10 Growers in FY23 - Part 1

10 High-Growth Companies to Watch in the coming year

The reporting season proved to be remarkably interesting (as they always tend to be, right?). There were definitely signs of returning optimism, as some robust reports led to substantial daily gains from the usual suspects—companies such as:

Altium (ASX: ALU)

Audinate (ASX: AD8)

Aussie Broadband Ltd (ASX: ABB)

Siteminder Ltd (ASX: SDR)

Bravura Solutions Ltd (ASX: BVS)

Accent Group Ltd (ASX: AX1)

All witnessed significant movements, with some experiencing jumps of over 20% in just a single day or a matter of a few.

I wouldn't go so far as to say that this exuberant behaviour means a buoyant bull market just yet. There were instances where certain companies reported average or even positive results, only to be heavily penalised for not meeting expectations. This situation underscores the importance of spending 10 minutes analysing the results to form your own conclusions before considering the direction in which the stock is moving as the better indicator of the truth. It's possible that other investors possess information you're not privy to, but more often than not, it may be that they have a shorter time horizon (or a shorter fuse) than you do.

Now that the reporting season has concluded, I believe it's only fitting for someone who goes by the name 'Go For Growth' to spotlight 10 strong growth results for the year. I'll be breaking this down into three parts over the next three weeks. Let's go.

#1 : Camplify (ASX : CHL)

I wrote an in depth piece detailing my thoughts on Camplify for a rich life, for those looking for the long version of this, you can find it here. Whilst not perfect of course, I thought Camplify’s full year results were strong.

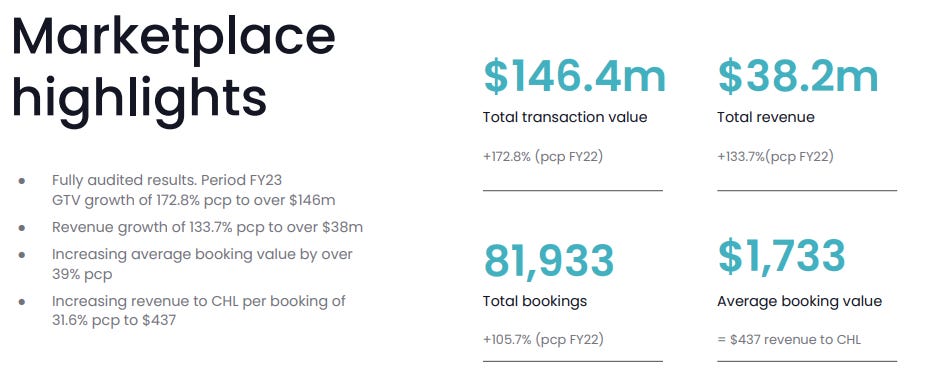

Reported figures:

My Top Figures:

Estimated Organic Revenue growth at 75%

Average booking value at $1,799 = $473 to Camplify (flat on half year results, and up 45% from last year results)

The Opportunity

Camplify is positioned for good growth with future bookings of $28.6 million and a market share of less than 2% across all regions they operate in (except for NZ at 2.6%). This promising outlook suggests a substantial runway for potential growth.

Their NZ business is experiencing remarkable growth, with bookings soaring by 630% this year. At this rate, Camplify is well-positioned to establish itself as the preferred choice in NZ over the next five years.

The Challenges

Despite confirming that the UK region returned to growth in the second half of the year, the yearly figures show a year-on-year decline. To maintain robust growth, Camplify must focus on restoring sustainable growth in the UK region.

As mentioned in the article on a rich life, the issue of hirers experiencing van damages without proper compensation remains unresolved. I think Camplify must address this concern fast.

Whilst Camplify claim they are not too worried about direct or indirect competitors (from the likes of Uber Carshare) I would remain attentive to the competitive landscape here. Someone’s growth is someone else’s opportunity for disruption.

What to look out for

Growth in European markets. Keep an eye on the growth in European markets as Camplify completes its integration with Paul Camper within the next year.

Growth in average booking value. Monitor the growth in the average booking value and Camplify's direct revenue generated from these bookings. This is the core of Camplify's business.

Marketing efficiency. Assess the efficiency of Camplify's marketing efforts. Management claims ongoing improvements based on experience and network effects, and it would be valuable to see tangible evidence of this in the coming 12 months.

#2 - Vitura Health (ASX : VIT)

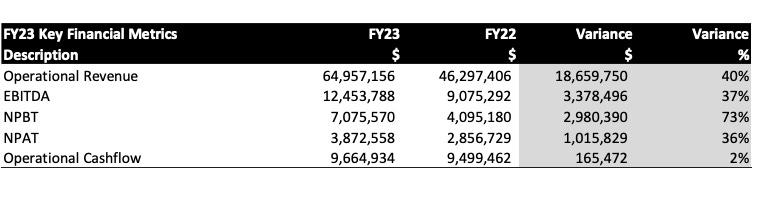

I previously discussed Vitura's robust first-half results in February (here). In March, I provided additional insights into why investors might not have been impressed by what seemed to be excellent figures (here). After reporting it’s full year results, with top line growth of 75% and bottom line growth of 129%, the stock continued its downward spiral.

Why did this happen? Let's look into it.

Reported figures:

Observations:

NPAT and EBITDA increases outpaced revenue increased. This is good, showing signs of operational leverage.

Revenue growth came in lower than units sold growth. This is not good, and may indicate lower pricing power.

Cash at bank healthy at $18M. They shouldn’t go broke anytime soon (dare I say…)

The Opportunity

It's evident that Vitura delivered exceptionally strong results, and historically, successful companies tend to sustain their winning streaks (even through pit stops for water in between wins). The potential for Vitura to continue executing effectively over the next few years seems quite plausible.

