The Low Multiples Crew 🪫

High level view on 15 companies with sticky software recurring revenue

The narrative this week continued to be mostly dark and scary, with nearly all the focus on big macro, and investors hypothesising on the demise of the American banking system of the back of Silicon Valley Bank’s collapse.

It’s fascinating to see how many people came out with a newfound expertise on banking policy. I’m not such a person. One perspective I did enjoy reading, given I think he’s earned the right to have believable opinions on such things, is Ray Dalio’s (link here).

All the movement in big macro created the feeling that the reporting season ended years ago. The fear in markets caused many companies to slide further downwards. This is slowly translating to a growing number of companies at fair value, and an equally growing number that now seem outright cheap.

On this note, after my post on IntelliHR last week, the excitement continued. Now TAG will pay ~$68M for them. That’s a 400% premium on where IHR was trading 3 months ago.

In this post, I thought I would explore a few companies on my watchlist that have suffered further declines in previous months. Many of these companies need to prove themselves back to investors to regain their confidence. I'll share my opinions on what many might want to see. As always, let’s remind ourselves that turnarounds rarely do turn, and the wise words of Lynch below:

“Bottom fishing is a popular investor pastime, but it’s usually the fisherman who gets hooked” - Peter Lynch

Companies that look cheap with Recurring Software Revenues

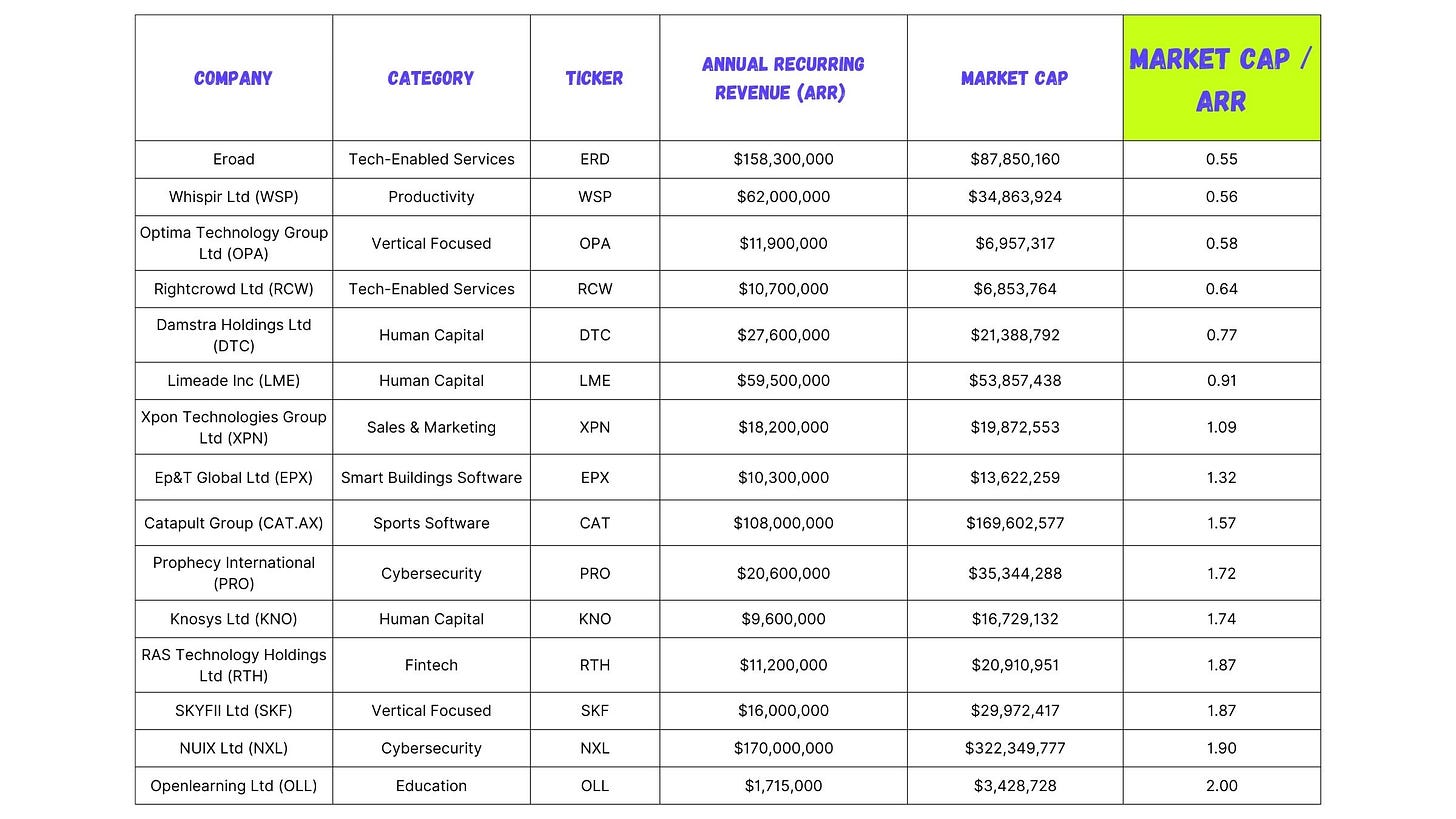

A very quick investor shorthand is to start by looking at the price/sales ratio of companies. This is necessary for companies that are not yet profitable; P/E ratios are unavailable, because there’s no ‘E’ to speak for.

Fast-growing tech companies in their early years will likely fall in this category has they race to capture market share before focusing on monetisation through nice cash margins. In such a ratio, price refers to the market cap of a company ( price of 1 share x all shares outstanding), and sales refers to the revenue (top line).

When possible, a slightly preferable simple ratio is Price / ARR (Annual recurring revenue). Annual recurring revenue (ARR) is better in the world of software because ARR only captures the part of a company’s revenue that will happen again in future years. Typically this means removing services revenue, and keeping only the part of your revenue with high margins. One thing to keep in mind however is that ARR gets measured when a contract is signed, as opposed to when revenue is recognised, so it will naturally end up being ahead of revenue (in extreme cases, this forms part of what creates the Pointerra drama I commented on 2 weeks back).

Naturally, looking at companies this way is incomparable to completing a proper Discounted Cash Flow. This simple ratio only offers a view on where the company is today.

