2023 Year in Review

A mistake repeated more than once is not a mistake anymore. It is a decision. - Paulo Coelho

It's that time of the year again when we take a moment to reflect on our performance over the past calendar year, a tradition many of us find quite useful.

I did this 6 months ago in 2 Down Years when I shared 5 important lessons I had learned over the last financial year. I concluded this article saying:

As this cycle turns, investors’ mentality will slowly start to change, from today’s very pessimistic view, to a more optimistic tomorrow. News about inflation has improved and the economy doesn’t seem so bad after-all. With a reporting season coming soon, we may find that the forward return for some of these extremely cheap stocks could be dramatic.

Thinking optimistically, the last two months may mark the beginning of the scenario I foresaw back then. Perhaps this rally is a response to the Federal Reserve's decision in December to maintain unchanged rates, acknowledging the easing of inflationary pressures. It could also be attributed to the widely shared sentiment that small companies are currently undervalued.

Alternatively, this upswing might be the adversary throwing us a lifeline before another blow. Who knows? I have no idea how to make money in the short term, I’m in this for the long haul.

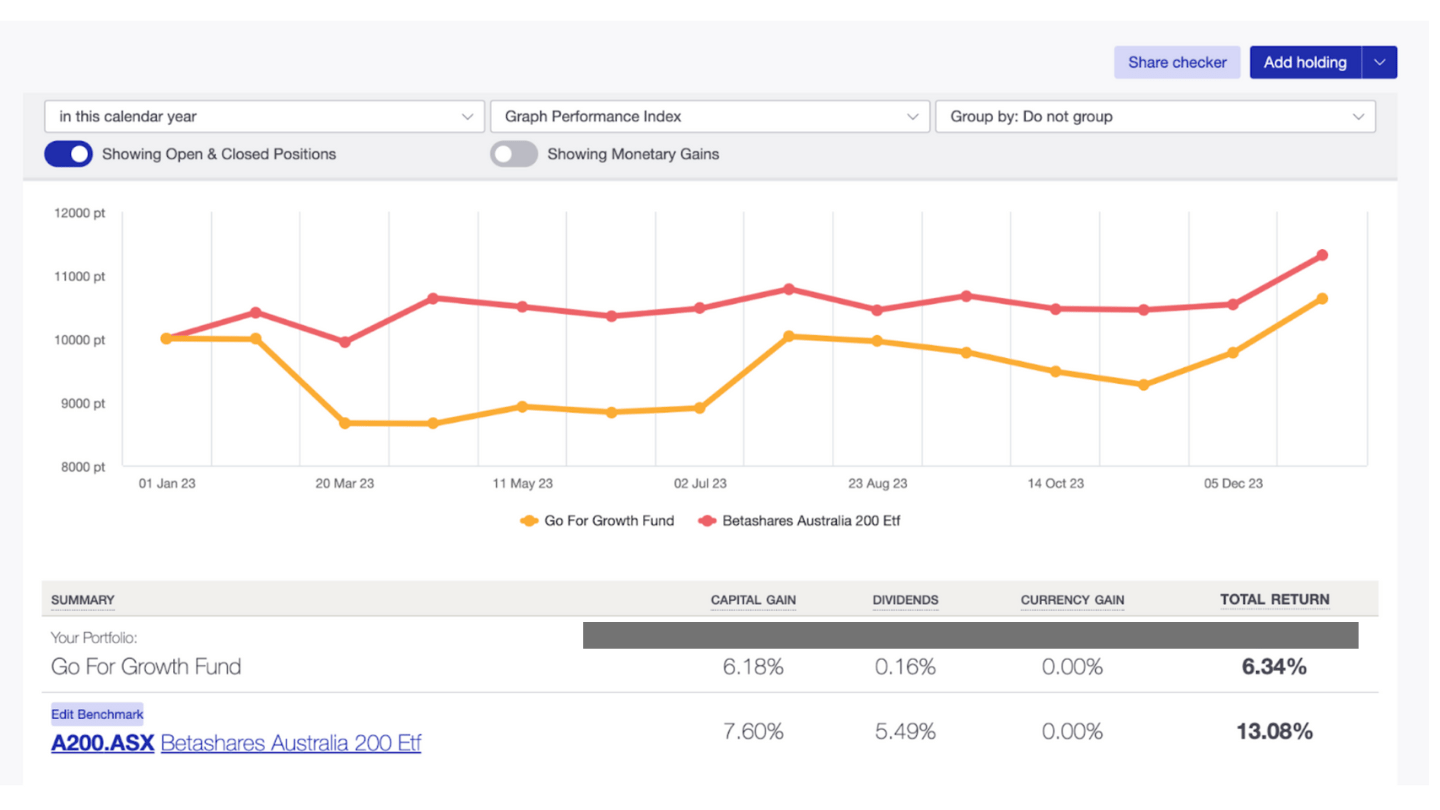

This Year’s Result: 6.34%

Over the past 12 months, I lagged behind my benchmark, the ASX 200, by 6.7%.

