10 Growers in FY23 - Part 3

[Part 3] 10 High-Growth Companies to Watch in the coming year

Our yearly growth summary explored 6 companies to date:

Camplify (ASX: CHL)

Vitura Health (ASX: VIT)

Vysarn (ASX: VYS)

Rectifier Technologies (ASX : RFT)

Mad Paws (ASX: MPA)

Acusensus Ltd (ASX: ACE)

Here are their performance on the rule of 40 (using NPAT margins):

The articles of the last 2 weeks examined the context behind their numbers and my thoughts on key factors to monitor in the coming year.

In this week's edition, we wrap this up in style with the final 4. Let’s go.

#7 : AVA Risk Group (ASX:AVA)

AVA is a business I’ve followed for a while, but never wrote about here before.

In a nutshell, they are a provider of technology and services to safeguard critical assets and infrastructure. They have three key business segments: Future Fibre Technology (FFT), BQT Solutions (BQT), and GJD Manufacturing (GJD).

FFT specialises in smart fibre optic sensing systems for security and condition monitoring in applications like perimeters, pipelines, conveyors, power cables, and data networks.

BQT focuses on high-security biometric readers, access control, and electronic locking products.

GJD develops hardware like perimeter detectors, illuminators, and ANPR cameras.

Although results were mixed, I would say in general they were mostly positive. Here’s my take on things.

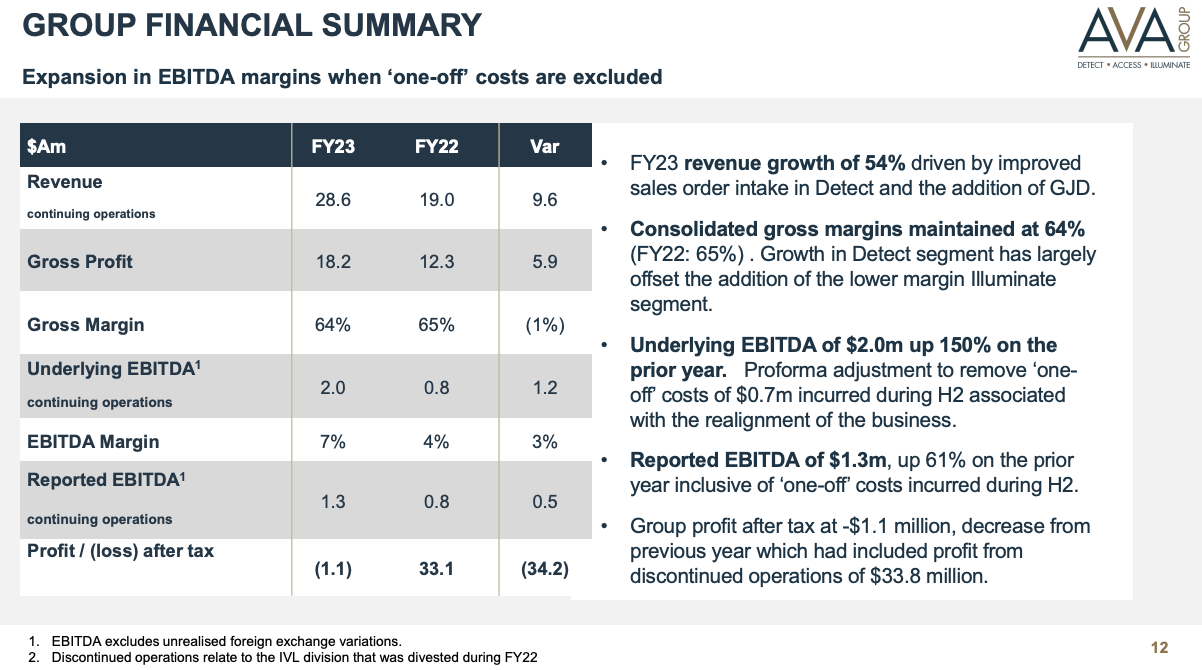

Reported figures:

The Opportunity

Back to strength. Recently appointed CEO, Mal Maginnis, turned his focus towards enhancing customer-facing sales and support capabilities. With a remarkable 54% increase in top-line revenue compared to the previous year (factoring in GJD, organic growth stands at 36%), it's evident that he has already achieved impressive results in a short time. If the new leadership team he’s appointed are given another full year, we should anticipate sustained strong performance ahead.

Investment in growth conceals margin potential. Setting aside the success of their services division (the proceeds of which have been returned to shareholders through a special dividend), AVA hasn't fully impressed the market in the past five years. This might be attributed to the absence of a positive bottom line (this year, they reported a loss of approximately $1M). However, this is not unusual given the emphasis on expanding sales. As these efforts continue to yield benefits, the currently unseen bottom-line figures should gradually start to emerge.

