The High Multiples Crew 🦅

How do these companies escape gravity in a weak market?

Two weeks ago, I shared my comments on software companies with a recurring revenue model that currently look cheap (link here).

Diving into their individual stories highlighted some very good reasons why some of them might currently be trading at low multiples.

These companies are still in their early days, and burning cash. How much cash they have in the bank is important, and a few (Rightcrowd (RCW.ASX), Whispir (WSP.ASX), Limeade (LME.ASX), Eroad (ERD.ASX), Openlearning (OLL.ASX)) look they might need to raise soon (many have a leadership team saying raising won’t be necessary, so let’s see). Others look like they’re stalled, and need a new pathway to growth.

Today, let’s look at the other side of the coin; companies that have earned themselves a high multiple.

It’s interesting to look at these companies because a high valuation, as an end goal, will be necessary to generate the 10 to 100x returns we want. As Christopher Mayer portrayed in 100 Baggers, all the 100 baggers of the last fifty years he studied had one thing in common; growth happened in the business (with top and bottom line), but also very much in the valuation of the business. Mayer labels growing sales combined with a growing price to earnings multiple as the “twin engines” of growth.

Here are the companies we’ll look at:

High Level View

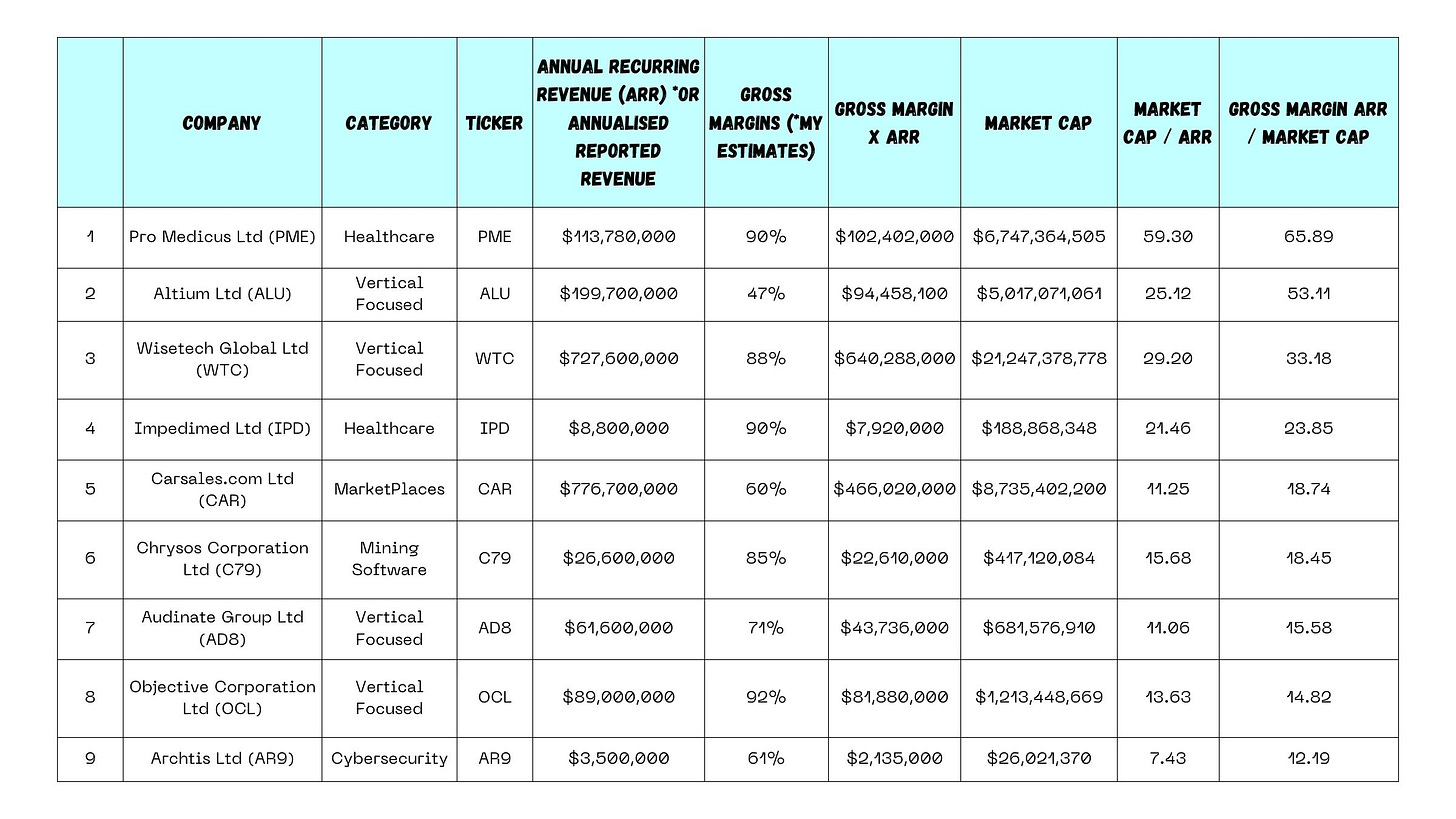

Whilst in the last article I focused solely on business models with Annual recurring revenue (ARR), I recognise that some excellent businesses, namely marketplaces, don’t lend themselves to such a revenue model. Hence, we will go broader this week and look at estimates I made of annualised revenue on the back of the recent reporting period.