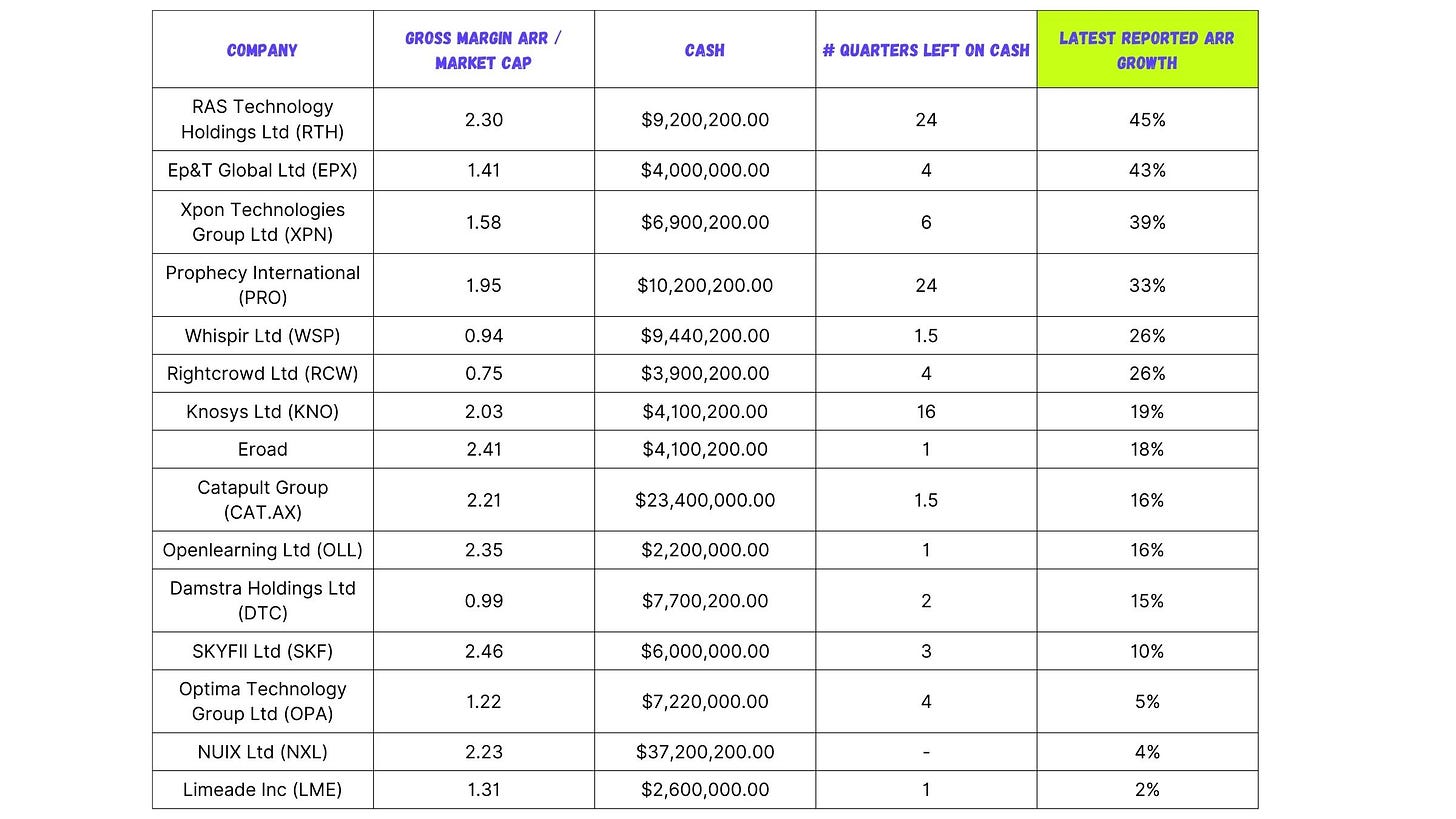

Still, if we look at it, here are companies that offer a low Price / ARR ratio. All of these 15 companies offer a P/ARR ratio of 2 or below.

Add Gross Profit

An almost equally effortless ratio is the price / recurring gross profit. This one is much more useful, because it takes into account the non-negotiable costs of getting this recurring revenue. Gross margins also offer a small glimpse in the potential quality of a software.

If we apply the reported gross margins of these companies, here’s the new story we now end up with:

Add Growth

Of course, there are very legitimate reasons why a company might be trading on a low multiple. Young, cash-burning software companies need to first prove their product-market fit. They need to show that they’re creating a product people need and want.

The simplest and best lagging indicator we have for this is growth. A small company that’s not really growing likely needs to spend more time developing a product that really solves a problem.

On the other hand, when a company’s growth is north of 20%, for a reasonable level of cash burn, then you might be looking at something interesting. Maybe. Just maybe.

Comments

15 companies is too many to comment on (unless you offer to buy me a beer whilst I write my comments down). Instead, I’ll focus on the top five growers on this list.

RAS Technology Holdings (RTH.ASX)

RAS Tech offers data, software and market analytics to the racing, sporting and wagering industries. I think they never really captured the attention of anyone, because they went public in about 1 year ago, in March 2022, when markets showed little interest to small tech companies.

When RAS provided their last 3 annual reports at the time of going public, it wasn’t clear either that they had a continued history of consistent growth. We can see that 2020 and 2019 were mostly flat years. Things started to get interesting in 2021, when the company reported 44% growth, and started to share a new narrative around a focus on growth.

In the most recent half, reported results remain interesting, with ARR growing 25% for a reasonable level of cash burn. With ~$9M in the bank, RAS is not at risk of having to raise money anytime soon. Let’s keep an eye on them and see what they get up to.

