. But many expect the growth to continue. The interesting thing about Vitura is that the stock is down more than 40% in the calendar year despite these strong results.

Why?

Leadership Dramas: There’s clearly some form of turmoil happening in leadership there. The company issued a press release in November saying peace was reinstated, but clearly, not everyone agrees to this.

Future growth: The company’s not been listed for long, but it’s also only recently completed this new structure. Therefore, we don’t yet have proof that this strong growth can be maintained for years to come.

Escrowed shares worries: In December, the company released a statement about a large number of shares being released from escrow. The fact that the company had performed very strongly in the last 2 years (despite a fall after November), had many investors worried that receivers of escrowed shares would cash things in, and put downwards pressure on the stock. This worry apparently still hangs in the air today.

Worries around legislation changes: A part of the thesis behind Vitura is that government rules around Cannabis will remain the same. If indeed the government shows willingness to loosen up laws, and get inspired by Canada and some American states, then a big part of Vitura’s network will become much less valuable. If laws change and people no longer need a prescription for weed, than their 3-sided marketplace is much less useful.

The contrarian viewpoint

A lot of these potential reasons putting weakness on the share price are focused on the short term. Vitura’s recent track record has been extremely strong, and leadership has been able to remain concentrated on good growth in these difficult times. The CEO Rodney Cocks has got a strong track record, with a nice Australian of the Year award has an added bonus.

Let’s see what they can do in the next 5 years.

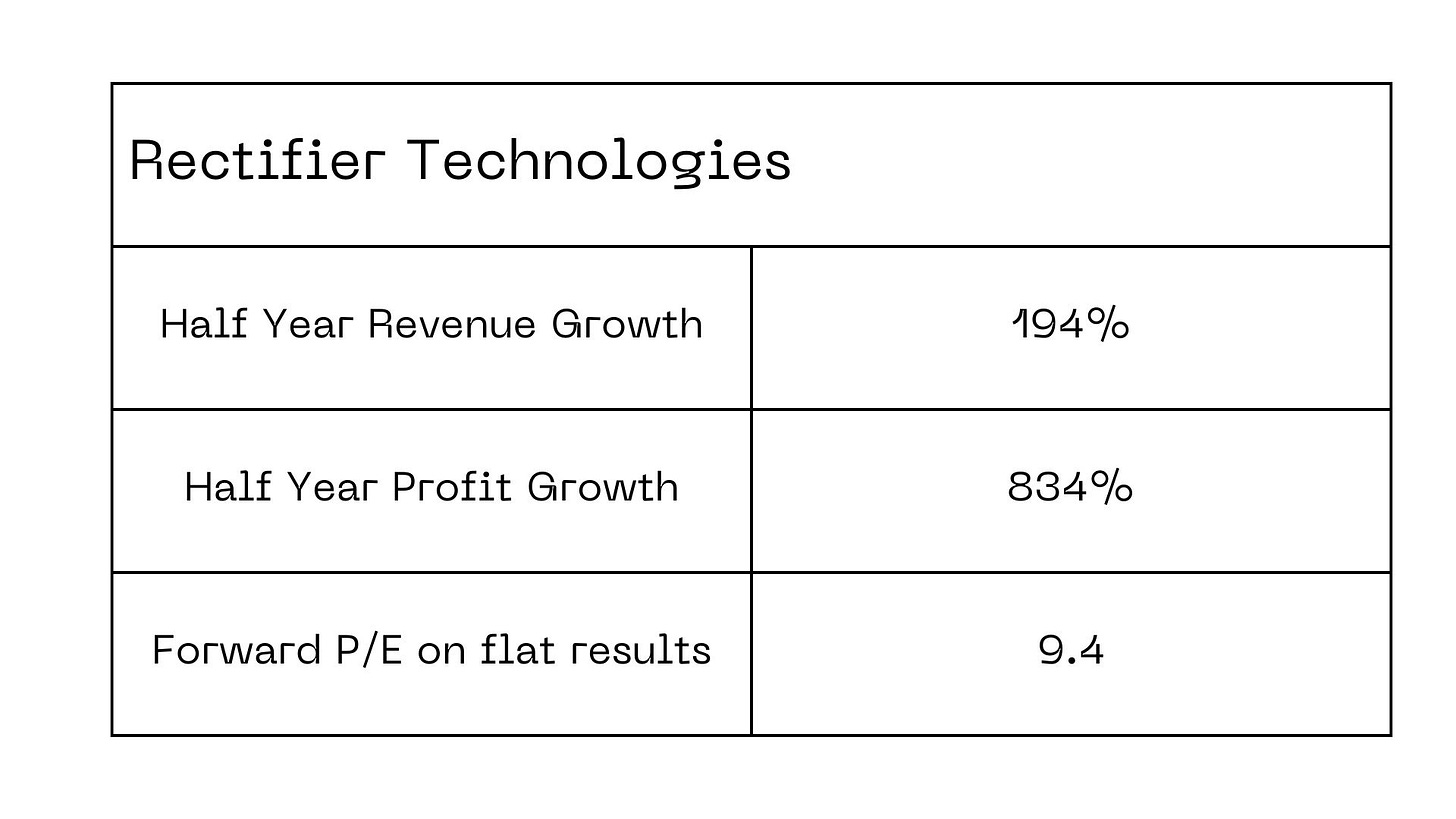

Rectifier Technologies Ltd (RFT.ASX)

As their name suggests, rectifier manufacturers power supply units for high powered electric vehicle charging.

In a market that can’t seem to buy enough EVs, it would appear that Rectifier is well positioned to benefit from this strong tailwind. Their contracts won would indicate this too; in the last 12 months they released a number of announcements about winning large EV supply contracts (namely Tritium at $20M USD). Whilst this moved the market strongly on the day of the announcement (stock went all the way up to 7.8c), the hype fell off rather quickly. The stock is down 12% for the trailing 12 months, and down nearly 90% over the last 5 years.

Why?

But can you deliver these units: Orders of charging stations are not like orders of software licenses. It appears investors are focused on the costs the company will have to incur to build these units.

Future growth: Today’s recurring theme doesn’t escape Rectifier. A strong demand today doesn’t guarantee that the demand will continue to grow over the coming years.

The contrarian viewpoint

The last 5 years for investors have been a rollercoaster ride, and things may well remain this way in the future for Rectifier. Management has done a fine job delivering such results in a difficult environment, and that deserves a hat tip. Institutions have not shown much real interest in the company to date, but if execution continues, this will surely change in the coming years.

Conclusion

In this environment, growing and profitable companies whose stock isn’t going anywhere aren’t really the exception. I sometimes wonder what we will think of these years in 5 years time, do you?

As always, feel free to share feedback, offer a healthy challenging perspective, or shoot through any companies you would like my opinion on.

Disclaimer

The content and data on this website is for information purposes only, and should not be read as investment advice, or advice on tax or legal matters. The companies and strategies discussed are on the site for entertainment only, we may or may not at any time be invested in the companies, and may be referencing companies simply as examples, ideas or for discussion.

By viewing the contents of this article, you agree:

(1) you have read and understood the warning and disclaimer above;

(2) not to make any decision based on the contents of the article;

(3) not to place any reliance on the contents of the article; and

(4) that the author is not responsible or liable, directly or indirectly, in any way for any loss or damage of any kind incurred as a result of, or in connection with, your use of, or reliance on, any of the contents of these articles.