Vitura 🌿, Rpmglobal ⛏️, Fineos ☂, Chrysos 🧈

My comments on VIT.ASX, RUL.ASX, FCL.ASX, C79.ASX

This week was a very good showcase that investors are particularly wary of company’s showing chinks in their armors. Anything short of perfect (especially towards the bottom line) seems to have been sold down heavily.

Some big names saw the value of their market cap shaved by 20-30% on reports that were mixed. In this week’s article, I’ll share my opinions on a few companies whose reports were interesting to me. These are companies that are slightly bigger in size to the ones I’m normally interested in, with market caps ranging from $250M to $500M.

VIT.ASX : Vitura Health Ltd

Rpmglobal Holdings Ltd (RUL)

Fineos Corporation Holdings Plc (FCL)

Chrysos Corporation Ltd (C79)

VIT.ASX : Vitura Health Ltd 🌿

I’m still not used to their new name; Vitura health is the new label for Cronos Australia.

Vitura manufactures and distributes medicinal cannabis products. They operate under five aligned subsidiaries to offer their customers a fairly complete suite of products - CanView, CDA Clinics, Cannadoc, BHC and Adaya.

They’ve had a very interesting journey since listing in 2019. They hadn’t quite caught my eye at the beginning. At the time they were solely focused on producing THC and CBD products, and I could hardly see any differentiation from the other players.

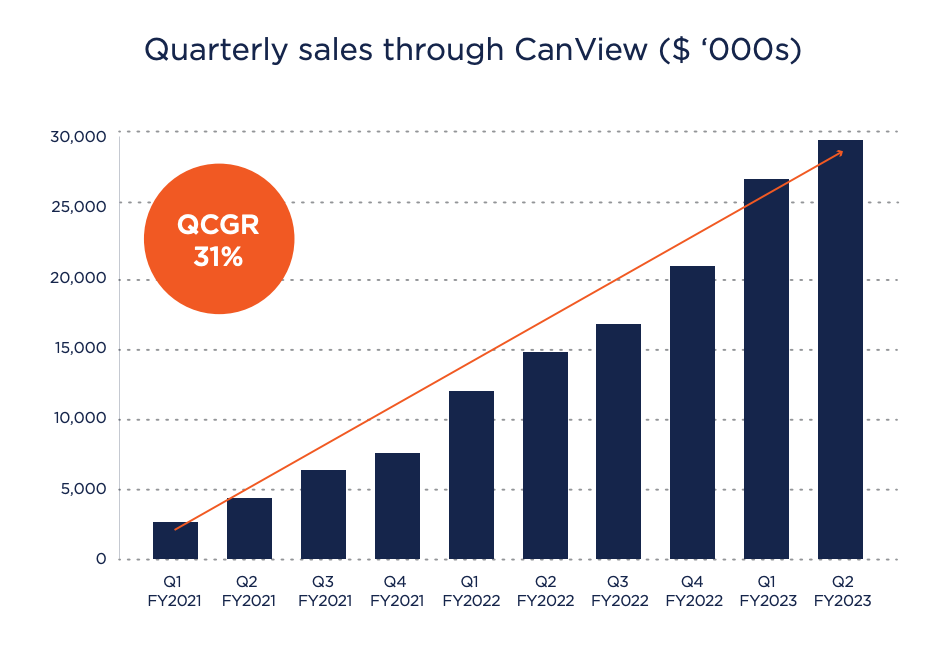

Things became interesting when they merged with CDA Clinics. The merger brought with it an online portal, which they call CanView. The portal is a 3-sided marketplace that connects doctors, pharmacies and customers on a platform. Since the merger momentum has kicked off for the group and growth has been impressive.

Their recent results have demonstrated a continuation to this trend of strong growth. Headlines showed gross revenue for H1 2023 of $57.6m, up more than 110% on previous half-year, and net profit after tax of $7.7m, an increase of (127% on previous half-year). Even if they flat-line for the rest of the year, this puts them on a forward PE of ~20. This isn’t too demanding for a company growing at this pace. But as always, the devil is in the details, and things are far from perfect.

First of all we must acknowledge that the merger is skewing the growth rates. Thankfully they do provide a little more historical context, which offers a more accurate view of reality. Real growth rates are more likely in the high twenties or low thirties.

