2 Down Years

Reflections, and 5 lessons learned from 2 difficult years

FY23 is a year I’m keen to put behind us for good. Let’s just say it wasn’t pretty.

It would be remiss however not to take the time to properly reflect on lessons learned, given this is the best way to improve.

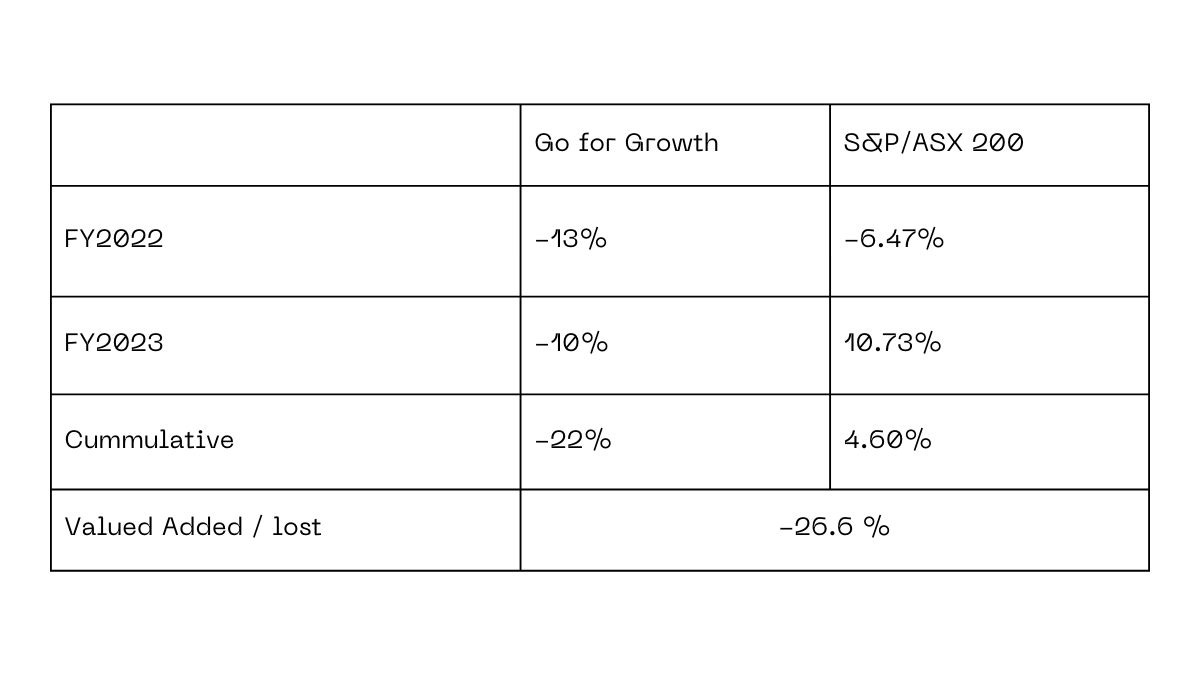

As far back as my memory goes, this is the first time I’ve experienced 2 negative years consecutively. Here were my results:

On twitter, I used Bill’s face to represent how I felt:

Given the tough performance experienced over the last 2 years, I felt it was an opportune moment to reflect on some key learnings to improve my investment philosophy, process, stock selection and portfolio construction.

“If you can develop a reflexive reaction to pain that causes you to reflect on it rather than avoid it, it will lead to your rapid learning/evolving”

-Ray Dalio

Lesson #1: Process vs. Outcome

A good process doesn’t always guarantee a good result

Reflecting on where I was as an investor 5 years ago vs. today, I have no doubt that I’ve become far better at my craft.

The me of 5 years ago:

Wrote short theses that were far too influenced by other investors, and shortsighted on the risks.

Spent too little time thinking deeply and independently, and hardly had a unique point of view of businesses that others would have been able to replicate.

