Identifying Mispricing in FY23's Growth Stocks

Crunching the Numbers: Analysing Last Month's Top Performers

Ladies and gents, happy Sunday.

I hope the sun is shining wherever you are. My Substack statistics tell me we've got a new reader from Illinois (bloody oath, we’ve gone international). So here's to hoping that life is treating everyone well in Chicago and all the other cool places you wonderful folks are joining us from.

Over the last three weeks, I've shared quick insights on ten companies that have reported strong financial performances for the year.

Today, I thought the analytical minds among us would enjoy a deep dive into some simple, back-of-the-napkin math (well, kind of) into the numbers. To make this exercise more valuable, I've added another 12 companies to the mix to our initial 10 performers. The goal of this exercise is to share a simple way to add companies with potential to your watchlist.

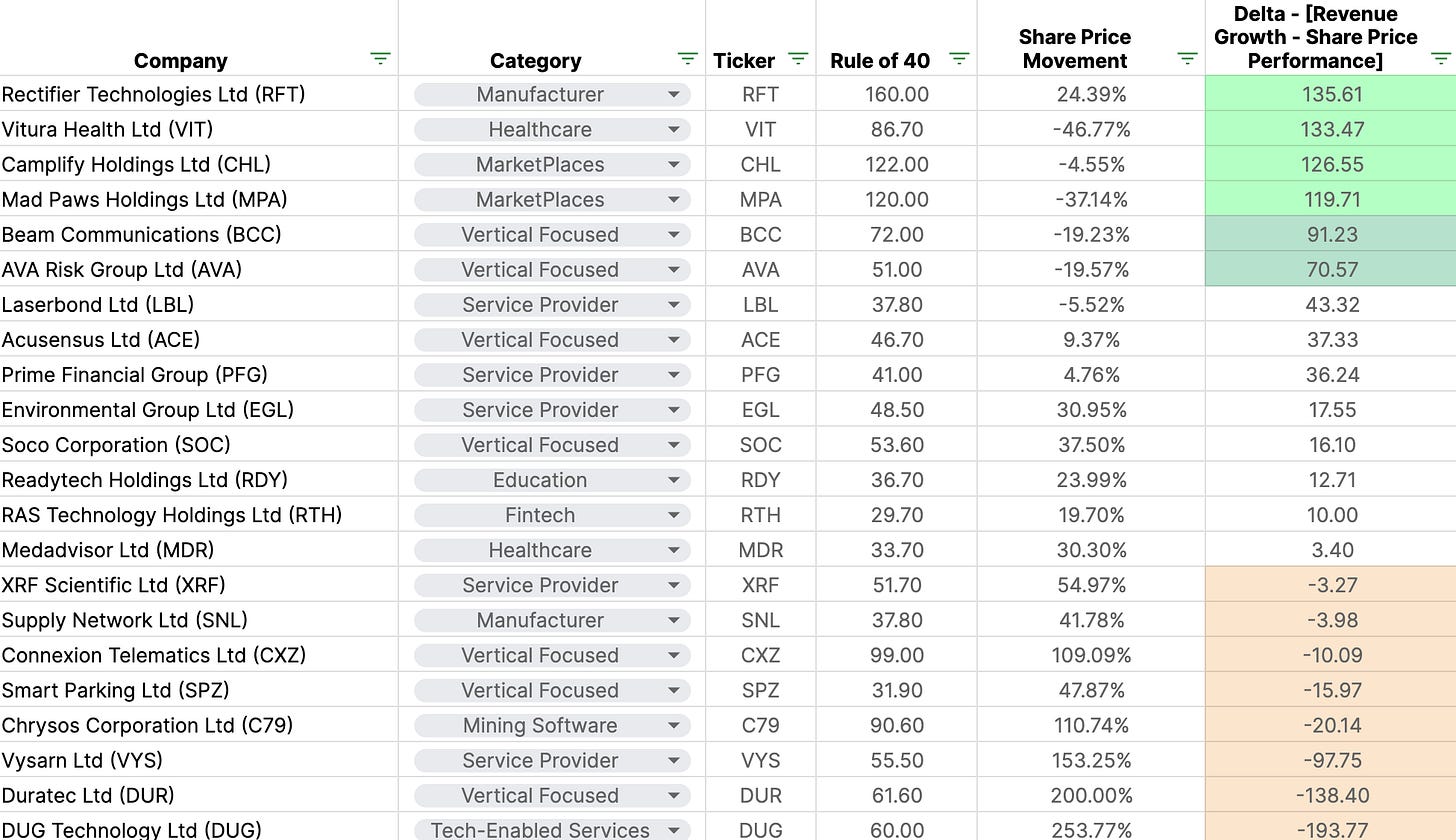

Below, you'll find the list of companies we'll explore today. Let's jump right in.

