Software Category & Valuation

Are the leaders in any given category getting an unfair share of the economic pie?

This is post is the continuation of Business Models & Valuation which I published last month.

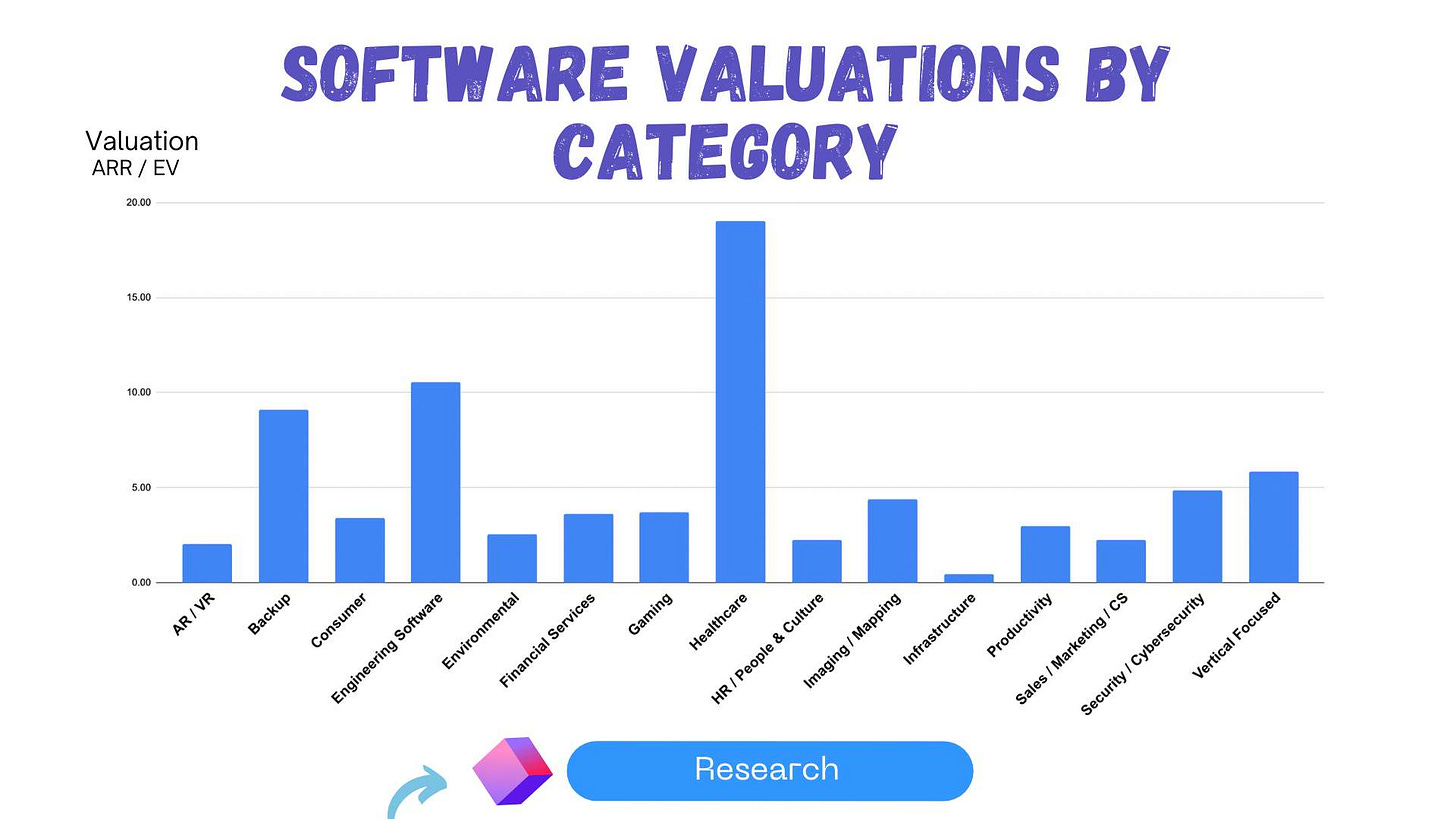

One tendency I notice, and never studied too deeply, is that the software category in which you play, and the industry you serve, will have an oversized impact on your valuation.

This felt sharply amplified in the heyday of 2020 and 2021; at the time, simply stating you were a healthcare software company was probably enough to get people to like you.

Thinking about this a little more deeply, it should make sense that some software companies are more valuable than others.

Here’s an over-simplified way to look at it.

Company A makes a software that helps the average structural engineering save 1H / day. The average salary for this role is 115K / year (source here). This software therefore saves ~$60/day, meaning $12K / year.

