Playside (PLY.ASX) : Deep Dive

They make games and have fun doing it

This month’s deep dive is about Australia’s leading game studio: Playside.

I heard about Playside a little nearly 4 years ago when I listened to an interview with the CEO Gerry Sakas (link here).

I remember a fear of sharks and airplanes mentioned, but don’t remember any mention of the company going public anytime soon. Hence, I failed to dive deeper into the company when the listing happened at the end of 2020.

To say the least, things have been interesting since they listed, so let’s dive into it.

If you like these deep dives, please share them around, and always remember this is never financial advice.

🖐 4 bullet Summary

The bull view: Playside’s creative leadership continues to release unique and popular original IP. The work-for-hire segment grows in the background feeding cashflow, and the publishing division kicks-off nicely. These growing pillars lead to sustained growth in the 30% range for years to come.

What the market is missing:

Lumpy nature of the business can lead to dismissing a good strategy which continues paying off.

Impressive track record of growth goes back to early days.

Stronger industry tailwinds than most anticipate.

Key risks: New dev tools means the large competitive landscape will continue to expand rapidly in the next 5-10 years. New entrants can enter the market more rapidly than ever before and release games faster than before.

Some key client concentration, and increased headcount cost risk in WFH business.

Bear case: A unlucky streak of original IP games that don’t take off mean more write-offs. New segments may fail to scale quickly, and all this puts pressure on cash burn. All the while, new entrants benefit from the disruptions in the industry and the new tools, eating away at Playside’s market share.

History

Gerry Sakkas enjoyed playing games as a kid, but not any more than the average kid. He never owned a lemonade stand, and there’s no clear signs that he was bound for entrepreneurship either.

When Gerry was still debating what direction to take his studies, his dad went to an expo and saw a games degree advertised there. Coming back home that night, he told Gerry he had learned that day that game designers could make up to $130k a year. Gerry thought this sounded rather interesting. So he registered for the first course ever in games to be taught in Australia, which was at RMIT at the time.

After graduating he got a job at EA sports, and was quickly promoted up the ranks to be the lead designer of the Australian studio. Whilst this sounds great on paper, Gerry spent most of this time at EA working on a console title that he felt wasn’t going to make the cut.

The compelling moment happened 3 years in. Steve Jobs died. Content about Jobs was everywhere you looked, and Gerry decided to watch his Stanford address (never gets old that one, link here if you’re keen).

Steve jobs can deliver a pitch and his words inspired Gerry to get up and tell his coworker (soon to be cofounder) TJ that he was out. TJ calmed him down a little, told him to take a deep breath.

Weeks later, Electronic Arts shut down in Melbourne. Gerry got a $15,000 redundancy payout, and that became his first year’s salary for PlaySide’s. Oh, and TJ was in. Today he heads up business development for Playside. Gerry also roped in a veteran of the wealth management industry, Mark Goulopoulos and Aaron Pasias brought his finance skills to the table has Co-Founders #2 and #3 respectively.

Playside was formed in 2012 and listed in December 2020, raising $15m via the issue of 75m shares at $0.20/share.

When the market was in a great mood in 2021, Playside raised a further $28.0m at $0.75/share to further fund the working capital requirements of new partnerships.

🥊 So what do Playside do?

Games. That’s what they do.

The company has now released over 50 titles across 4 platforms. These are mobile, virtual reality, augmented reality, and PC.

On their website, they summarise their mission as “We’re pioneers in mobile gaming with a driver and focus for high quality development, monetisation and user acquisition.”

The second part of the business happened by accident (kinda).

After sweating over their first game for nearly 1 year, Catch the Ark received mixed reviews when it came out. But the standard it bolstered for a first release got Playside to receive emails from Nickelodeon, Warner Bros and Universal. All saying; we’d love you to make our games.

That’s how their work for hire business began.

Business Model

Whilst Playside started with the vision to create their own games, opportunities have presented themselves to them which allowed the business to grow to now 4 business segments.

Original IP

This is how the business got started; making games themselves and publishing them directly. Most of these are mobile games, and 10 have reached a #1 position on the top download charts.

As part of this division, Playside announced in 2021 they would develop console titles for Playstation and Xbox.

Work for Hire

This is the part of the business that kicked off when Nickelodeon called. Since, this part has been thriving. Current clients include Meta, Netflix, Disney, and Pixar. These contracts on average will last for about 1 year, and are very handy for cashflow purposes.