Step 1: Pick 20 companies that reported strongly

On top of the 10 companies we spotlighted over the last month, I added another 12. Many of these were companies I was keeping an eye on from a distance, looking for more proof in the pudding.

Out of these 22 companies, an impressive 16 surpassed the Rule of 40, with the remaining ones exceeding the 30 mark (we’ll grant Racing and Sports rounding points).

Step 2: Add share price performance to chart

Now that we have our 22 companies and have populated their data, let’s add the column that will serve as our primary benchmark: the annual share price performance.

Note: Rather than plotting share price performance for the financial year, I’ve taken rolling last 12 months share price performance (September 15, 2022 to September 14, 2023). I’ve done this to help the share price movement reflect financial year reports.

Observations

Massive winners all profitable. This year's standout winners (From DUG to Connexion), with share price performances exceeding 100%, are all profitable. No surprises here.

Biggest margins ≠ biggest winners. It seems there’s still a certain level of acceptance (albeit low) for companies that are showing low margins as they continue to grow. Both Duratec and Chrysos saw big share price moves on small margins while they continue to prioritise growth over profitability.

Lack of profits means no love. Out of the five companies that were not profitable in our list of 22, 3 saw their share prices decline. Again, this aligns with expectations and the sentiment of current times.

Is steam accumulating? The average revenue growth of companies in the chart is 60%, whilst the average share price performance is 46%. A gap like this is normally good for long-term minded investors.

Beyond these initial observations, there are more insights to uncover. Let's delve deeper into the data to uncover additional lessons in the next phase of our analysis.

Step 3: Look at the Delta between performance on the Rule of 40 and Share price performance

There is no evidence stating that a company's share price movement should be proportional to its performance on the Rule of 40. That would be way too simplistic thinking.

What we're essentially doing here is using a yardstick to gauge how the company's performance aligns with its share price.

We do this by:

[Rule of 40 - (Share Price Movement * 100)] = Delta

I've used conditional formatting to quickly identify potential mispricing:

Green highlights upside potential, suggesting that the company's performance seems to have outpaced its share price movement.

Amber indicates the possibility that the stock may have surged ahead of the company's fundamentals.

Note 1: way too simplistic to be completely accurate.

Note 2: See Phil Fisher’s quote below.

Observations

Context matters. The first thing to do when we see a potential anomaly is to dig into the story. Vitura and Mad Paws are both good examples here. We’ve looked at them in Part 1. Numbers alone seem good. Numbers with the story, less good.

Upside Surprise. What we observe with the share price performance of DUG, Duratec, and Vysarn, even over the short timeframe of 12 months, is the lesson we keep re-learning: winners can run higher than we might think. Even in tough markets. A healthy reminder for me: don’t sell your winners too early.

64% of companies are building steam. If we accept the hypothetical logic of this exercise, we find that 14 out of the 22 companies seem to have fundamentals that have performed more strongly than their share price. That’s 64% of the companies in this small sample.

Step 4: Look at the Delta between Revenue Growth and Share price performance

Simplifying further, we'll now solely focus on revenue growth and its correlation with share price performance. This step eliminates the influence of margins, which has been a primary focus for investors in the past 18 months. By doing this, we aim to determine whether the emphasis on margins might be causing investors to overlook potential opportunities.

While this approach may seem overly simplistic, let's step back and examine the logic behind it.

If all aspects of a company have remained consistent over the last 12 months (such as the same margins, the same number of outstanding shares, the same balance sheet strength, and the same prospects), then theoretically, share price performance should align with the company's organic growth. This is often where “In theory, theory and practice are the same. In practice, they are not.”

That’s true, but it can still serve a purpose as a useful exercise.

