Intellihr Ltd (IHR.ASX)

What IntelliHR's competitive bids tell us about current valuations

How the average investor thinks, and how the average PE firm thinks 🤔

Few tech companies have performed well in the last 18 months. The majority of those that escaped this difficult fate was due to acquisition bids being put in front of them. It’s tempting to think that a private equity firm will gain from the acquisition purely by applying its secret sauce, ripping out costs, and running the business for cash flows.

While this is likely true, I believe another truth is the PE firms look further into the future. A lot of companies whose stock have been beaten down are burning cash, but growing consistently north of 20% YoY, with very sticky recurring revenue and high gross margins. 5 years into the future, the financials of these businesses will look completely different. This is especially true if free cash flow becomes the metric you start optimising for. In a recent podcast, Thoma Bravo shared that they target 40% cash flow margins as the goal for their acquisitions once they’ve done their work.

“The stock market is a device for transferring money from the impatient to the patient.” - Warren Buffett

The growing gap 🤏

In my view, having exposure to both sides of the fence, private and public markets, the gap between VC-backed valuations and public ones is extreme. A plausibe reason for this is the time horizon of investments; when you take part in a raise for a startup, you don’t expect to see your money back for minimum 5 years (more likely 10). What if that become the default view? Many investors claim this is their modus operandi, but I feel their trading account summary might tell a different story.

In Forager Fund’s December report, Steve Johnson was writing:

“Acquisitions become far more attractively priced in an economic downturn and can be far more important for small companies than large ones. That is both for companies that are doing the acquiring and those that get bought. Our Forager Australian Shares Fund received takeover offers for five different companies in the second half of 2022, out of a portfolio of just 30 stocks.”

A company I had been interested in for a while has recently seen its valuation go up nearly 3x given acquisition bids.

IntelliHR

Let’s dive into what IntelliHR’s recent adventure tells us about current market valuations in the small end of technology-listed companies on the ASX.

intelliHR provides software for human resources (HR). Their cloud-based people management platform offers people analytics, employee experience modules, and sentiment analysis.

When it listed on the ASX in 2018, IntelliHR barely made any revenue. Their first quarterly cash flow statement shows customer receipts of $65,000. 3 years later, the company reached a first significant milestone of $5M in ARR.

Until then, fast growth continued. Not any type of growth, quality growth; annualising around 100% the last few years, organic and largely coming from existing customers expansion.

The Fall 📉

At its heyday in December 2020, the company held a market cap of ~A$139M.

When the markets turned in 2021, IntelliHR got punished, largely because it was slow to get with the program, and to start focusing on cash efficiency.