From Half-Yearly results they reported $10m revenue across ten projects and In FY23 they have seven major contracts expected to contribute revenue in the low $20m range.

Licensing

This is where they buy the “brand” of a movie, and turn it into a game. Examples of this are Legally Blonde, Godfather, and Dumb Ways to Die.

Publishing

A more recent decision, in July 2022 was to launch a publishing branch. That’s quite different to the rest of their business. Publishing is a large part of the gaming market that works like this:

Game developers will make a game, and start promotion prior to the launch (Youtube, Instagram, Twitter, etc..). Publishers enters the portrait with a promise to provide advice, finance, localisation tips, and marketing help. The intent is to multiply the game’s success for a share of the profit.

To make publishing possible, Playside have gone out and hired the right talent. They brought in Harley Homewood as the Global Head of Publishing. Harley is ex-Team17 Digital who are well established in the publishing space. Other hires were made from Activision Blizzard and Rockstar games.

Secret Sauce 🥫

Looking at their past execution, the secret sauce appears to be their “Lean” startup thinking, combined with a “be there first” mentality.

They identify key innovation areas, and create quickly to be there first. VR is a good example: when Oculus launched the touch controls, which have now become the controls everyone uses, Playside launched one of the first games on it (Zombie Riot).

Zombie Riot is estimated to have only cost them about $150k to develop; hence, the risk wasn’t very large for the potential payoff that comes from being there to grab the early adopters of these new technologies.

Now, there is a risk that this “secret sauce” fade over time as early access to games becomes the norm, and quickly changes game development process. According to research published in Empirical Software Engineering, approximately 15% of all games offered on Steam are “Early Access”.

Revenue Model 💵

Revenue from Original IP

For original IP games, Playside generates revenues from in-app advertisements, in-app purchases and subscriptions.

The mobile releases often come with a freemium model. As an example, Legally Blonde is free to play, with some in-game items purchasable for real money.

Indie titles on PC & Console will either cost US$20-45 or more, depending on the development time and effort.

Revenue for Work for Hire

The work-for-hire (WFH) space typically involves fixed contracts and some form of profit share post-release, which varies by title. As the segment grows, Playside is increasingly focusing on larger contracts which open up more cross-platform opportunities.

Revenue from Publishing

Publishing deals, if well executed, can be great for business. I heard the CEO on a recent interview mention that Team17 Digital they make roughly $130M per year from publishing revenue, and that profit margins on publishing can be as high as 30%.

Tailwinds: Gaming is booming 🧨

The sheer size of the industry: The gaming industry is larger in revenue generated than the TV, movie and music industry combined.

Mobile gaming: In 2020, 57% of the gaming market was coming directly from mobile games.

The Trend to buy in-games continues. “After overtaking video game purchases, in-game consumer spending accounts for the biggest share of the video gaming market.” (J. Clement , Sep 7, 2021).

The continued rise of watching gaming streams.

Culture ⛷️

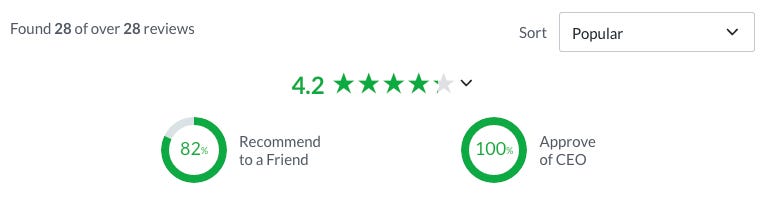

As you can see in their youtube culture videos, working there looks a little like what work is portrayed to be in movies. Glassdoor too tends to support this trend that working at Playside is very enjoyable.

Comments are made about:

CEO is hands on: “The CEO, who often helps create the vision on each project, works closely with teams to ensure the work coming out of our Studio is AAA quality.”

Close-knit Culture: “These people are my family and I can't imagine working any where else ever again.”

On the flipside, notes around:

Goals are hard to define. “Undefined tangible goals for success per product release. Unclear vision holders and directors of products. Could benefit from more pre-production.”

Some roles may have unfavourable compensation. “Good company with meh pay”

Employees

Playside’s headcount has grown significantly in the last 2 years as they hired quickly to fill demand from their increasingly growing work for hire deals. LinkedIn shows evidence of this:

📈 Growth

Playside’s growth to date has been quite impressive.