We do this by: [(Revenue growth * 100) - (Share Price Movement * 100)]

Observations

Biggest revenue growth ≠ best returns. It's interesting to note that only one company from the top 5 in revenue growth, Chrysos, also made it to the top 5 in terms of share price growth. This suggests that the "growth at all cost" mentality is dead. At a deeper level, this observation underscores the importance of organic growth and the fact that today's investors pay more attention to the overall context than they did a couple of years ago. That’s a good thing.

Gradually and then suddenly. Some of the share price movement numbers may initially seem staggering, but upon closer examination of these high-performing companies, it becomes clearer that it may be reasonable. This serves as a reminder that when small, rapidly growing companies hit a turning point (not all of them will), things can accelerate rapidly.

Profits pay off. In line with the previous point, it's worth noting that many of these significant share price movements occurred when companies had recently become profitable.

Step 5: Come up with your list

As a result of this exercise, we’ve landed on at least 10 companies that are certainly worth keeping tabs on.

Speculate on the Gap. You can get fancy like me and add a column speculating on why you think a gap exist at present. Perhaps even another with your notes on what you would like to see happen for you to get properly interested.

Adjust to Organic Numbers. To get even more accurate, you could adjust the numbers here to reflect organic growth rather than reported growth. See my article on Camplify for a rich life for an example on how I tend do this.

A note on the strong share price performers

In a future article, I’ll share some notes on my recent re-read of Phil Fisher’s classic; Common Stocks, Uncommon Profits.

The book is filled with gems.

Here’s one of particular importance to today’s article. I have a feeling Phil would remind me of this if we had beers together after he read this article.

“By giving heavy emphasis to the “stock that hasn't gone up yet” investors are unconsciously subscribing to the delusion that all stocks go up about the same amount and that the one that has already risen a lot will not climb further, while the one that has not yet gone up has something “due” it. Nothing could be further from the truth.

The fact that a stock has or has not risen in the last several years is of no significance whatsoever in determining whether it should be bought now.”

Context matters. Make sure you get the context right.

Conclusion: let’s not be so short term minded

While this analysis provides valuable insights into short-term market trends, it's essential to recognise its limitations. We've primarily focused on a one-year snapshot, which may not capture situations where previous expectations of strong results have already led to share price adjustments ahead of the company's fundamentals. We know this happens all the time.

Nonetheless, this exercise underscores the ongoing inefficiencies in financial markets. However, it's crucial to remember that inefficiencies alone cannot form a comprehensive investment strategy; they must be integrated into a broader narrative. Mispricing opportunities can persist for 5+ years, so we must also understand what catalysts or compelling events might trigger a change in the situation.

Additionally, I would caution against drawing overly narrow conclusions based solely on share price performance that may have outpaced company fundamentals. There are numerous factors to consider here. One obvious factor to keep in mind is the significant underperformance of small companies over the past two years. It's entirely possible for a company’s share price to surge by 300% in a single year and still be effectively "underpriced" in the context of a broader investment horizon. Ultimately, your investment strategy should align with your individual goals, style, and philosophy. It's essential to remember that none of the information you read from me here constitutes financial advice.

I hope you found this helpful.

As always, I value your perspective and welcome discussions on where you've identified mispricing opportunities, particularly within the small-cap segment of the market.

Previous Related Articles

Part 1 : Camplify (ASX: CHL) Vitura Health (ASX: VIT) Vysarn (ASX: VYS) - here

Part 2 : Rectifier (ASX : RFT) Mad Paws (ASX: MPA) Acusensus (ASX: ACE) - here

Part 3: AVA Risk (ASX:AVA), Chrysos (ASX:C79), DUG (ASX:DUG), XRF Scientific (ASX:XRF) - here

Disclaimer

The content and data on this website is for information purposes only, and should not be read as investment advice, or advice on tax or legal matters. The companies and strategies discussed are on the site for entertainment only, we may or may not at any time be invested in the companies, and may be referencing companies simply as examples, ideas or for discussion.

By viewing the contents of this article, you agree:

(1) you have read and understood the warning and disclaimer above;

(2) not to make any decision based on the contents of the article;

(3) not to place any reliance on the contents of the article; and

(4) that the author is not responsible or liable, directly or indirectly, in any way for any loss or damage of any kind incurred as a result of, or in connection with, your use of, or reliance on, any of the contents of these articles.