Alcidion (ALC.ASX) : Deep Dive

A small innovator supporting the next generation of improvements in public healthcare

In August 2011, Marc Andreessen coined the phrase 'software is eating the world' (great article, link here).

We can now argue that data is also eating the world.

A generation of software providers are building tools powered by collating data from disparate systems, and creating algorithms to draw valuable insights from that data.

This is Alcidion’s proposition to public healthcare. Alcidion have been on my radar for a number of years. I first heard the CEO Kate Quirk present in 2019. They’ve evolved since. With a nice recent quarter of positive cashflow (don’t read too much into it), now seems as good a time as any to dive deep into it. Let’s go.

🖐 4 bullet Summary

The bull view:

With a lot of whitespace and and a clearly mandated expansion potential, Alcidion continues to grow its footprint in the UK.

Recent government incentives help fuel the growth.

The company reaches profitability in the next 2 years when they pass $45M in revenue, and growth remains strong in the 20-25% environment.

What the market is missing:

True market penetration in the UK is lower than perceived (estimated at 10%)

The potential upside from new, complimentary products.

Key risks:

Well established competitive landscape.

Long history of cash burn.

A history of raising for acquisitions which could dilute shareholder returns.

The bear case:

Failure to continue fast innovation leads to growth slowing down. With the company still “priced for growth”, they get downgraded.

History

The Alcidion story starts with one of the two co-founders; Malcolm Pradhan.

Malcolm was studying medicine in Adelaide when he started diving further into emerging computer technology in the mid-80s. When he started working in hospitals, he couldn’t help but notice how many things could be improved with technology.

This is what prompted his decision to study the field of medical informatics at Stanford in California. There, he studied medical AI, and how computers could help clinicians make decisions under uncertainty.

After a stint in academia and consulting, Malcolm noticed the growing momentum around understanding preventable errors in healthcare that cause patient harm.

Malcolm ended up working at Australian Patient Safety Foundation, which is where he formed a relationship with Ray Blight. At the time, Ray was the Chairman and CEO of the SA Health Commission.

Both had a shared awareness that problems in healthcare could be solved with technology, helping to make healthcare safer and more efficient. In 2000, Alcidion was born to improve patient safety.

A stark, painful realisation happened when they found incentives were dangerously misaligned in healthcare at the time. The government funding models in the early 2000s meant that hospitals were reimbursed for errors. Therefore, the incentive to invest in their system was only partially there.

With a lot of innovation, patience, and good leadership, and acquisitions, the Alcidion product has involved immensely since. Fortunately too, financial drivers in healthcare have changed around the world to support patient safety, so the headwinds became tailwinds.

Ray and Malcom have both taken a step back from the business and retired. Both remain close to the business with some good skin in the game: Malcolm owns 10.61%, and Ray owns 7.34% of Alcidion.

🥊 What problem do they solve?

The challenge they solve is one we would have likely all experienced. Given Alcidion works with a lot of ED departments, let’s focus on this and share a story.

You arrive at the ED, and get screened by a nice, tired nurse. The nurse will ask you dozens of questions.

One you’ve answered them, you naturally ask how long it will take to be see by a doctor, because you’re in pain. The answer comes back; “the wait at the moment is around 1 hour”. You double it in your head.

4 hours later, an exhausted looking doctor guides you through an ED ward filled with beds in the corridors because there’s not enough room for everyone.

You notice patients playing Candy Crush on their mobile phones who seem in good enough a state to head home, but remain in the crowded area.

The doctors asks you all the same questions the nurse did. Eventually, they short you out. You’re ready to go home now, but there’s just no doctor or nurse around to confirm your discharge.

What I’ve described here is a fictional version of the problem the Royal Darwin Hospital was facing.

Alcidion helps healthcare staff communicate between each other, so actions can be taken faster. They help healthcare leaders understand and track the journey of patients, so they can iron out the pain points. In the case of the Royal Darwin, results were:

The number of patients processed within the ED in the four-hour target increased by 10%

The number of patients discharged by midday increased from 23% to 27%

This improves your experience as a patient, and saves hospitals money.

