Revenue per Employee

Is it really The GOAT of SaaS Metrics? And can it be applied to all industries?

What feels like a few lifetimes ago, a reader which I dearly respect called Noddy suggested we look into what CJ Gustafson calls The GOAT of SaaS Metrics for our favourite type of companies; Australia small caps.

Well, it took me a while, but we got there in the end. Today, we’re aiming to validate or disprove two hypothesis:

That Revenue per Employee is ‘The GOAT of SaaS Metrics’

That Revenue per Employee can be very useful outside of the world of SaaS

Let’s get into it.

The Challenges we ran Into

Understanding the employee count of Australian public companies poses challenges due to the absence of reporting obligations.

To obtain this information, manual research, primarily using LinkedIn, becomes necessary. However, relying on employees to maintain updated profiles and dealing with multiple LinkedIn profiles for a single company present hurdles. Some industries also disregard LinkedIn, leading to potential inaccuracies.

The challenge therefore lies in the inherent imperfection of manual efforts. While inconsistencies may exist, I think the metric's utility remains when applied across a diverse sample.

I’ll also add my usual disclaimer that I’ve likely made some errors whilst doing this. Accept my apologies if you find some.

Now, let's delve into the findings.

What CJ Said

This metric, often used in the world of Saas, is sometimes referred to ARR per FTE; meaning Annual Recurring Revenue (ARR) per Full Time Employee (FTE).

The reason why this metric is especially good in Saas is because the vast majority of your expenses are your people. You essentially need developers, product managers, and GTM folks. The rest is typically your Kombucha expense and your compute costs. So in the world of SaaS, Revenue per Employee is great way to benchmark companies against another to measure comparative efficiency.

Of course, the stage of the company will impact these results. If you’re really early days and pre-product-market-fit (PMF), most of what you do is inefficient by nature (remember rule #2 ; do things that don’t scale). As you grow past PMF, efficiency starts to matter a lot and you will be benchmarked against your peers.

CJ Gustafson brings up a good example which offers an accurate scenario in which this metric is a helpful view into a business’ efficiency.

You see it all the time - a company is doing $10M in revenue with 50 employees. They’re excited about the traction they’re seeing, so they go on a hiring spree to “double down on GTM and capture the market.”

But 12 months later, they’re stuck at $14M in total revenue with 130 employees.

When you take your eye off revenue per employee, there’s a proliferation of supporting functional heads that tend to get hired (finance, HR, legal, strategy, and anyone else telling the people who build or sell the products what to do).

Revenue per employee is the most honest metric in the world.

I’ve worked for companies in which the above happened, and it’s no fun. Everyone feels less efficient, and the data supports that this is indeed true.

Why Revenue per Employee is a good metric

The above highlights one of the main reason why it’s a good metric:

Resource Management.

It helps you understand if you're using your resources (employees) wisely.

If you have a low Revenue per Employee, it might indicate that you're either overstaffed (common) or your GTM team is underperforming (which in itself could indicate issues with your product too).

Here are other reasons why it’s helpful:

Productivity Check:

Allows you to compare your business's productivity over time or against competitors.

Increasing Revenue per Employee over time can show that your team is becoming more efficient and effective.

Profitability Signal:

Generally, higher Revenue per Employee can contribute to higher profitability. If you're making more money with the same or fewer employees, it can positively impact your bottom line.

Strategic Decision-Making:

Helps in making strategic decisions about hiring, expansion, or streamlining operations.

If Revenue per Employee is low, you might consider optimising processes, improving employee skills, or re-evaluating your business model.

What does good ARR / FTE look like?