Company B makes a software that helps the average radiologist save 1H / day. The average salary for this role is 195K / year (source here). This software therefore saves ~$100/day, meaning $20K / year.

Company B should be able to price their software 66% more.

The benefits can be much more than pricing power.

Today I look at how the ASX values different technology companies that operate in different industries. This could help offer a lot of different insights. Let’s jump into it.

Methodology & Assumptions

For this exercise, I started with the initial 114 listed technology companies on the ASX.

Criteria were:

Software & Technology focused companies: Whereas in Business Models & Valuation I used companies with all 4 business models to study that point, here I focus only on what was #3 - Technology & Software creators.

Under this criteria, I had 75 businesses listed in the ASX.

Removing Vertical Software, which will be covered in the next article in this category, I had 48 businesses.

Enterprise Value (EV): Company’s EV had to be below $1B, and preferably below $300M.

I made an exception to this rule and included the following 7 companies with larger market capitalisation to broaden the scope of available measurements.

More than 75% of the companies chosen have a market cap below $300M.

This year estimates: Same as in the last few studies, for this year’s revenue, I made estimates on where these companies may land for full year revenue.

If guidance was provided, I simply used the mid-point of the guidance.

If no guidance provided, I didn’t do anything fancy, I simply annualised current run-rate.

Given we’re 3/4 of the way there, there’s no way it will exact, but it can’t be too far off either. Take the actual number with a big grain of salt; the point wasn’t to spend much time on this; but more time on data crunching & pulling out lessons.

Categorising Software by type & industry

The first step was to load up the sheets again, and this time create categories using my best judgement. Here’s a snapshot:

Notes

Obvious limitation: the world of listed software on the ASX is still very nascent. Whilst the NASDAQ would have hundreds of software companies listed at scale, the ASX is still home to a number in the double digits with a certain scale.

This limitation makes some of the conclusions on group valuation less useful; you can see in the above that Dropsuite sits alone in the backup category, and that consumer, environmental, and gaming are quite lonely at the moment.

ASX Listing Categories: Under the ASX’ own categorisation system, there are currently about 150 listed software companies (link here), but I like to go through a yearly exercise of filtering the list.

There are companies in the category with little to revenue, and others which are not accurately classified (ie. Cosol is more a ISP than a software company from my reading).

#1 - Healthcare Software - The big winner

Healthcare has long been the big winner in its ability to command very high valuations in the software category in the ASX.

Healthcare avg. ARR / MC multiple: 17

Healthcare avg. ARR / MC multiple (ex. Pro Medicus & Impedimed) : 5.6

Referring back to my example in the introduction, it makes sense that shaving time off highly paid healthcare professional’s calendars would be very valuable, and through second order consequences, that may eventually makes its way into valuations.

Some of the key consideration for healthcare software:

It can’t be half-baked: Traditionally, one of the reasons healthcare has been a slow mover in adopting new technology is because the stakes are high. We’re dealing with people’s life, so a product needs to meet a high standard before adoption can be taken seriously.

This means that starting from scratch for startups can be more challenging. Finding your first few customers with an MVP can prove difficult.

This dynamic offers an indirect moat to more established software providers in healthcare.

This is also part of the reason why healthcare has traditionally been dominated by large, legacy, and dinosaur like software providers

Do well and do good. Healthcare software also offers the obvious “do well and do good” feeling to investors.

When Motley Fool's David Gardner says "Make your portfolio reflect your best vision for our future", it’s easy to think of healthcare first with all the benefits good technology could offer in this space. This likely plays its part in higher valuations.

#2 - Engineering Software

Engineering software encompasses software for PCB design engineers (usually an electrical engineer) with Altium, to electric power engineers working for a utility using Ike’s platform.

Engineering avg. ARR / MC multiple: 11

Engineering avg. ARR / MC multiple (ex. Altium) : 7.6

The average valuation numbers in this category are skewed by the bigger players (Altium and Audinate) which offer the view that engineering software too, can command very high valuations at a certain scale and growth pace.

Some of the key consideration for engineering software:

Domain Expertise: Whilst this could be argued of all categories, I find it especially true that building, and selling engineering software requires deep domain expertise.

If you dive into Altium’s engineering workforce, you find deep domain experts who have spent their careers in PCB applications. That’s what you need for success.

A differentiated GTM. The successful engineering software companies I’ve studied had thought deeply about their sales and marketing process. Engineers like to buy quality products, and don’t like to be sold to. Similar to the point above, you would likely leverage the relationships, sales by engineers, and getting your products into the hands of your users with as little friction as possible.

Looking at Pointerra’s business development team, you’ll find quite a few previous geospatial engineers turned salespeople. Having experienced the pain with the previous workflow yourself is a great advantaged in positioning your software.