Here’s what it looks like for these 9:

Commonalities

Rather than taking the company by company approach, I thought it might be more useful to break down the key pillars that may have been responsible for earning these companies their high multiples. Here we go.

1. Business Models

Let’s start with an obvious one. A framework that may have been initially coined by Wharton School of business or Deloitte, is a simple model hypothesising that there are only 4 types of businesses:

Asset Builders

Service Providers

Technology Creators

Network Orchestrators

I like this simple framework as a quick way to classify businesses. Here’s an example using some companies I follow (many of which I’ve commented on in the past):

It’s obvious why VCs (and us private investors) will often only show interest in 2 types: technology creators and network orchestrators. These are the business models with most potential for scale and operational leverage.

All businesses in this article fall within these 2 categories. Of course, there’s a bit of selection bias here from my part. There are other businesses on the ASX with a high multiple that fall outside of these 2 categories (PWR Holdings (PWH.ASX) is a good example). But, these businesses are rare.

Often a business will fit into more than 1 category, which is the case for many in the diagram above (Kip McGrath might also be labelled as technology with Tutorfly, Dug is certainly a technology creator as well, MadPaws is also asset builder with its vet medicine brands, etc…). But, in general thinking of the main revenue generating area as the main category can be helpful.

So, idea #1 is to keep looking for technology creators and network orchestrators.