Products

The Alcidion software suite is made of 4 primary products:

#1 - MIYA Precision

This is Alcidion’s flagship product.

This platform facilitates multiple clinical and operational applications, with the aim of providing new applications, and also enhancing existing IT inputs from multiple systems into consolidated, meaningful information.

Beneath the platform are 15 modules under the MIYA umbrella.

These focus on areas such as bed allocation, simplified reporting, emergency department management, vital sign observations with automatic risk scores and notifications.

Customers include ACT Health, NSW Health, NT Health, South Tees NHS Trust.

#2 Patientrack

Patientrack is a mobile application to capture patient data at the bedside.

The information is entered via a tablet or integrated from patient monitoring.

This data is then automatically evaluated to give an Early Warning Score. Depending on the protocols of the hospital, alerts can be issued to management.

Current clients of Patientrack include ACT Health as well as a number of NHS hospitals in the UK.

#3 - Smartpage

Smartpage is a smartphone and web-based app enabling hospital communication and task management for both clinical and non-clinical users.

On the clinical side, the platform enables group chat, image sharing, handover, and task management. On the non-clinical side, modules covers areas such as food, cleaning, security, porters, and orderlies.

Customers include ACT Health, Monash Health, Townsville Health, South Tees NHS and Waitemata District Health Board in NZ.

#4 - Services

Alcidion compliments its offering with a services offering.

The includes the delivery of product implementation, product support and maintenance, systems integration and data analysis services.

Anywhere from 20-30% of their revenues have historically come from services.

Building with Users

You may classify this as nothing but good LinkedIn marketing, but Alcidion are showing good evidence of listening to their users and building a solution fit for purpose this way.

The post of the left shows a User Group meeting, and the one on the right shows the co-build process for virtual care and RPM patients at Sydney Local Health District.

Culture ⛷️

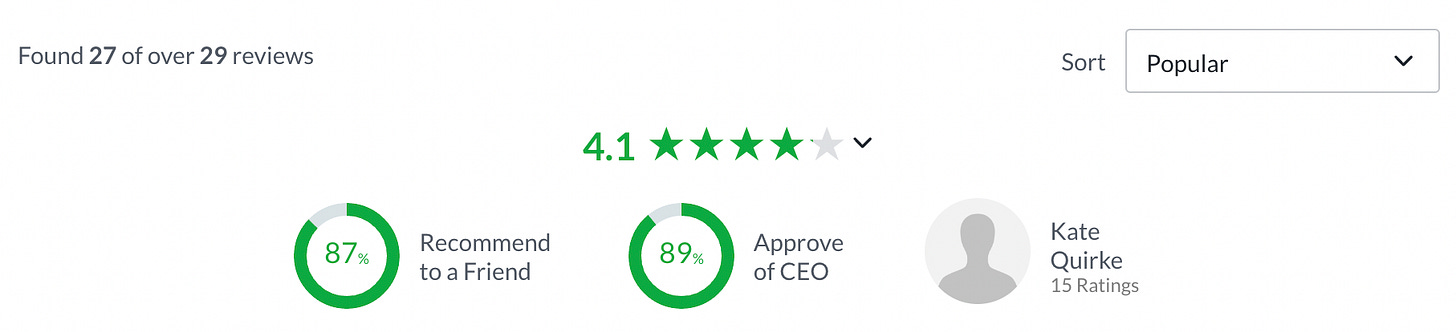

Alcidion scores highly on culture from my research. Some of my ex-Salesforce colleagues stated they have a good reputation in the world of healthcare software.

They seem to take Glassdoor seriously, with their Chief People Officer, Amanda James responding to every comment made.

Positives often stated:

Work flexibility Autonomy and independence in job

Strong leadership “supportive managers, and a fantastic CEO”

Learning opportunities

Great technology and products “Interesting product portfolio and a lot cooking.”

Potential negatives (as always, we must account for bad leavers and take this with a grain a salt):

Integration challenges : “With any acquisition and transition into a corporate structure, there may be integration challenges”

Management challenges : The daily huddle seems to be a practice some still need time to get used to…

Compensation: “Need to update salaries to match Australia wide salaries”

Employees

In alignment with the wider tech industry, Alcidion seems to have reduced their headcount in the last 6 months.