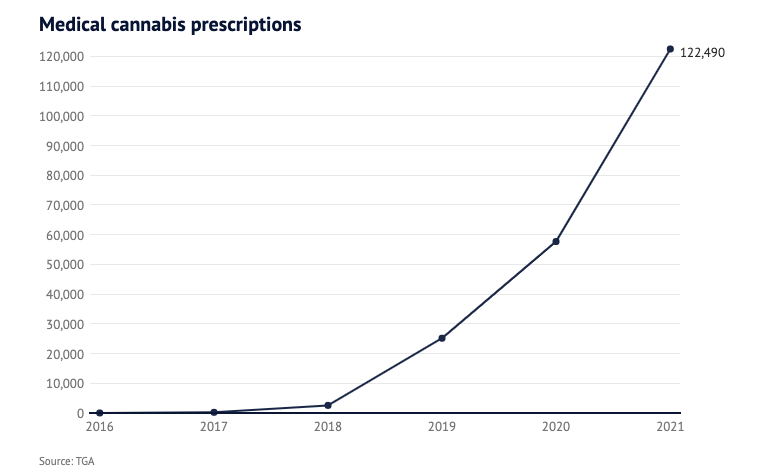

Furthermore, the medical cannabis sector is experiencing strong tailwinds, as indicated in the chart published by the Sydney Morning Herald, which I reference below [link]. These factors could further support Vitura's growth prospects.

The Challenges

Why is growth stalled? The transition from H1 to H2 witnessed almost negligible growth (approximately 3%), with profit declining compared to the first half. This decline can be attributed in part to changes in the product mix, including more third-party products, resulting in narrower profit margins.

Competitive landscape. While Vitura's CEO, Rodney Hicks, has expressed confidence in the face of competitors, the medical cannabis industry is becoming increasingly competitive. Competitors like Cannatrek, HelloMello, Polln, and Honahlee seem to be gaining traction. While Vitura may have a head start, maintaining a strong operational cadence will be essential.

What to look out for

Growth. Can they growth again? Whilst the stock is currently trading on a PE of ~15 at today’s price (stock trading at 38cents), if growth is dead, it will likely fall much further from here. We’re seeing our fair share of single digit PEs in the land of small caps at the moment.

Unit Sales. With the transition of strategy to go completely online now complete, we would want to see unit sales grow again. The company doesn’t offer regular quarterly updates, but does update us with this metric semi-regularly, I would look out for it when it comes.

Pharmacies and Prescribers accounts. Pharmacies and prescribers make the hard side of their network. If we can see them continue to grow the supply side strongly, this should give us belief in the long-term growth potential.

Director behaviour. Directors in this company have been a significant impediment to the share price’s growth. The moment momentum appeared, directors sold into strength. It would be nice to see a end to this trend soon.

#3 - Vysarn (ASX : VYS)

I'll keep this last one short and sweet, especially since I have limited knowledge of this business

They say success leaves clues. Well, that was certainly true in the case of Vysarn this year. After upgrading guidance twice, Vysarn delivered super solid results.

Vysarn Limited operates a drilling, dewatering and test pumping services business for mine sites. Let’s look into them.

Reported figures:

The Opportunity

Valuation remains reasonable. Whilst Vysarn wouldn’t be trading on multiples of a high-margin, sticky Saas company, there’s still a simple case to be made that even after a 200% surge of the share price in the last year, the valuation still looks reasonable (Market Cap of ~$83M and NPAT of $3.8M) if they are at the beginning of the tipping point into profitability.

Tailwinds continue. Management are quite promotional of this aspect of the company, and so far they appear to have been correct: “The board and management continue to maintain the view that one of the largest and growing impediments to ongoing iron ore production is the removal and disposal of surplus water. This thematic has since proven to be sound and has provided a unique opportunity to build a business of scale in a short period of time.”

The Challenges & What to look out for

Growth Concentration. This was highlighted by Benjamin Sayers who introduced me to the company in his article for a rich life. At the moment, there remains risk in this company being “become just another drilling company servicing the mining sector”. This is now getting offset by new non-hydro divisions which are showing positive signs, but those signs need to keep going in the right direction.

New segment performance. Building on the above point, it’s often easier to get a business with momentum to continue flying, than it is to get a more nascent one off the ground. This year will be about monitoring the progress of the project engineering and pentium test pumping segments.

Conclusion

That’s it for today ladies and gents.

Next week, I’ll cover another 3 strong growers. Feel free to leave your suggestions in the comments. Feedback always welcome.

Disclaimer

The content and data on this website is for information purposes only, and should not be read as investment advice, or advice on tax or legal matters. The companies and strategies discussed are on the site for entertainment only, we may or may not at any time be invested in the companies, and may be referencing companies simply as examples, ideas or for discussion.

By viewing the contents of this article, you agree:

(1) you have read and understood the warning and disclaimer above;

(2) not to make any decision based on the contents of the article;

(3) not to place any reliance on the contents of the article; and

(4) that the author is not responsible or liable, directly or indirectly, in any way for any loss or damage of any kind incurred as a result of, or in connection with, your use of, or reliance on, any of the contents of these articles.

Always an easy and interesting read JP. My 2 cents worth for these early growth companies (which is a spooky area for me - but am wanting to learn):

3 key matters determine the future fate (1) quality and conviction of management - this rules out VITURA for mine (2) genuine commercial prospects at scale - as a former motor home owner I know the reluctance to lend or rent because of the potential for damage, so Camplify is a wait and see for mine (3) genuine moat status (and cash) to withstand competition. Your expression in this regard is priceless - “Someone’s growth is someone else’s opportunity for disruption.”