2. Growth

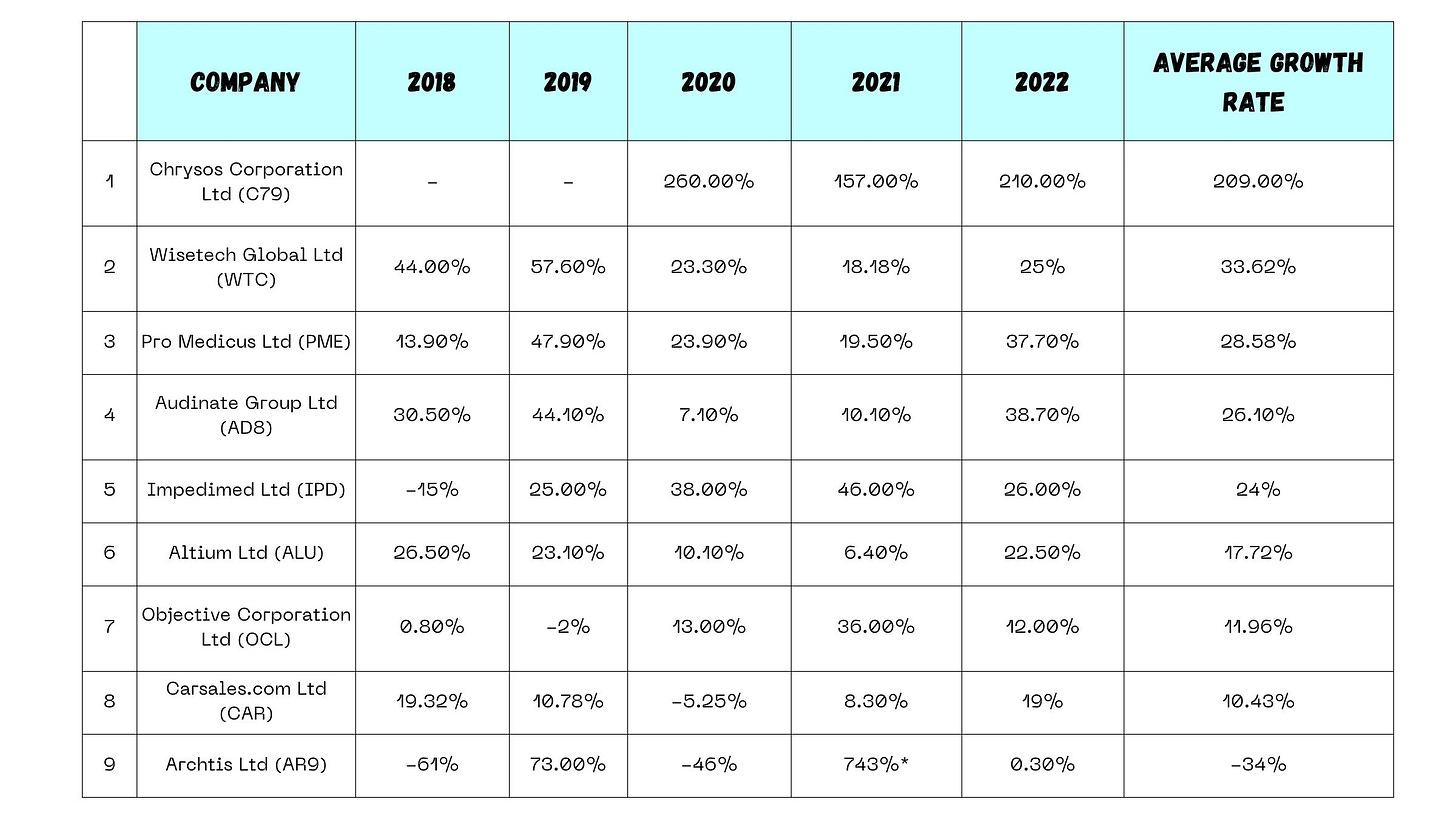

One hypothesis I had prior to looking into this is that all these companies would have growth endurance. When investors say they want to see growth, really what they mean is a specific type of growth; one that is consistent and can still grow in difficult environments. A personal benchmark I’ve created for myself is that growth endurance means average growth above 20% for the past 5 years.

So let’s look at how the companies did on this:

Observations:

Not all have met my initial criteria, but more than half did. Five of these companies have averaged a growth rate north of 20% over the past 5 years (Chrysos Corporation, Wisetech Global, Pro Medicus, Audinate Group, and Impedimed Ltd.)

Strong growth. Just look at Wisetech, Pro Medicus and Audinate in 2019. These numbers are beautiful. Solid growth such as this is a powerful showcase of these company’s product-market-fit. Admittedly, Chrysos is smashing it out the park here.

Slower growth can still give you a high multiple. You would probably be able to find a large pool of companies with average growth rates around 15% like a few on these tables. So what earns them the high multiple? Let’s look at the criterias below.

Does growth show a perfect correlation to stock gains? No. If that were true, that the highest average grower would have the highest return:

Idea #2 is to look for average growth rates about 20% in the last 5 years.

3. Margins

In the case of Objective Corporation (OCL.ASX), you may be a little dumbfounded if all you did was look at the top line and were told the valuation. That of course, is extremely single-sided and no go investor would think this.

The beauty of this business, and a majority of others in this article is in the margins.