I've always leaned towards the ASX 200 rather than the Australian Small Ordinaries Industrial Index. The rationale is straightforward – if I weren't actively picking stocks, chances are I'd opt for an index mirroring the ASX 200, rather than one representing small caps. I suspect this inclination is shared by many investors.

However, delving into the performance of small companies becomes pertinent for me, given my sweet spot lies in market caps below $250M.

Zooming in on these smaller players, the bear market that started nearly two and a half years ago finally shows signs of coming to an end. The recent shifts in interest rates might just be the catalyst needed for a long-awaited rally in this asset class.

Reviewing all the decisions you made

Reflecting on the year, I've come to terms with a fair share of mistakes. While it's true that the small company landscape faced challenges, I don't use that as an excuse for some of the lapses in judgment I've made.

My philosophy has always been that making mistakes is inevitable, but repeating them is not acceptable. On a recent podcast I listened to with Nir Eyal, he shared this gem of a quote by Paulo Coelho who said it better than me.

A mistake repeated more than once is not a mistake anymore. It is a decision.

- Paulo Coelho

In order not to lose the lessons, I’ve created a habit a few years ago to spend 2 hours at the end of the year reviewing my key investment decisions over the last 18 months.

I chose the timeframe of 18 months because I like to evaluate the quality of a decision 12 months after it was made. Whilst this may be too early in many cases, in many others it’s the perfect timeframe to rate the quality of your decision, and to write down key lessons you learned on the back of this decisions.

Creating new guidelines

Building on these insights, I've crafted a set of new investment guidelines. These guidelines are not set in stone; some may not withstand the test of time and could be proven wrong, with reasons only becoming apparent later.

In the last 3 years, I’ve found that more often than not, these guidelines evolve into integral aspects of my continuous improvement.

Since the inception of GoForGrowth was driven by my pursuit to become a better investor, it only feels right to share these guidelines with you. If you hold a differing opinion or have insights to offer, I'd love to hear them.

New Guidelines

New Guideline #1: Sell when the stock drops 20%

I’ll start with perhaps the most controversial of my new guidelines. I will now exit most of my positions if they decrease by around 20% of my entry point. Here’s why. In 2022 and 2023, losses have significantly impacted my gains. Of course, being black and white is not nearly as easy as it sounds, but quick math on my returns point out following this guideline would have improved my overall results by 10%.

Lack of discipline in selling has prevented me from achieving better results. For 5 companies in my portfolio, I’ve accumulated losses exceeding 30%. Setting a stop loss at 20% would have limited this loss significantly.

Yes, small, illiquid companies can witness substantial drops quickly, so it’s important to monitor that this loss of 20% didn’t happen on irrelevant volume. Sure. But in general 20% is substantial enough that it won’t happen in a matter of days. This rule is somewhat of a proxy for the fact that in investing, there’s often no distinction between being too early and being wrong.

New Guideline #2: Only Add to Existing Position When Growth per share is Above 25%

In 2022 and 2023, several poor additions to existing holding were made. These may not have damaged results, but often led to nothing at all, and a 0% return is not good enough.

When I looked more closely at my bad calls from these additions, the most common factor among the worst decisions was adding on results updates that were good, but never great.

Many of them showed revenue growth in the high teens, but never above 25%. It’s OK to be demanding as an investor. I will now be much more demanding when adding to positions.

New Guideline #3: Almost Never Average Down

Upon reviewing my decision log for 2022 and 2023, it became evident that almost all averaging down decisions proved to be unfavourable.

Notable exceptions include Dropsuite, Camplify (I wrote about it for a rich life) and Frontier Digital Ventures. For Dropsuite and Camplify, the exceptional growth (with growth per share above 40%) played a crucial role. As for Frontier Digital, its recent comeback is not entirely clear to me.

This realisation reinforces the principle: when growth is not above 25% per share, never, ever average down.