Limited his research to common areas used by other investors, and rarely found insight from unconventional sources that offer a true edge.

Focused too much on the numbers, not enough on the story.

Yet, the me of 5 years ago was rewarded with very strong results for 3 years. In the last 5 years I’ve improved sharply on all these fronts, and my last 2 year returns have been poor.

This reality highlights that you can’t always judge the quality of decisions or a process by their result. The silver lining is that in difficult times, it’s easier to remain humble and curious, and these are necessary ingredients to improving.

Writing this reminds me of Jason Zweig’s seven virtues of great investors:

Curiosity

Skepticism

Independence

Humility

Discipline

Patience

Courage

The last 2 years have been a great test on many of these 7.

In short: Stay curious, disciplined and patient when judging your results

Lesson #2: On Cash burners

The path to profitability needs to be in the bank

Three years ago my philosophy was that I was OK to invest in cash burners, granted they retained about 1.5 years worth of cash in the bank, and had a clear strategy to reach their next milestone prior to a capital raise being necessary once again. By that point, the company would have likely grown significantly in size given it’s hyper-growth period, and the next capital raise would have likely been conducted at much higher valuations.

The last two years have shattered this reality. The above mentality makes sense in an environment where money is essentially free given such low rates. This is over now, and I don’t think 0% interest rates will return anytime soon.

The key learning from this period has been that cash burners were riskier and produced lower returns than the profitable businesses in my portfolio. There was no alpha to speak for really.

Understanding how the industry worked in more depth, I’ve come to realise that unprofitable businesses gather disproportionate interest from brokers that promote them because they are likely to raise capital, and therefore generate lucrative fees for these brokers.

Now, my view has changed.

To lower my risk, if I choose to study an unprofitable business, I look for businesses that have enough cash reserves in the bank to reach free cash flow profitability. I’m very much aware that this is still a risk. Many will fail to deliver on this strategy in the process. However, I remain of the view that for the ones that do, when those businesses become profitable, returns will more than compensate for the initial risk.

In short: I am now far more selective about cash-burning businesses.

Lesson #3: Investing in growth initiatives

Be careful with the “investment for growth” strategic plans

2 years ago, companies were announcing growth initiatives, today their announcing strategic reviews. They’re both bad news, and I’ve become as skeptical about one as the other.

Those that have read my articles in the last 6 months will know that I’m a growth investor. If I have any unique insight from my career which has been spent mostly in sales, from junior to senior roles, it’s that growth rarely happens in wild spurts from tripling the size of your team.

In a number of leadership roles I’ve had in the past, I overestimated our ability to accelerate revenue growth via large headcount increases in my teams. There are 3 reasons I’ve learned for this:

Time to hire & ramp: Getting new hires ramped and productive always takes longer than expected. This phenomenon is magnified by having lesser top quality talent to chose from in times of boom, given every other company is also trying to hire for the same talent as you.

Customer adoption: Buyers buy when their ready to, not when your quarter ends. There’s only so much you can do to influence your prospect’s readiness to adopt new technology, and growth plans fail to take this into account.

Next cohort rules: New territories rarely offer the same potential as current ones, given new ones are carved out of current situation. Another way of saying this is that the early adopters and most likely buyers will have been found already, the next cohort of clients may be harder to recruit. Note that this if often false, context matters.

I’ve seen the same play out in the last 2 years, with management teams of companies I held overemphasising their ability to accelerate revenue growth via large step changes in their cost base, most commonly sales and marketing spend.

Too often this resulted in a large increase in the cost which failed to deliver the expected acceleration in revenue. The pain, and time lost, years later of having to reverse course and cut headcount is real.

In short: I now approach investments in growth with an added lens of scrutiny.

Lesson #4: Building positions

Build the position as management executes, not as the stock price moves

Good decisions are based on the basis of the company’s execution, not the movement of its stock price.

This dynamic is hard to action in good markets and bad.