Ep&T Global (EPX.ASX)

I’ve already shared my comments on Ep&T Global in the past (ref. 3 small caps I’ll be watching this reporting season link here).

Since that post, the company showed signs of slow progress in their recent half report, with ARR growing at 12%.

They’ve been keeping the market updated on their progress towards breakeven, but it appears investors are not confident they will get there with current cash reserves.

Ironically, whilst I was writing this article, I noticed that Luke Winchester and Claude Walker both commented on the company on Ausbiz this week (link here).

Xpon Technology (XPN.ASX)

Xpon tech help organisations simplify and boost their marketing results with an integrated end-to-end solution. They offer a combination of software and services.

As we can see, this means lower gross margins then many of the other companies on the tables above.

Xpon was a on a very impressive streak of continued growth until it reporter no growth whatsoever in their January quarterly. There was no commentary on why that was. The company instead chose to focus on the half-year growth, which still landed at 39%.

The harder economic climate might be slowing decision making for their prospects, which is a fate many software companies are suffering. With that in mind, I’m keen to see what they report in the next quarterly, and see if they can go back to moving upwards.

Prophecy (PRO.ASX)

Talk about a ticker. Prophecy provides two different types of software; call centre management software (eMite), and cybersecurity software, (Snare) for centralised log management solution.

One segment, in my opinion, has always been more interesting than the other: eMite.

In their most recent report, it appears Prophecy was also a victim of a harder economic climate, with growth slowing down a lot from last year’s; going from ARR growth in the 70% to now 33%. This is still good growth however, and the company remains well funded with ~$10M in cash.

So this will be an interesting one to continue to monitor over the coming reporting seasons. If they show continued signs of strength, it’s very possible they will be re-rated upwards.

Whispir (WSP.ASX)

Whispir provides enterprises with a communications management platform. 3 years ago this was a darling, with a market cap of approx. $500M. A large benefactor of Covid-related communications, it quickly became clear they wouldn’t be able to maintain such strong growth indefinitely. Since, the company’s fallen completely out of favour with investors.

The immediate problem in front of Whispir now is that they’re running out of cash, and it appears they’ll have to do something imminently about this. A capital raise might be unavoidable at this pace.

Once this is complete, it will be interesting to see if the company can deliver on its promised plan to reach cash blow breakeven. If it can show that, then a company trading slightly below 1x annualised recurring gross profit is almost certainly too cheap.

This is far from done though. At at this point, seeing will be believing.

Conclusion

As I mentioned last week, buying a stock purely because it looks undervalued is not a good strategy.

One important step I’ve not spotlighted in this article is to add to the table the cash margins of these companies. Not all growth is created equal. Some of these company’s story speaks well to this; namely Openlearning (OLL.ASX) and Rightcrowd (RCW.ASX). Whilst both of these are showing decent growth; the proportional amount of cash they are burning to achieve such growth puts a serious question mark over their unit economics.

Next week, I’ll tackle the reverse view; who are the companies that seem to be escaping gravity in a weak market? I’ll spotlight companies with high multiples, and attempt to explain what earns them the right to be trading at a premium, even in a market full of fear.

As always, thanks for reading folks. Feel free to leave a comment about other software companies that seem cheap to you. Feel free to also challenge my thinking. Also, please share the love with a mate.

Disclaimer

Please not the calculations on the tables may be incorrect; I did them based on the latest half-year reports, and could easily have made mistakes when pulling up the numbers.

Also, the content and data on this website is for information purposes only, and should not be read as investment advice, or advice on tax or legal matters. The companies and strategies discussed are on the site for entertainment only, we may or may not at any time be invested in the companies, and may be referencing companies simply as examples, ideas or for discussion.

By viewing the contents of this article, you agree:

(1) you have read and understood the warning and disclaimer above;

(2) not to make any decision based on the contents of the article;

(3) not to place any reliance on the contents of the article; and

(4) that the author is not responsible or liable, directly or indirectly, in any way for any loss or damage of any kind incurred as a result of, or in connection with, your use of, or reliance on, any of the contents of these articles.