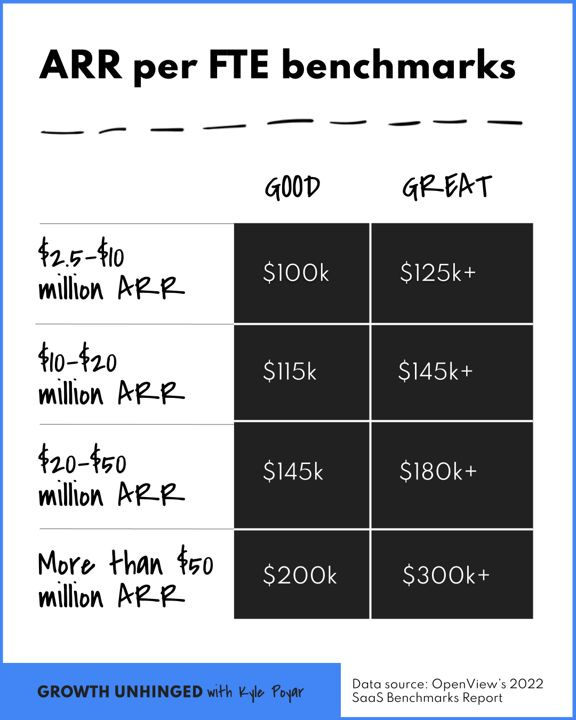

So back to my point above, what does good look like? Well, as is often the case, we've got data here, but it’s US based data. There’s an argument that the numbers shouldn’t change too much from the US to AU, and my research support this. So let’s see it. Credits to Kyle Poyar for putting OpenView’s numbers into a neat chart:

Who are the high performers on the ASX?

On the back of our research, here are 26 companies who appear to be performing well on this metric.

In reviewing the table, some results are genuinely surprising, while others align with expectations. The presence of Pro Medicus (ASX:PME) at the pinnacle is hardly shocking; it's arguably the highest quality business listed on the ASX, and the Revenue per Employee metric further reinforces this notion.

Another noteworthy mention is Jumbo Interactive (ASX:JIN), a high-quality, founder-led business that has demonstrated consistent growth in both revenue and profitability over the years.

The Questionable Performers

Then, there are the surprising companies. When the metric looks very favourable, it can cause raised eyebrows and gets me to think a little deeper.

Gratifii Limited (ASX:GTI)

Take Gratifii Limited (ASX:GTI), for example. The company has been experiencing impressive growth, but upon closer inspection, much of it seems to be inorganic. While the top line is heading in the right direction, there's a lack of corresponding improvement in the bottom line—both in accounting and cashflow figures. Moreover, they continue to burn cash and the cushion is noticeably thin.

To gain more insights, let's examine the cashflow statement:

The staff cost of only $837,000 for the quarter seems to support the claim that this isn’t a very people heavy business.

But then we have the problem of $5.8M in product manufacturing expense. If this business is indeed a “full-stack customer engagement technology provider that delivers end-to-end technology solutions for businesses to engage with their employees and customers”, then it seems to me that the only logical explanation to this bulky product manufacturing expense is outsourced development costs. If my hypothesis is true here, then our promising-looking revenue per employee metric is void for them.

I can’t be sure here. And certainly, Gratifii appears to be moving in the right direction. With claims that the next quarter will be cashflow positive, and that growth will continue, it’s likely one to keep watching closely.

Laserbond (ASX:LBL) and Rectifier (ASX:RFT)

Whilst they are mostly two completely different businesses, Laserbond and Rectifier share in common that they are both manufacturers (sort of).

Why do the numbers look so favourable for both of them?

I’ll offer 2 potential reasons:

1. Limited LinkedIn Representation

One factor contributing to the favourable numbers could be the nature of the manufacturing industry. Many manufacturing roles, such as trades, mechanical engineers, and machinists, may not have LinkedIn profiles, leading to an under-representation of staff numbers. Consequently, relying solely on LinkedIn data may not accurately capture the workforce size.

2. Embracing Efficiency Through Automation

Efficiency is paramount for manufacturers, and a significant portion of their expenses may be attributed to leveraging machines and industrial automation. In such cases, the revenue per employee metric might not offer a comprehensive understanding of their operational efficiency. Manufacturers, particularly those employing advanced automation, tend to allocate a substantial portion of expenses to machinery and technology rather than a large workforce.

So perhaps this means that for some industries, namely this one, my second hypothesis is void.

Betmakers Technology (ASX:BET)

Betmakers is another interesting one. If it’s so efficient on the Revenue per Employee front; than why is it struggling to make a profit?

This discrepancy can be attributed to Betmakers' business model, specifically its acquisition of content rights necessary for marketing bets and the upfront minimum guarantees stipulated in contracts. These aspects pose working capital challenges for the business.