In 2021, I added to positions because they were going up. In 2022, I added to positions because they had become too cheap. Decisions based on the share price tend to be driven by emotions, and lack objectivity.

When I reflected on this happening, I resolved that to minimise the likelihood of repeating this behaviour, I should simply check my portfolio less often. I now log in once a month, sometimes less. I’m much better off for it as a result.

In short: Make decisions based on the business, not the stock price.

Lesson #5: Patience

Patience is becoming a more valuable skill daily

In an upcoming post I have in my drafts, I share 30 lessons from Morgan Housel. I credit him for putting this lesson very clearly. Here are his words:

There are the 3 types of hedges one can have

Being smarter

Being luckier

Being more patient

Only the last one do you actually have a fighting chance at.

This lesson I’ve learned in the last 2 years is as simple as it is powerful. Some, perhaps even many, of my holdings have delivered very impressive revenue growth in the last 2 years, yet their share price has gone backwards.

I wouldn’t give up on a company who’s growing at an impressive clip. The answer here is to embrace patience, and realise that the fair outcome is more likely to happen over longer periods of time.

Most financial mistakes come when you try to force things to happen faster than they should

-Morgan Housel

In short: Patience you must have, my young Padawan.

Conclusion: Bear markets makes you a better investor

As Howard Marks reminds us often and well, the market moves in cycles and as long as human emotion is involved, it will continue to work like this.

Small, fast growing companies have felt this downturn especially hard.

Ironically, many of these companies have continued to grow both revenues and cash earnings.

As I showcased in Today's Growth Multiples, I feel that this has led to valuations and in turn the opportunity, looking seemingly very attractive.

As this cycle turns, investors’ mentality will slowly start to change, from today’s very pessimistic view, to a more optimistic tomorrow. News about inflation has improved and the economy doesn’t seem so bad after-all. With a reporting season coming soon, we may find that the forward return for some of these extremely cheap stocks could be dramatic.

Success is a lousy teacher. It seduces smart people into thinking they can't lose.

-Bill Gates

No one style of investment management stays in fashion forever. Lose with equanimity, stay humble when you’re winning.

-Farnam Street, April 2023 Client Letter

Disclaimer

The content and data on this website is for information purposes only, and should not be read as investment advice, or advice on tax or legal matters. The companies and strategies discussed are on the site for entertainment only, we may or may not at any time be invested in the companies, and may be referencing companies simply as examples, ideas or for discussion.

By viewing the contents of this article, you agree:

(1) you have read and understood the warning and disclaimer above;

(2) not to make any decision based on the contents of the article;

(3) not to place any reliance on the contents of the article; and

(4) that the author is not responsible or liable, directly or indirectly, in any way for any loss or damage of any kind incurred as a result of, or in connection with, your use of, or reliance on, any of the contents of these articles.

what you write makes sense and what you explain has occurred since time began, really. having bought my first shares in 1985 i have seen many cycles. 2017-2021 was a strong one- but an outlier. it made many believe it was their skill not the market pricing up risk, and that has happened many times before. as buffet has been saying forever, the stock market moves wealth from the unknowledgeable to the knowledgeable and the impatient to the patient and it will continue to do so imo. to me the growth area has always been more challenging, because it requires more product/industry knowledge, but so be it, persevere, you appear to have learnt from the experience, i think you never stop learning something in this game, i am after 35+ years investing!

Another excellent piece JP - you demonstrate the humility you advocate for. By the way those performance numbers from the last two years don't look that bad to me. My sense is my own performance would be worse (although maybe I'd claw some back from 1H FY22).

Hey do you follow CJ Gustafson's substack? He had an interesting one recently on Revenue/Employee being the metric to rule them all. I'd be interested in your thoughts and it could be a possible future idea for an article. I'm not fully sold on it for several reasons, including availability of the data and lag, but it might be interesting to track some Australian microcaps with this lens.