What worries me most with Vitura is that the sector’s growth in Australia is so strong that it will continue to be appealing for new players to join the market. While their platform serves as a moat, it’s not impossible that newer entrants can start to take actions that will slowly decrease their moat’s value overtime. Whilst they’ve had a very strong quarter, one metric that was particularly weak was the number of new patients on the platform. The 3.5% growth on the previous quarter is the slowest growth they’ve experienced to date.

This said, I have confidence in their new CEO Rodney Cocks, and am keen to see how the story continues to unfold in the next few years.

Rpmglobal Holdings Ltd (RUL.ASX) ⛏️

Whilst the headline numbers certainly didn’t blow the lights out, it appears Rpmglobal is making some progress that’s hidden behind the scenes.

The software provider for the mining industry posted numbers that seemed dozy at a high level:

Revenues up 12.8%

Profits down 13%

The first thing to note is that last year’s profits were skewed positively from the company receiving $1 million in Government COVID subsidies. So if we discount these, then real profits would have been up.

It is indeed pleasing to see the bottom line improvements; operating EBITDA increased by $6.0 million.

What I’m watching for Rpm is whether or not they can accelerate the growth for net software revenue. They continue to transition perpetual license to subscription, which is a good showcase that clients see value in the product to agree to the transition, but the net growth is what I’m interested in, and it remains a little slow at 10% growth.

Let’s see what the second half brings for them.

Fineos Corporation Holdings Plc (FCL.ASX) ☂

Fineos saw its market cap slashed by 22% on Friday when it reported worrying results.

Fineos provides software (and consulting services) for life, accident and health insurance carriers. It’s investing in growing its footprint in the US, having largely conquered a big part of the AU market.

They report in Euros, and the total comprehensive loss of €16.8M (~$26M AUD) would have been hard to digest for shareholders.

The good news for shareholders is that the company continues to grow its ARR, albeit at a slower pace. They were open in their comments about clients being more cautious on spend, which means they may have a hard time getting growth to pick up again:

“Our very strong sales pipeline has moved out due to decisions taking longer – this combined with the drop-off in Services from a major client who are moving more strategically to investing in product means FY23 revised revenue guidance of the range €124m - €128m”

Fineos serves as one of the very interesting case studies of how challenging it can be to deliver ARR growth north of 20% in weaker economic environments.

Let’s see what they get up to in the next reporting season, and if the US’ growth can help them move the needle faster.

Chrysos Corporation Ltd (C79.ASX) 🧈

New kid on the block Chrysos also reported this week. Chrysos only recently listed in May 2022. They are a blended hardware and software provider of technology that allows for faster, more accurate analysis of gold.

What’s interesting is the growth, which is coming in strong at 109%, although off a small base.

There’s clearly a strong demand for their technology, and buyers of this type of technology must see clear value if we look at the impressive total contract value Chrysos has been able to achieve.

What’s scary is the valuation.

There’s a lot of escrowed shares here, bringing the total market cap to $379.21M. Whilst they have $81M cash in the bank, the fact that they secured a $30M debt facility indicates they intend to use most of this cash soon. Even if they surpass their yearly guidance of $26.6M in revenue for the year, that remains a demanding multiple of 10x on enterprise value / revenue. In this current environment, this seems a little too demanding.

For me they are an interesting one to look at from afar.

Conclusion

We’ve got 2 more days left in the half-yearlys, and still a good number of companies left to report, so let’s see how these go!

As always, thanks for reading. If you’ve got any feedback, or if you would like my comments on a company you follow, feel free to ask away.

Disclaimer

The content and data on this website is for information purposes only, and should not be read as investment advice, or advice on tax or legal matters. The companies and strategies discussed are on the site for entertainment only, we may or may not at any time be invested in the companies, and may be referencing companies simply as examples, ideas or for discussion.

By viewing the contents of this article, you agree:

(1) you have read and understood the warning and disclaimer above;

(2) not to make any decision based on the contents of the article;

(3) not to place any reliance on the contents of the article; and

(4) that the author is not responsible or liable, directly or indirectly, in any way for any loss or damage of any kind incurred as a result of, or in connection with, your use of, or reliance on, any of the contents of these articles.