You can see evidence of this in the latest quarterly (see 1.2 (b)):

If Betmakers can execute its growth plans as promised, simultaneously maintaining cost control, there is potential for the company to become more compelling in the not-so-distant future.

The Performers

The primary objective of this exercise was to identify companies showing promise on the metric, and the results were encouraging.

Although the small ASX companies are still a distance away from the benchmarks set by NASDAQ giants (with Google and Meta boasting significantly higher Revenue per Employee numbers: $1.7M and $1.4M, respectively), our evaluation is based on a different perspective. We are betting on this metric to witness substantial improvement over the next 5 to 10 years.

Here are my thoughts on a selection of companies.

Pointerra (ASX:3DP)

Despite recent missteps and errors, Pointerra (ASX:3DP) showcases good efficiency by generating $8 million in revenue with only 28 employees (assuming this figure is accurate). Although a stagnant software business without reported Annual Recurring Revenue (ARR) does not interest me, there's potential for a shift in my perspective if two crucial aspects change—growth and transparent reporting of ARR.

According to management, these changes are on the horizon, so it's worth keeping an eye on Pointerra to see if they deliver on their promises in the near future.

Cogstate Limited (ASX:CGS)

Facing some growth delays, Cogstate (ASX:CGS) recently reported modest movements in growth at the AGM with 1Q24 Total Revenue at $9.2 million (1Q23 $8.9 million). Despite these figures, management expresses confidence in the near-term future, highlighting achievements such as a significant increase in deliverables by the proposals team (1Q24: 109 vs. 4Q23: 64) and a record historical high in the value of sales opportunities.

For Cogstate, successful execution could help transition the company into a growing entity with enhanced quality. The revenue per employee metric, the potential for increased profitability, and the positive indicators mentioned by management position Cogstate as one to watch closely in anticipation of future developments.

Energy One Ltd (ASX:EOL)

Energy One Ltd recently acknowledged that the fallout from a failed takeover has been a source of distraction, resulting in an anticipated growth slowdown. Despite these challenges, we can see from the revenue per employee metric that the organisation is a good image of efficiency.

Looking ahead, with the transaction mishap behind them, Energy One promises to be an increasingly interesting company in the not-so-distant future.

Medadvisor Ltd (ASX:MDR)

I was surprised to see Medadvisor rate so highly on this metric. You could argue some of the GuildLink employees are incorrectly labelled on Linkedin, but from my research it appears the company transition them onto the Medadvisor profile. While recent growth has been commendable, a substantial portion is attributed to the acquisition of GuildLink. The future trajectory of growth will be crucial in assessing the company's overall performance.

Of greater importance to me is whether MedAdvisor can successfully navigate its current transition phase—shifting towards generating sustainable, positive cash flow and, ultimately, achieving profitability. Over the next 12 months, I will closely monitor their progress to determine if the company can make the necessary strides in these key areas.

The Laggards

On the other end of the company’s I looked at, we’ve got:

That’s also an interesting bunch, there are companies in there I also find very interesting.

A high level view indicates many of these entities are still in the early stages of their growth trajectory. The nature of early-phase startups often involves substantial investments in various areas, from technology to GTM, which tends ti result in a lower Revenue per Employee metric. However, this metric alone may not tell the full story, as there are other contributing factors.

Beyond the growth phase, operational inefficiencies, industry-specific challenges, or capital-intensive business models could be influencing the lower Revenue per Employee figures. Identifying the root causes behind these metrics requires a deeper analysis, considering the unique circumstances of each company.

FELIX Group Holdings (ASX:FLX)

I wrote up a 1 pager on Felix (here) and made comments on their recent quarterly (here). I find this business interesting, but clearly this metric highlights a current weakness in the business. While the Revenue per Employee metric unveils a current weakness, a closer examination provides valuable insights.

Notably, a significant portion of Felix's workforce, 34 employees in the Philippines and 13 in Panama, highlights their strategic use of overseas talent. Leveraging international expertise, especially in the early stages, can be a prudent move for companies, and in Felix's case, this appears to be a positive aspect.