Their continued investment in business development could be read as an encouraging sign that pipeline continues to get created and they see further potential ahead.

Tailwinds

4 years ago, Julie Yoo from Andreessen Horowitz wrote this excellent piece called How Software is Eating Care Delivery in Healthcare (link here). Much of it isn’t directly relevant to the landscape of the UK and ANZ, given vastly different government structures.

Still, relevant points are made. She mentions 3 tailwinds, and the first is directly aligned to Alcidion’s value proposition:

One of the major tailwinds is the fact that an entire layer of tech infrastructure has now been laid down. That allows us to lift our heads up and look towards the possible higher-order use cases and application areas.

I think in future years, this statement could help drive’s the company’s acceleration.

I would add 3 tailwinds helping Alcidion:

Healthcare staff shortages mean digitisation is required

Patient expectations continue to change

Significant increase in patient-related data which hospital systems grappling with legacy IT have struggled to handle

Leadership

Alcidion’s leadership team have now accumulated some good good tenure in role. Kate has been in the business for 5 years now, and many of the other leaders have passed the 2 year mark in role.

Kate was asked by Ray to become the CEO when Alcidion acquired MKM Health in 2018. With the last 20 years spent in Healthcare technology leadership roles, Kate’s domain expertise would be as impressive as her rolodex in this space.

Both their country leaders appear to be well loved internally and externally.

Kate Quirke, CEO:

85% of ratings approve of the CEO on Glassdoor.

“CEO has a good vision on company’s direction.”

“Regular, transparent communication from CEO,”

Lynetter Ousby, UK MD:

“Lynette is bloody awesome. She's a great combination of a very sharp mind, with a completely down to earth and hugely authentic personality.

- Thomas Webb, Founder and CEO at Ethical Healthcare - March, 2023

Growth 📈

Similar to my comments in Volpara’s deep dive, Alcidion’s historical growth at the top line isn’t a perfect representation of reality given the acquisitions (listed in chart).

I do hold the opinion that they’ve been strategically selective with these acquisitions and that they can scale better with them.

They have however been unlucky with the timing of the Silverlink acquisition; markets were starting to get shaky at the time and with hindsight we can hypothesise a better price may have been possible to achieve had they waited a little longer.

Here’s what it looks like at a high level, using simply their appendix 4Es:

Growth in the last 4 years has been very good, but they certainly has been helped by these acquisitions.

The important question is always; what can it look like in future years? No one knows, but we can attempt to evaluate the strategy against what’s possible.

Future Growth

Here are some of the primary future growth levers for the company:

#1 - Expanding current customers

This is something leadership often talk about. They mention they have very little penetration inside of their current customers, and that channel alone could see great growth potential for the company.

This makes sense considering they’ve expanded their technology extensively over the last 5 years (by both internal development and by acquisition).

To that end, the company shows a potential example (pictured below). These can be summarised to say :

Step 1: they will lead and land with their flagship Miya Flow product

Step 2: Now that the customer has got quality data in one location, they will want to extend the value of their Electronic Patient Records (EPR) and add in clinical noting, medications management and Observations and Assessments

Step 3: This is about trying to extend clinical decision support, and upgrade their PAS : they would position Silverlink here.

#2 - Net new logos (new Trusts) in the UK

Here the company is helped by a strong government tailwind which they’ve talked about. Through the Digital Aspirant programme, 60 trusts are now receiving funding and support for their digital transformation journey (source here). It’s expected the number of Trusts will increase over time.

Here’s Alcidion’s strategy for this:

We could make a few assumptions here to calculate the potential of such a strategy.

1st, let us assume that of the 106 sites above, they can close 20-30 in the near-enough future.

We can 1 land, and 1 expand example:

Land: The East Lancashire Hospitals NHS Trust signs 5 year Miya Flow contract was for $300K ARR,

Expand: the Dartford and Gravesham expand upon existing Miya Precision contract was for $600K of ARR.