In the most recent half year report, Objective Corporation achieved 20% profit margins. And that’s with continued significant investments in R&D ("We invested $13.4 million in Research & Development (R&D), an investment increase of 4% over 1HY2022 ($12.9 million) and representing 24% of revenue"). These are phenomenal margins.

Carsales is perhaps the best example here. In the most recent half year announcement, they report 36% net profit margins. This shows the exceptional power marketplaces (or network orchestrators) can reach at maturity.

So, idea #3 is to look for expanding margins over time.

4. Moments That Matter

As I was in the process of writing this post, Impedimed announced that The NCCN released a new version of its Clinical Practice Guidelines in Oncology for Survivorship which, for the first time, included bioimpedance spectroscopy (BIS).

With ImpediMed currently having the only FDA-cleared BIS technology (as far as I know) for the assessment of lymphoedema, this should, in layman’s terms, mean that they will be higher demand for their technology.

As a result of this announcement, shares doubled overnight.

A lot of these companies have had such moments where a key turning point was reached to unlock further growth. Pro Medicus had many when they announced these massive contract wins.

In August 2019, Objective announced a $38M contract with the city of Gold Cost; the share price doubled in the next year.

Idea #4, is pay attention to moments that matter.

5. Potential

For the smaller companies on this list, I must admit it’s hard to fully explain the reasoning behind a perceptively high valuation. Impedimed (IPD) and Archtis (AR9) seem like they have a little way to go in terms of growth consistency to prove their growth consistency.

Perhaps with Impedimed that’s not completely true; like many other healthcare software providers, the business generates revenue from services as well as software. This helps with cashflows. They’ve also been fairly consistent in their growth in the last 5 years. But, they’ve haven’t quite reached the 40-50% that many of the others have.

There are a few areas in the world of technology that tend to generate a feeling of high potential. It seems to me that healthcare software, and cybersecurity software are two of them. When investors look at these companies, they see potential for growth to step-change, and start to really crank up over the coming years. Let’s see if this actually happens.

Idea #5 is to look for areas with large potential for disruption.