Untapped markets. While it's challenging to estimate the Total Addressable Market (TAM) precisely, it appears to be large. This offers significant room for growth. The CEO asserts that in their current markets (APAC, the UK, and the US), there's ample room for expansion.

The Challenges & What to Watch Out For

Large Contracts. Following the final report, AVA announced two contract wins, totalling $1.8 million. The vas majority of AVA’s revenue isn’t recurring, so achieving $40 million for the year would require securing numerous such contracts. Ideally, they would also secure more substantial deals ("elephant" contracts) to drive substantial growth. Keep an eye out for those.

Acceleration of Growth. With the company openly stating its aim to reach $70-$100 million in 3 years, we’ll need to see sustained and even accelerated growth. If this doesn't materialise in the next 2-3 reporting periods, it may test the patience of investors who are already eager. This would not be great. While their current organic growth of 36% aligns with the lower end of their goal, it's important to remember that as the base expands, achieving such growth can become progressively challenging each year.

Profitability on the Horizon. The market's response, or lack thereof, to AVA's positive results likely stems from the investor's desire for profit and cash flow. AVA didn't deliver these this year. However, the improvements in nearly all metrics above the Net Profit After Tax (NPAT) line, along with management's emphasis on future dividends, suggest that these are forthcoming. Although AVA doesn't provide a 4C report every quarter, they still offer updates. While these updates typically omit the bottom line, I'll analyse them for any subtle hints.

#8 - Chrysos Corporation Ltd (ASX:C79)

Chrysos provides assay services to the global mining industry using a patented technology called PhotonAssay, developed by CSIRO, which they have the rights to sell.

They manufacture a specialised machine for this purpose. Their clients consist of gold mining companies and laboratories.

Why is this thing leading to a gold rush? In short because their technology offers a faster and more accurate assay process, reducing sample preparation time and labor requirements. It also operates mostly automatically, enhancing workplace safety, and providing better environmental outcomes while accommodating larger, more representative sample sizes.

Reported figures:

The Opportunity

Sustained Organic Growth: This year, Chrysos achieved an impressive 89% year-on-year growth entirely through organic means, deploying 10 new units. There were no bolt-on acquisitions or questionable joint ventures involved—just pure, clean growth. Such growth is always a pleasing sight. As per the point below, looks like it’s set to continue…

Strong guidance. In FY24, Chrysos anticipates total revenue ranging from $48 million to $58 million, based on revenue from installed units and 18 units scheduled for deployment during the year, without provisions for consumables supply (which they’ll stop doing). They also expect an EBITDA range of $7 million to $17 million. The clustering strategy of their manufacturing hubs is set to reduce average unit costs over time, with at least 18 PhotonAssayTM units projected for deployment and a total of over 38 units operating by the end of FY24, supported by improved deployment and manufacturing capabilities. This guidance is very strong. Considering their track record of slightly surpassing this year's guidance, it appears entirely plausible that they may not only meet but exceed these expectations.

The Challenges & What to look out for

Valuation Concerns: When I first covered the company in February, I noted that the valuation was already on the high side. Since then, it has nearly doubled. Considering the presence of a significant number of escrowed shares, the fully diluted market cap, at today's share price of $6.05, stands at an impressive $602.45 million. Let's imagine they surpass next year's guidance significantly and achieve an EBITDA of $20 million. This would result in a Market Cap to EBITDA (MC/EBITDA) ratio of approximately 30. While exceptional companies can often surprise us with high valuations, this introduces an element of risk. Any misstep by the company at this point could potentially lead to a painful drawdown.

Total Addressable Market (TAM): Management asserts a "Total Addressable Market of 610 units globally." Currently, with 38 operating units forecasted for this year, they've captured just 6% of their TAM. Clearly, room for growth remains. However, I still question: how much of the TAM can they realistically claim? It's reasonable to assume that a significant portion of miners will continue relying on traditional methods such as fire assays. Management claims that their technology has growing applicability, especially in other metals, which is a positive sign. Still, I will closely monitor how they discuss the evolution of their pipeline to gauge whether future deals become more challenging to close. When a new technology enters the market, early adopters are often easier to convince, and there might be a lull in adoption afterward.

#9 - DUG Technology Ltd (ASX:DUG)

DUG’s monster year was mostly evident. Despite the ASX lifting the requirement to lodge Appendix 4Cs in May, we had access to them for most of the year, allowing us to clearly observe the signs of their remarkable achievements.

I covered them after their strong quarter in February, and again in April. Their consistent growth and impressive results have rightfully earned them a spot among the top performers of the year. Now, let's wrap up the annual DUG story with my insights and reflections.