#3 - HR / People and Culture / Safety Software

A popular category on the ASX has been HR software. The takeover bids for Elmo, IntelliHR (I wrote about this here) and Limeade shade a light that PE may currently have more appetite for this category than public investors.

HR avg. ARR / MC multiple: 3.06

HR avg. ARR / MC multiple (ex. Kinatico & Xref) : 1.6

*Note that both Xref and Kinatico are currently transitioning to a Saas model. I’ve used their most recently reported ARR figures here rather than their revenue figures. I’ve done this to align with the purpose of this article. Given they are early in this transition, this isn’t an accurate way to valuate them yet.

Some of the key consideration for HR software:

It gets competitive: The primary asset of a business lies in its people. Historically, one of the first pieces of legacy software to be create was to deal with workforce management.

Workday’s incredible success story (explained well here), of growing at 100% YoY would have been an inspiration to many to enter this field.

People management is complex with so many angles to tackle. This gives place to a lot of point solutions (this is how Xref began its journey, as only reference checking, and is now slowly expanding into the hire-to-retire journey) that transition to broader platforms over time.

Data half life considerations.The half-life of data means to the amount of time it takes for the majority of it to become irrelevant. On the point above of point solutions vs. platforms, an important dynamic of people management software is the type of data that lives in the software.

There’s a large difference between displacing your reference-checking engine (not very long data half-life), vs. your full HRIS platform.

#4 - Financial Services Software

Financial services will also interest investors. Blockchain, Gen AI, Autonomic systems, all will continue to have their growing place in this industry.

Financial Services avg. ARR / MC multiple: 3.5

Financial Services avg. ARR / MC multiple (ex. Ansarada) : 2.26

*Similar to the above, Ansarada is currently transitioning to a Saas model. I’ve used their most recently reported ARR figures here rather than their revenue figures. I’ve done this to align with the purpose of this article. Also early in this transition, this isn’t an accurate way to valuate them yet.

Some of the key consideration for Financial services software:

The Bundle disruption: Financial services software has traditionally been very fragmented. Integrating with banks was historically a difficult mission, so software providers would surround transactions and provide most of their value elsewhere.

With the rise of regulations such as the Consumer Data Right (CDR) which launched in Australia on 1 July 2020, Open Banking became game changer for the financial sector.

The ability to share your banking data with third parties will continue to allow for disrupters in the space to expand into more powerful platforms overtime.

#5 - Security / Cybersecurity Software

Combining physical and cyber security into one category is likely a faux-pas, but such is life when you have little data to play with.

Security / Cybersecurity avg. ARR / MC multiple: 5.6

Gartner’s report on the Top Strategic Cybersecurity Trends for 2023 (link here) is filled with buzzwords that mean little to me. There are interesting and evident ideas in there, namely about:

Cybersecurity platform consolidation. Gartner states 3 drivers behind this. It would seem sensical that organisations would use fewer vendors and also want to “distribute technology and analytical work to expand the volume, variety and velocity of cybersecurity risk decision”.

This might mean it could be harder for smaller, niche entrants to breakthrough. But again, this dynamic might be argued for all categories, and many companies have proven this to be untrue over the years.

Conclusion

Whilst this was a useful and fun exercise, one of the highlights remains that, as a16z put it, ‘category-leading companies going after huge markets with business models that demonstrably scale’ will continue to win. This is how companies like Pro Medicus and Altium can command a valuation that’s 5x to 10x more than the average valuation of their category.

In the future, I’ll likely come back to this article to dive deeper into one single category at the time to offer more meaningful insights.

👉 If you’d like the sheet I used for this article, download it here.

Notes:

I’ve put in ARR manually, and some companies are not black and white about it, so it will likely by inaccurate in some places.

Given the MC field is dynamic (formula pulls from Google Finance), and that ARR is not (my manual numbers), the valuation field will become incorrect over time.

If I missed some interesting companies in these respective categories, feel free to add them in the comments; I will include them in future coverage.

Next Up - Vertical Software…

In the next chapter of this series, we dive the largest category on the ASX, vertical software.

Disclaimer

The content and data on this website is for information purposes only, and should not be read as investment advice, or advice on tax or legal matters. The companies and strategies discussed are on the site for entertainment only, we may or may not at any time be invested in the companies, and may be referencing companies simply as examples, ideas or for discussion.

By viewing the contents of this article, you agree:

(1) you have read and understood the warning and disclaimer above;

(2) not to make any decision based on the contents of the article;

(3) not to place any reliance on the contents of the article; and

(4) that the author is not responsible or liable, directly or indirectly, in any way for any loss or damage of any kind incurred as a result of, or in connection with, your use of, or reliance on, any of the contents of these articles.