6. Multiple Expansion

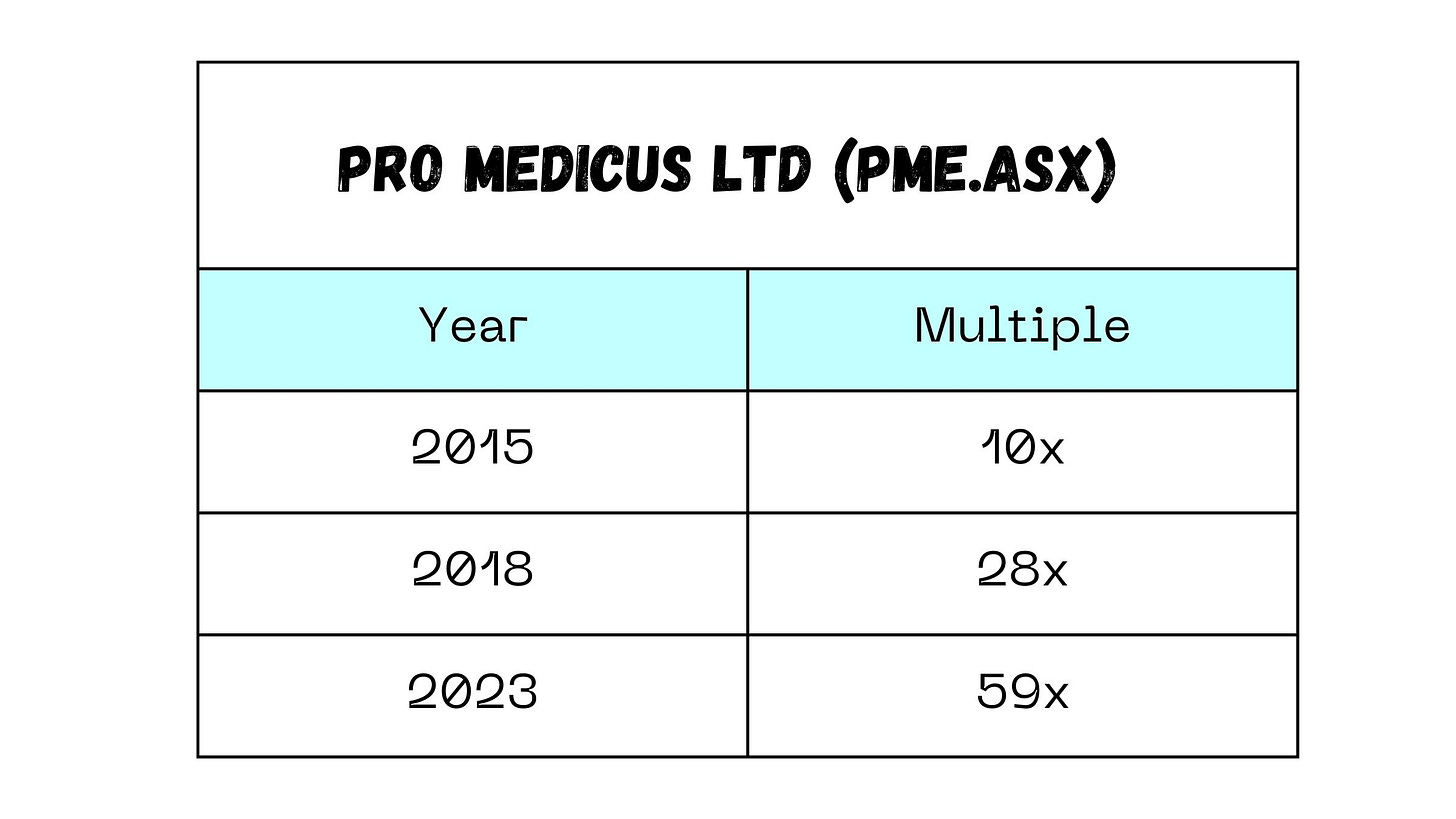

The difficulty when evaluating business with a high multiple is the mind game.

A first thought could be that a business with a 10x multiple on ARR won’t be quickly re-rated, and will need to offer quite a bit of growth for quite a long time before the valuation changes, but we saw in this article that this isn’t true. Let’s look at Pro Medicus using their Price/Sales ration as an example:

Idea #6 is to let yourself believe that multiple expansion can go further than you think.

7. Acquisitions

There’s a lot of mixed feelings about growth by acquisitions. But it can’t be all that bad, because a lot of the 9 on this list grew largely by acquisition. The best example of this is Wisetech.

In a recent AFR article, this was well explained:

“Logistics software giant WiseTech Global has started 2023 with a bang by making its largest acquisition to date, buying transport management system software company Envase Technologies for $US230 million ($325 million).

In its early years as a listed company, WiseTech was highly acquisitive and has done more than 40 deals since March 2016. Its flagship software, CargoWise, is a global logistics management platform, designed to help companies manage tariffs, regulation and taxes across the world.”

Wisetech would not be the company it is today without all this buying.

Idea #7 is that acquisitions aren’t always bad.

Conclusion

It’s obvious that there would be other ingredients that form a part of earning a high multiple, and it can be hard to pinpoint exactly what that factor is.

Reading through the article I just wrote, it feels like the factors are obvious. Perhaps a big part of investing is about constantly reminding ourselves of what is obvious, and making sure progress continues over time.

As always, I’m curious to hear from my readers if there are any other strong indicators of that may lead to a higher quality business. Share you opinion in the comments.

Disclaimer

The content and data on this website is for information purposes only, and should not be read as investment advice, or advice on tax or legal matters. The companies and strategies discussed are on the site for entertainment only, we may or may not at any time be invested in the companies, and may be referencing companies simply as examples, ideas or for discussion.

By viewing the contents of this article, you agree:

(1) you have read and understood the warning and disclaimer above;

(2) not to make any decision based on the contents of the article;

(3) not to place any reliance on the contents of the article; and

(4) that the author is not responsible or liable, directly or indirectly, in any way for any loss or damage of any kind incurred as a result of, or in connection with, your use of, or reliance on, any of the contents of these articles.