Reported figures (note this company reports in USD):

The Opportunity

Stepping into the Big Leagues: DUG's impressive year has brought them to the attention of more institutions. Notably, we've observed additional purchases on the ledger from institutions like Regal Funds Management and newcomers such as Philip Imperial Schwan and Wilson Asset Management Group. This development bodes well for DUG as it can help stabilise stock movements and may attract even further institutional interest in the medium term.

Leverage appearing. With this year’s big move, we saw the margin profile become much more interesting. Their EBITDA margins moved from 8% to 30%. That’s very nice to see, and if this story repeats again this year, we might expect continued improvement which would trickle further down on to the NPAT line.

Bullish Outlook: Management presents a notably optimistic outlook for the upcoming year, stating, "July 2023 saw the largest recorded single month of Services orders with US$18.6 million of new tenders awarded, increasing the Services order book to US$42.2 million at 31 July 2023. The Services business shows no signs of slowing down." With a robust order book and record tender wins, the prospects for the year ahead look promising. It will be intriguing to monitor how this unfolds throughout the year.

The Challenges & What to look out for

Software and HPC growth underwhelming. You can’t blame a company for feeding the ducks while they quack, but it’s obvious that their services arm is doing all the heavy lifting. Whilst the company says “The pipeline for new Software customers is strong with a number of evaluations underway with major companies.”, this year software grew only 8%. Services don’t have the same margin profile and are not recurring in the same way. I would be mindful of this and would love to see the revenue per segment profile of this company evolve over time.

Cyclicality in the Industry: DUG primarily serves oil and gas exploration companies, which inherently makes it a cyclical business. One lesson we repeatedly learn from economic cycles is their tendency to end suddenly. DUG, like many other businesses, was affected by the timing of COVID, which interrupted its momentum just as it was gaining traction. The sharp decline in oil prices had a significant impact on the company, setting it back by several years. Oil prices and exploration activities are showing signs of recovery, but the future remains uncertain. While I don't have expertise in this field, monitoring the oil industry's cyclical nature is a crucial consideration for DUG shareholders.

Crude Oil Prices - 20 Year Historical Chart. Source: macrotrends.net/

#10 - XRF Scientific Ltd (ASX:XRF)

This one will be brief, especially because XRF is a business I admittedly have limited knowledge of. Three years ago, when a friend introduced it to me, I defaulted to my old stubborn self and dismissed it, thinking it sounded too cyclical. Now, if you want to witness the consequences of my stubbornness, take a look at the share price chart. Another lesson learned the hard way.

Reported figures:

The Opportunity

Order book at record level: Despite concerns among investors about the sustainability of impressive growth in other companies, XRF has eased such worries with optimistic remarks about their order book. They stated, "The order book remains at record levels, with some product lines booked out for production past 1H24," and highlighted "high levels of machine demand from the mining and industrial sectors."

New Products. The plan for growth to continue also seems fairly robust. The company plans to boost sales of the newly launched xrTGA and increase Orbis laboratory crusher sales. They are also focusing on expanding in the Precious Metals division, pursuing geographical expansion, and introducing new products across all divisions.

The Challenges & What to look out for

Assessing Organic Growth Potential: It's worth pondering the extent of possible organic growth. While there's a strong argument (stated above) for the company's performance, it's evident that some growth has come from the Orbis acquisition, which, if my analysis of the figures is accurate, seems to have been the deal of the century. Despite management's optimism and a well-crafted growth plan, some investors might question how much organic growth will be achievable in the coming years. Examining the business's historical performance reveals relatively little movement over the ten-year period from 2011 to 2021, potentially leading to concerns about a recurrence of stagnant growth.

XRF’s 12 year Gross Profit Journey. Source: @ausallcapguy

Conclusion

That’s it for today ladies and gents. 10 strong growers. All interesting companies to keep an eye on as we head into this new financial year.

Next week, we’ll dive into the fun stuff.

I will be looking at the growth, margins, performance on the rule of 40 and how all these correlate to the stock price performance of these companies, and a few more.

Disclaimer

The content and data on this website is for information purposes only, and should not be read as investment advice, or advice on tax or legal matters. The companies and strategies discussed are on the site for entertainment only, we may or may not at any time be invested in the companies, and may be referencing companies simply as examples, ideas or for discussion.

By viewing the contents of this article, you agree:

(1) you have read and understood the warning and disclaimer above;

(2) not to make any decision based on the contents of the article;

(3) not to place any reliance on the contents of the article; and

(4) that the author is not responsible or liable, directly or indirectly, in any way for any loss or damage of any kind incurred as a result of, or in connection with, your use of, or reliance on, any of the contents of these articles.