New Guideline #4: Don't Buy Against the Trend

I used to think that the old addage of : “fundamental analysis provides insights into what to buy, while technical analysis tells you when to buy or sell” was too simplistic and not helpful in small caps. Now I think it may still be too simplistic, but I’m beginning to think it’s more helpful that I once imagined.

Upon reviewing my decision log for 2022 and 2023, it's evident that a common and costly mistake was buying into a new position or adding to an existing one when the chart was unfavourable.

It was a mistake to go against the market trend. Aligning with the tailwind of other investors' buying behaviour can make a significant difference. Buying when the chart looks favourable can lead to gains of 20 to 30% in a matter of months, and the same holds true in reverse.

New Guideline #5: Sell When Management Guides for an Upcoming Slowdown in Growth

Whilst this one won’t be applicable all the time, I've learned this rule the hard way in the last 12 months. A prime example is IKE GPS (I wrote about them here, and exited my position months later when growth disappeared), where management explicitly communicated upcoming challenges.

Despite this clear signal, I failed to take action, resulting in a significant loss of 40% in the next 3 months.

There’s advantages to investing in public markets (as opposed to what VCs do); why not take advantage of this dynamic?

New Guideline #6: Add to Your Winners

Upon reviewing my decisions in 2023, I've noticed a pattern of averaging down but very little averaging up.

This represents a significant factor that needs adjustment.

My tendency is to add to winners because I do believe that winners keep winning.

David Gardner

At the end of every quarter (not more often, I haven’t got the time of desire to trade a lot), I should assess the share price performances of each holding in the portfolio. As part of this evaluation, I should consider selling at least one loser to add to a winner. This is a simple experiment that could yield good lessons.

New Guideline #7: Start with a small Position Size at Cost (2.5%-3.5%), Only Add When Momentum is Clear

This approach serves as an effective means to minimise losses. In the past, I’ve made mistakes from building up a position too quickly.

A 20% loss on a 2.5% position translates to an overall portfolio loss of 0.5%. Protect the downside.

Rule 1: Never Lose Money

Rule 2: Never Forget Rule No. 1

Warren Buffet

The crucial aspect is that substantial gains are unlikely unless position sizing is increased over time. Therefore, it's imperative to adopt this strategy more consistently.

Conclusion

I can't be the only one in this community with this habit.

If you review your decisions and distill new rules from them, I'd love to read your notes.

Feel free to share them with us here and drop your thoughts in the comments. This post also signifies my one-year milestone of writing publicly. It's been a pleasure. Thank you for being part of my readership over the past 12 months, and here's to the continued journey ahead.

Disclaimer

The content and data on this website is for information purposes only, and should not be read as investment advice, or advice on tax or legal matters. The companies and strategies discussed are on the site for entertainment only, we may or may not at any time be invested in the companies, and may be referencing companies simply as examples, ideas or for discussion.

By viewing the contents of this article, you agree:

(1) you have read and understood the warning and disclaimer above;

(2) not to make any decision based on the contents of the article;

(3) not to place any reliance on the contents of the article; and

(4) that the author is not responsible or liable, directly or indirectly, in any way for any loss or damage of any kind incurred as a result of, or in connection with, your use of, or reliance on, any of the contents of these articles.

Reflecting and opening your mistakes is such an important part of improving. I am aiming to have more humility with my investment decisions - I might have high conviction in the company, but I have only been doing this for a few years so to have high conviction in myself is probably overconfidence. Limiting position sizes, deciding when to sell, and avoiding adding to losers are the big goals for this year.

My biggest losses are from averaging down, so I’m also putting some rules in place to protect against that. I am setting an alert for a trailing 20% drop to initiate a thesis review - there is some research that a hard 20% sell rule improves outcomes, but I’m not convinced this translates well to small caps. I’m putting a 6 month block on being able to add to a position too to slow down the process and avoid rushed decisions.

I have also missed out on adding to winners because I struggle with the psychology of averaging up. I am going to be more disciplined in updating my thesis and valuation for existing holdings every 6 months to help identify when adding is the best allocation.

Hi JP, you have inspired me to post on SM about DCA. in summary i don't think there is a silver bullet. my strategy after a few decades of contemplating it, is only to double down on quality or i am completely certain why the market is wrong. answering the right question in this last case can be tricky here and the consequences of getting it wrong are very poor. the market is differentiating business progress markedly at eh micro end, not too sure if that will pass or the 2017-2021 was an outlier. hope all is well