Further scrutiny into the roles of these employees reveals a concentration in business development, with approximately 40 staff dedicated to sales out of a total of 112 employees. This emphasis on sales positions signifies a strong focus on driving growth. If Felix continues to deliver on this front, the business will remain one to watch closely.

Get the Full List

For the complete list, you can get it here.

Please note that I do not plan to maintain this list regularly. The information is (mostly) accurate as of December 9, 2023.

Conclusion

Let’s go back to our initial hypotheses;

1. That Revenue per Employee is 'The GOAT of SaaS Metrics.'

2. That Revenue per Employee can be very useful outside of the world of SaaS.

The second hypothesis has faced quick disapproval, as seen with Gratifii Limited (ASX:GTI), Laserbond (ASX:LBL), Rectifier (ASX:RFT), and Betmakers Technology (ASX:BET). Various business models demand significant investments in physical assets, marketing, or allocate people expenses differently, rendering Revenue per Employee less useful outside of SaaS.

Regarding the first hypothesis, I personally don't deem it the GOAT (Greatest of All Time) metric. If I had to choose a single metric to evaluate a company, I would still prefer the Rule of 40. The Rule of 40 indirectly captures efficiency through margins, whereas Revenue per Employee provides no insight into growth.

What could be an even better metric?

An even more insightful metric could be free cash flow per employee.

However, the typical challenge arises – many of the small caps we follow are not yet optimizing their cash flow. While they may generate positive cash flow, it often serves to fuel future growth rather than accurately representing their financial reality.

This is where revenue per employee proves its utility; it gives us a baseline understanding for all companies, as revenue is a universal metric (unless they are just an idea rather than a business).

What’s Next?

I’ve got a list of 10 articles I’ve been working on in the past year sitting in my drafts. This new cadence of monthly writing will hopefully be sustainable for life.

If there’s a topic, a metric, or a company you would like coverage on; send it through.

In the meantime, happy holidays folks, and thanks for your support throughout the year.

Disclaimer

Please be aware that there may be mistakes in this article; I write quickly, and after all, I'm only human. If you spot any errors, kindly let me know and forgive me.

The content and data provided on this website are for informational purposes only and should not be construed as investment advice or guidance on tax or legal matters.

The companies and strategies discussed on the site are presented for entertainment purposes. We may or may not be invested in the mentioned companies at any given time, and references to companies may serve as examples, ideas, or for discussion.

By viewing the contents of this article, you agree:

1. You have read and understood the warning and disclaimer above.

2. Not to base any decision on the contents of the article.

3. Not to place reliance on the contents of the article.

4. That the author is not responsible or liable, directly or indirectly, for any loss or damage of any kind incurred as a result of, or in connection with, your use of, or reliance on, any of the contents of these articles.

Thanks for a great post. Hugely enjoyed it. I’d suggest the best use of this data would be tracking the change over time. A great way to catch early inflection points.

Top notch article and I am going to go through the lists very carefully for the gems hidden by a solid clod of dirt. Rev per staff member is a good metric for many professional businesses, indeed any biz which charges for time.

But, a caveat. The staff member has no control over revenue (read pricing of the tech

/service sold). That’s managements job and they can get it horribly wrong by incorrectly positioning it in the market. A very personal example: many years ago I wrote a set of business manuals for small/medium businesses. Started selling them at $169. Did all right. Then a marketing guy said to me ‘too cheap’, the perception is they cannot be any good. Increase the price to $489, he said. Absolutely heresy to my left Bain accounting background, but I did. They sold better than at $169. Go again he said. Try $695 but throw in an annual monthly newsletter, he said. I did, and they sold more and quicker than at $489. When I sold the biz in 2007, a much enlarged set of manuals sold for $3,000. Not possible today because the internet has made information pretty well useless.

My point is management is responsible for building the perception which dictates the price which determines the revenue. I would nominate Wayne Hooper of Laserbond as being one who is underselling his tech because he hasn’t built the perception of the value of what he offers the market.

Met a yank called Harry Schulz many, many years ago. His claim to fame was that he charges $3,000 an hour for his advice. And many flocked to him. I later discovered that his guarantee was this ‘and if I don’t deliver value, I will give you an additional 10 hours absolutely free. Harry’s probably still counting his loot in heaven.