Note that this year when they presented growth rates, they excluded Bean’s. I’m not entirely sure why management made this judgement and it’s skews the portrait a little. If they reach guidance, this year’s growth will be around 20%.

Future Growth

Here are the some of the growth levers I can see Playside leveraging in future years:

Big hit titles with a strong long-tail: A successful game is a revenue stream that can remain strong for a decade. The Candy Crush Saga game was released by King in 2012. Ten years later, Candy Crush was still generating revenue of ~$US600 million dollars (in US alone). In 2016, King was acquired by Activision Blizzard for $5.9 billion. Now that Playside has more experience making original IP titles, a fair assumption could be that they stand a better chance at making “hit” titles in the future.

Publishing kicking off: Whilst I don’t think it’s fair to expect a material contribution from publishing in the next few years, as the division makes a name for itself, publishing could become a nice margin booster for Playside in the next 5 years.

Work for Hire continues to Scale: Whilst investors like this segment less, because it’s effectively a services business model, WFH’s recent performance could indicate there still a long runway ahead. As a comparison, the Irish WFH game studio Keyword reported 35% revenue growth last year to €691 million. This proves WFH alone can become a big business. The challenge here I think is that it would demand strong leadership to be run well, given the headcount expansion necessary to make it work.

Leadership

One things for sure when looking at Playside’s cap table; there’s plenty of skin in the game there. The 3 co founders each own ~19% of the business each. Together with TJ, they make up more than 60% of the company’s ownership.

I think of Playside very much as a founder-led business. The original crew that formed the company 10 years ago are all still involved in the company, with a mix of new experienced leadership brought in over time.

The team can be found on their website here.

🐻 Risks

I feel like a broken record starting with this, but like many other small cap growth companies, two years ago, investors may have looked at Playside thinking valuation alone was a big risk. In FY2020, Playside traded over 30x revenue.

Revenue has grown since, and the share price got re-rated, so this risk is now reduced, but of course, remains present.

The risks I see now are:

Indie game producers have better tools: Building games 10 years ago was much harder than it is today. The advent of better quality, and easier to use tools for game devs means a likelihood that more indie studios will enter the market, increasing the competitive landscape of the market.

Change of Plans from WFHs clients: Whilst Meta expanded their WFH contract with Playside, they also made the decision to shut down Crayta on March 3, 2023. This hypothetical scenario to write plans could mean some key WFH contracts get terminated for Playside, which would hinder progress.

Key leadership and talent loss: As mentioned above, I think of this business as founder-led. If any of the original members left, the strategy could become much harder to execute on. Success in gaming is also about finding and keeping the best creative and technical talent. Playside will have to continue to invest a lot of effort here.

Fragmentation or big player advantage? With the field changing quickly, there are diverging opinions as to what it will look like in 10 years. Bain and Co think that “As competition increases, scale will become even more important, since big games are expensive to make and require a massive global audience to succeed.” Source here. This is a risk in itself; there are large number of players that are significantly bigger than Playside in the industry, that could win given their sheer size.

No straight path to growth: gaming depends on the performance of your hit games. Paretto’s 80/20 principle is definitely at play here; a few key titles tend to drive the revenue of the whole company (see Candy Crush reference above). Playside may well fail to develop one of those in a given year, as a result total revenue could go backwards on the last year. A down year isn’t something the market likes.

Conclusion

Playside is an interesting business operating in a quickly changing industry. They will be interesting to watch in the future as we see new technology continue to enter the world of gaming.

Thanks for reading all.

Feel free to leave a comment about things I missed, your contrarian opinion, or anything else relevant.

Other Deep Dives I wrote

Disclaimer

The content and data on this website is for information purposes only, and should not be read as investment advice, or advice on tax or legal matters. The companies and strategies discussed are on the site for entertainment only, we may or may not at any time be invested in the companies, and may be referencing companies simply as examples, ideas or for discussion.

By viewing the contents of this article, you agree:

(1) you have read and understood the warning and disclaimer above;

(2) not to make any decision based on the contents of the article;

(3) not to place any reliance on the contents of the article; and

(4) that the author is not responsible or liable, directly or indirectly, in any way for any loss or damage of any kind incurred as a result of, or in connection with, your use of, or reliance on, any of the contents of these articles.

Nicely put together mate.

Staggering how much revenue these games generate. Will be interesting to see how they adapt to new technology and the opportunity something like Apple’s vision pro creates for it.

It’s such a competitive landscape, will be an interesting watch.