So this means 1 potential sites that be reasonably evaluated at $500K ARR (there’s upside potential on both the contracts above).

20-30 sites : $10M in new ARR.

Now, please note my calculation is overly simplistic; I’ve not accounted for services which normally take up 20-30% of the deal size. This is purely back of the napkit to draw high level portrait.

Risks & Problems ⚠️

Two years ago, investors may have looked at Alcidion thinking valuation alone was quite a large risk. In 2021, the company traded at 20x sales. (See the multiple re-rate in my article here)

Since then, the revenue has grown, and the share price got re-rated, so this risk is now reduced, but remains present.

The problems I see now are:

Remaining Addressable market: Whilst there’s a lot of growth left to be had in ANZ and in the UK, the strategy beyond these markets isn’t exactly crystal clear. The number of countries with strong social public healthcare programs that fit Alcidion’s target isn’t infinite.

The counter to this is on further account penetration, and the remaining widely untapped status of the UK. Still, long-term thinkers need to bear this in mind.

Economic turmoil and political dramas in UK slows decisions. This is a risk that’s currently playing out now. At the beginning of the year, CNN who was covering developments in the UK wrote:

In December, 54,000 people in England had to wait more than 12 hours for an emergency admission. The figure was virtually zero before the pandemic, according to data from NHS England.

The NHS is now forced to deal with the crisis, and whilst one could think of this as a potential tailwind (surely better systems could help here), the reality is that in a crisis buying software tends to take the backburner.

The NHS will eventually overcome this, and a return to a new normal will eventually emerge, but there could be many more months of pain ahead.

Another part of this is that the NHS have now gone live with its EPR procurement program. This means hospitals now have to learn a new process to procure a system like Alcidion, and this has added to the delays.

Can’t turn the profitability corner.

This is one of the biggest risks for me. The company had announced to the market a while ago that a target of EBITDA Positivity would be reached by FY 2023. Now it seems that has become impossible.

Alcidion continues to navigate from quarter to quarter with one in the black, two in the red, and so on.

For investors to have faith in the long-term, they will to reach the cashflow positivity milestone for good, and this may take still more than 1 year if contracts in the UK continue to be pushed backwards.

Key leadership loss.

This tends to be a recurring risk for most of the companies I’ve written deep dives on. That’s because I’ve covered many companies which remain founder-led, or have had a key leader in place for a while.

Over the past 5 years, Kate Quirk as become synonymous with Alcidion. If she were to leave, I anticipate the company may struggle to fill such large shoes.

Other Deep Dives I wrote

Conclusion

Whilst Alcidion seems to be in the doghouse if you glance at the share price, recent execution has been good, and some of the signs I discussed above could indicate a potential turn to a brighter future.

I’ll remind you as always that this is article contains only my opinion, and nothing should ever be construed as financial advice. I’m not licensed to provide such advice. Good investors don’t take advice.

For those of you interested to stay abreast of Alcidion have a look at full year results at the end of August. Let’s see what they can achieve this year. Thanks for reading all.

Feel free to leave a comment about things I missed, your contrarian opinion, or anything else relevant.

Disclaimer

The content and data on this website is for information purposes only, and should not be read as investment advice, or advice on tax or legal matters. The companies and strategies discussed are on the site for entertainment only, we may or may not at any time be invested in the companies, and may be referencing companies simply as examples, ideas or for discussion.

By viewing the contents of this article, you agree:

(1) you have read and understood the warning and disclaimer above;

(2) not to make any decision based on the contents of the article;

(3) not to place any reliance on the contents of the article; and

(4) that the author is not responsible or liable, directly or indirectly, in any way for any loss or damage of any kind incurred as a result of, or in connection with, your use of, or reliance on, any of the contents of these articles.

Nice one mate. I liked the history intro at the beginning and you’ve gone into some great detail.

I think if Alcidion can begin landing some more contracts to compliment its existing ARR it could be a really good year at its current price. It’s a big if though, the additional sales in the June qtr felt low? I like it more than BMT currently as I feel it’s closer to that inflection point. Time will tell I guess 🤷🏽♂️