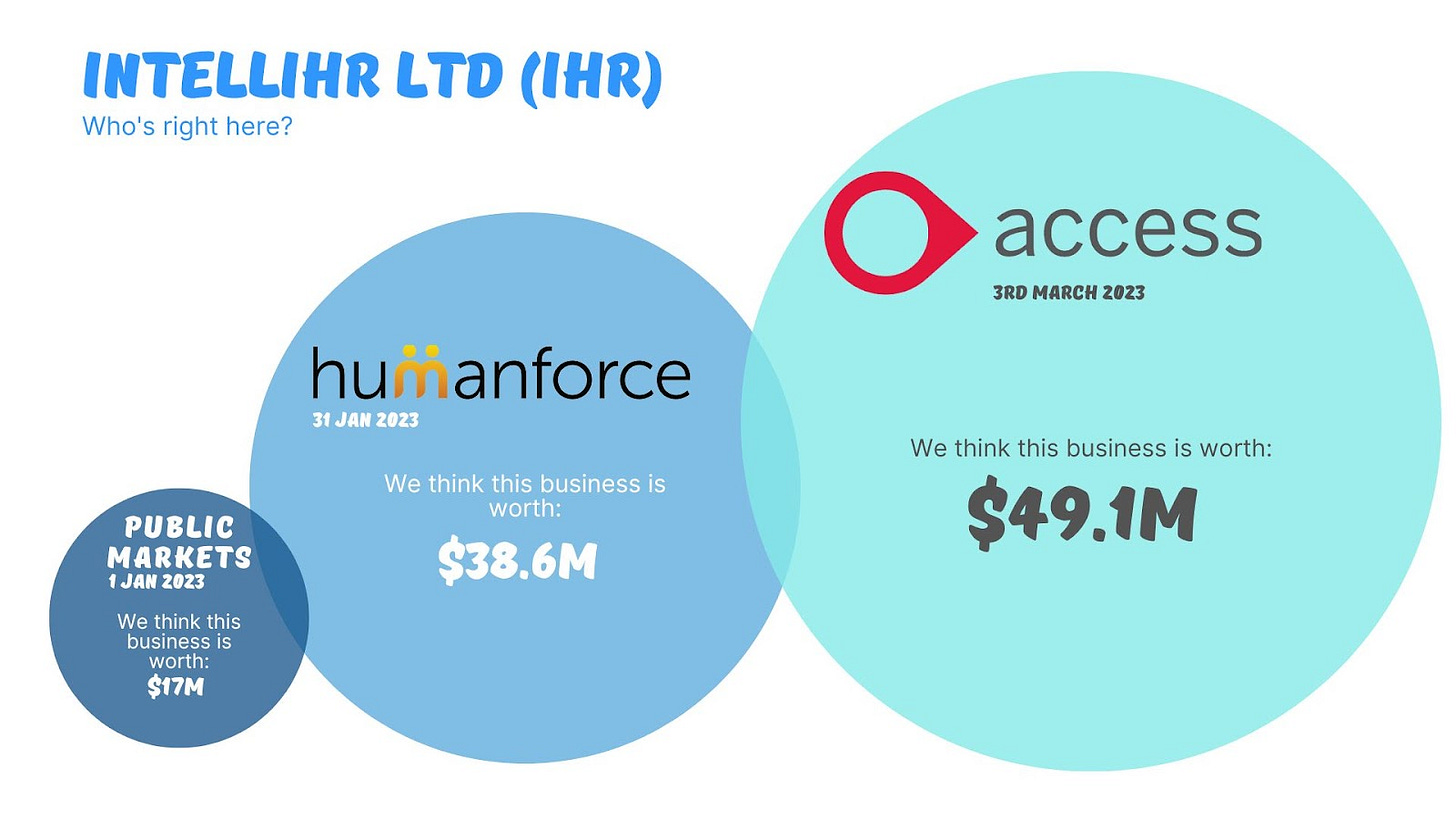

In December 2022, 2 years after its peak valuation, the market valued IHR at ~A$17M.

The Opportunity 🔍

In his November Monthly report, Luke Winchester commented: "At a market cap of $18m, IHR is generating annualised recurring revenues (ARR) of $8.4m and still growing organically very strongly. [...]

We are in an environment with plenty of merger and acquisition activity in the tech space and IHR could present a valuable asset in the right hands.”

Luke wouldn’t have been the only one thinking this; a company growing at ~100% YoY trading at ~2X ARR indeed can start to look very interesting.

If we take a very crude top level view at the valuation equation without even bothering to look at cash flow (DCFs is always a much more accurate tool; but hard to do when cash burn remains strong), good upside becomes very possible when multiples are decimated:

Put your money where your mouth is 👄

On the 31st of Jan, IntelliHR told markets that “Humanforce will acquire all of the issued shares in IHR for $0.11 cash per share by way of a recommended Scheme of Arrangement”. My perspective is that Humanforce were getting a great deal here; the majority of their revenue comes from Workforce Management, and having just recently launched its payroll solution, Humanforce would have a lot of customers to expand with IntelliHR’s tools in their toolbox.

But the excitement doesn’t end here. On the 3rd of March, IntelliHR now updates markets that “The IHR Board has received an unsolicited, conditional, non-binding proposal from The Access Group (“TAG”) to acquire all of the fully paid ordinary shares of IHR at a cash offer price of $0.14 per share, via a scheme of arrangement (Competing Proposal).”

The Access Group would have done some match crunching, and figured out that even an equity value of approximately $49.1 million for IHR was a good deal.

Conclusion

From IntelliHR’s story, I draw 2 hypothese:

The recent PE buyouts offer an opinion: some ASX listed tech stocks have become undervalued. Of course, buying a stock purely because it’s undervalued is not a good strategy (“Don't bottom fish.” - Peter Lynch). But, with so many stocks that have shaved more than 50% in 2022, and a further 20% in 2023, it may be time to start kicking the tires on some of them. Next week, I’ll offer a high-level view on a few software companies on low multiples. I’ll welcome yours as well.

Businesse that grow north of 50% YoY (which is the case for IntelliHR) are a special bread. For them, it might be worth taking a leaf out of VC’s books, and spend more time asking yourself the question: “What are all the things that could go right about this business?”, rather than the alternative.

I’m sure I’ve missed some important lessons too. What are your ones?

Disclaimer

The content and data on this website is for information purposes only, and should not be read as investment advice, or advice on tax or legal matters. The companies and strategies discussed are on the site for entertainment only, we may or may not at any time be invested in the companies, and may be referencing companies simply as examples, ideas or for discussion.

By viewing the contents of this article, you agree:

(1) you have read and understood the warning and disclaimer above;

(2) not to make any decision based on the contents of the article;

(3) not to place any reliance on the contents of the article; and

(4) that the author is not responsible or liable, directly or indirectly, in any way for any loss or damage of any kind incurred as a result of, or in connection with, your use of, or reliance on, any of the contents of these articles.

Good article!

$RDY ReadyTech whilst diverse, is practically the last listed HR/Payroll tech company on the ASX after buyouts of ELMO, Pay Group, Intelli etc

HR Tech is so hot right now with acquisitions left right and centre (not just listed)

An offer of $4.50/share for RDY fell through recently, now trading more than 30% off that... Consistent 30%+ growth company makes it attractive to PE and players like TAG